Annual Budget Worksheet

Save, fill-In The Blanks, Print, Done!

Download Annual Budget Worksheet

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (13.17 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to create an Annual Budget Worksheet? An easy way to start completing your budget is to download this Annual Budget Planning Worksheet template now!

Every day brings new projects, emails, documents, and task lists, and often it is not that different from the work you have done before. Many of our day-to-day tasks are similar to something we have done before. Don't reinvent the wheel every time you start to work on something new!

Instead, we provide this standardized Annual Budget Worksheet template with text and formatting as a starting point to help professionalize the way you are working. Our private, business and legal document templates are regularly screened by professionals. If time or quality is of the essence, this ready-made template can help you to save time and to focus on the topics that really matter, such as:

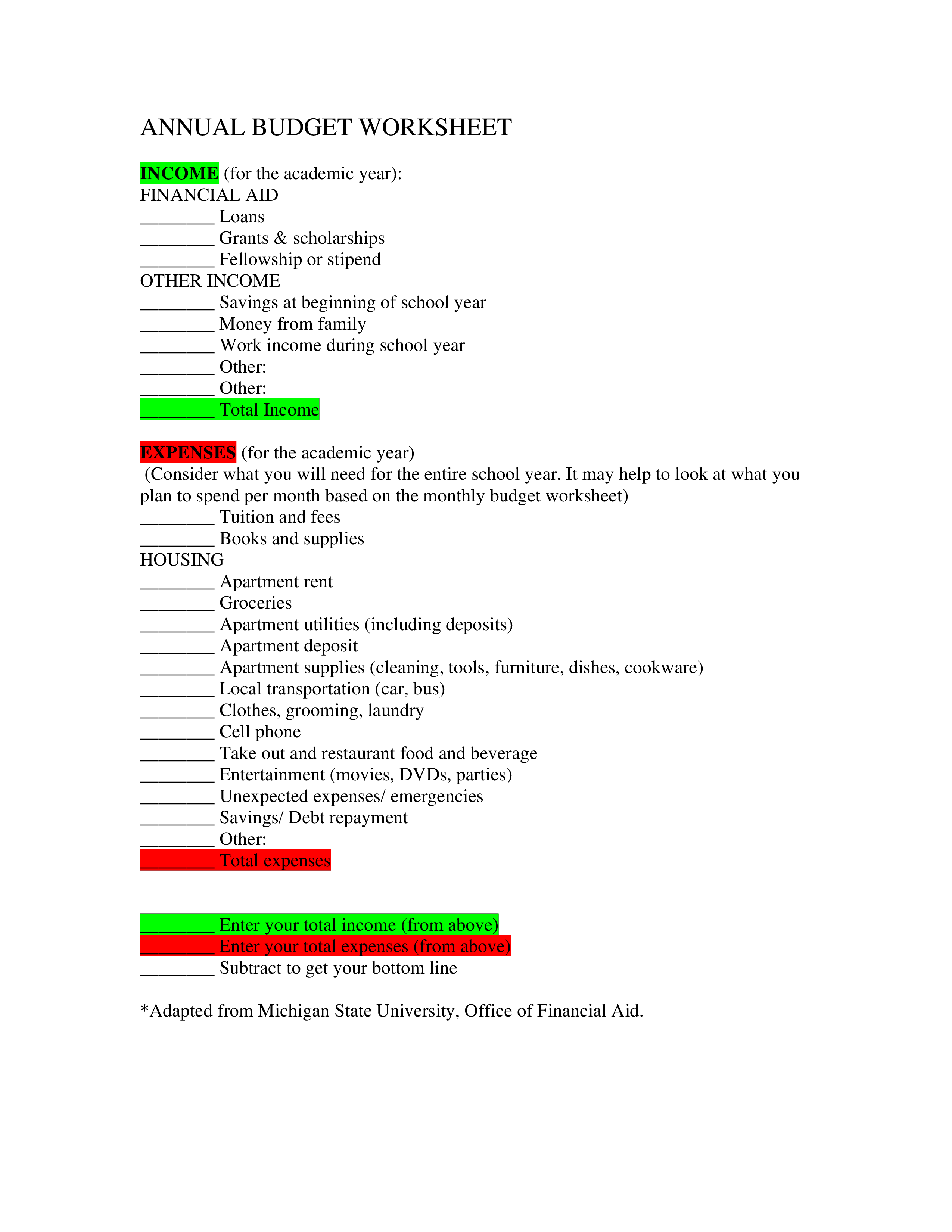

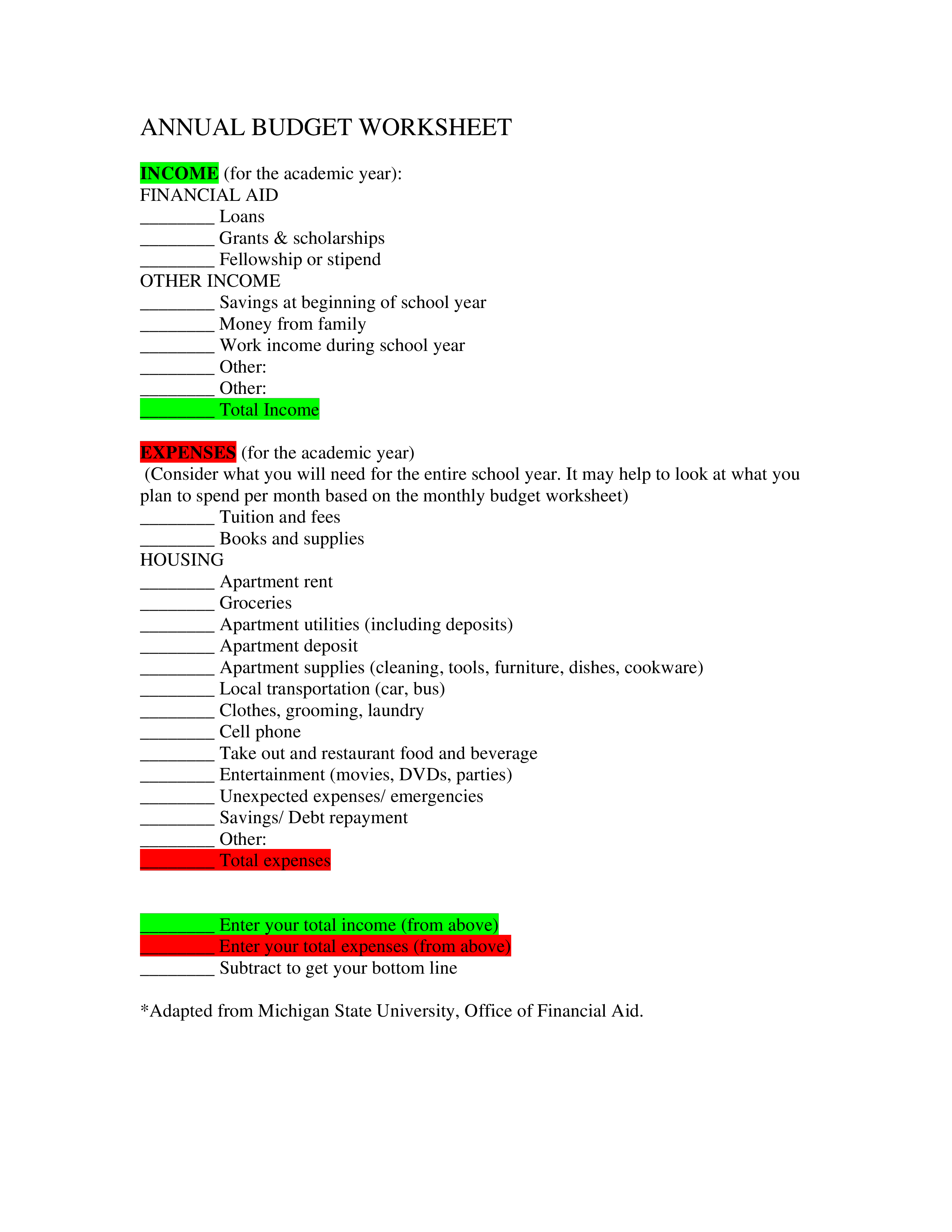

ANNUAL BUDGET WORKSHEET

- INCOME

- FINANCIAL AID

- Loans

- Grants & scholarships

- Fellowship or stipend

- OTHER INCOME

- Savings at beginning of school year

- Money from family

- Work income during school year

- Other:

- Other:

- Total Income

- EXPENSES (for the academic year)

- (Consider what you will need for the entire school year. It may help to look at what you

- plan to spend per month based on the monthly budget worksheet)

- Tuition and fees

- Books and supplies

- HOUSING

- Apartment rent

- Groceries

- Apartment utilities (including deposits)

- Apartment deposit

- Apartment supplies (cleaning, tools, furniture, dishes, cookware)

- Local transportation (car, bus)

- Clothes, grooming, laundry

- Cell phone

- Take out and restaurant food and beverage

- Entertainment (movies, DVDs, parties)

- Unexpected expenses/ emergencies

- Savings/ Debt repayment

- Other:

- Total expenses

- Enter your total income (from above)

- Enter your total expenses (from above)

- Subtract to get your bottom line

- *Adapted from Michigan State University, Office of Financial Aid.

- MONTHLY BUDGET WORKSHEET

- INCOME (per month):

- FINANCIAL AID

- Loans

- Grants & scholarships

- Fellowship or stipend

- OTHER INCOME

- Savings

- Money from family

- Work income

- Other:

- Other:

- Total Income

- EXPENSES (per month):

- Tuition and fees

- Books and supplies

- HOUSING

- Apartment rent

- Groceries

- Apartment utilities

- Apartment supplies (cleaning, tools, furniture, dishes, cookware)

- Local transportation (car, bus)

- Clothes, grooming, laundry

- Cell phone

- Take out and restaurant food and beverage

- Entertainment (movies, DVDs, parties) (consider a weekly allowance)

- Unexpected expenses/ emergencies

- Savings/ Debt repayment

- Other:

- Total expenses

- Enter your total income (from above)

- Enter your total expenses (from above)

- Subtract to get your bottom line.

Using this budget planning template guarantees you will save time, cost and effort! It comes in Microsoft Office format, is ready to be tailored to your personal needs. Completing your document has never been easier!

Download this Annual Budget Worksheet template now for your own benefit!

MONTHLY BUDGET WORKSHEET INCOME (per month): FINANCIAL AID Loans Grants scholarships Fellowship or stipend OTHER INCOME Savings Money from family Work income Other: Other: Total Income EXPENSES (per month): Tuition and fees Books and supplies HOUSING Apartment rent Groceries Apartment utilities Apartment supplies (cleaning, tools, furniture, dishes, cookware) Local transportation (car, bus) Clothes, grooming, laundry Cell phone Take out and restaurant food and beverage Entertainment (movies, DVDs, parties) (consider a weekly allowance) Unexpected expenses/ emergencies Savings/ Debt repayment Other: Total expenses Enter your total income (from above) Enter your total expenses (from above) Subtract to get your bottom line Adapted from Michigan State University, Office of Financial Aid..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Influencer Marketing Templates

What makes a good influencer? Check out our effective and useful Influencer Marketing Templates here! - House Cleaning Schedule Daily Weekly Monthly

Cleanliness is not just about what’s outside; it reflects what’s inside." Check out our House Cleaning Schedule Daily Weekly Monthly templates here. - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs...

cheese