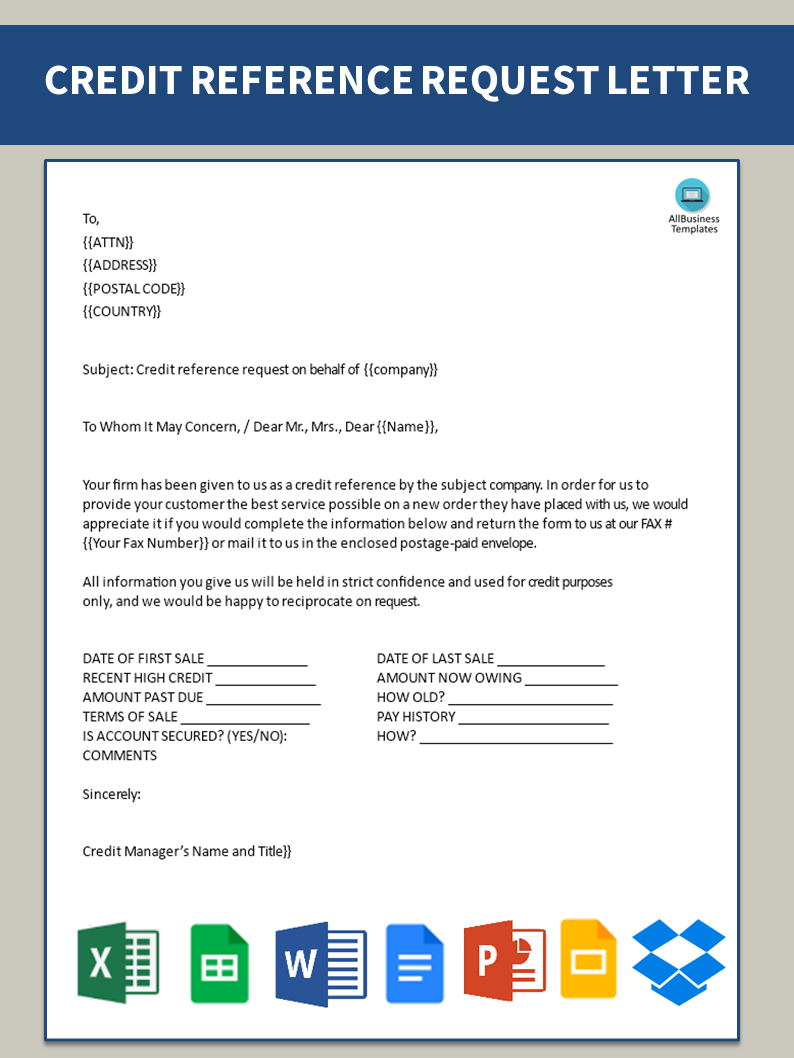

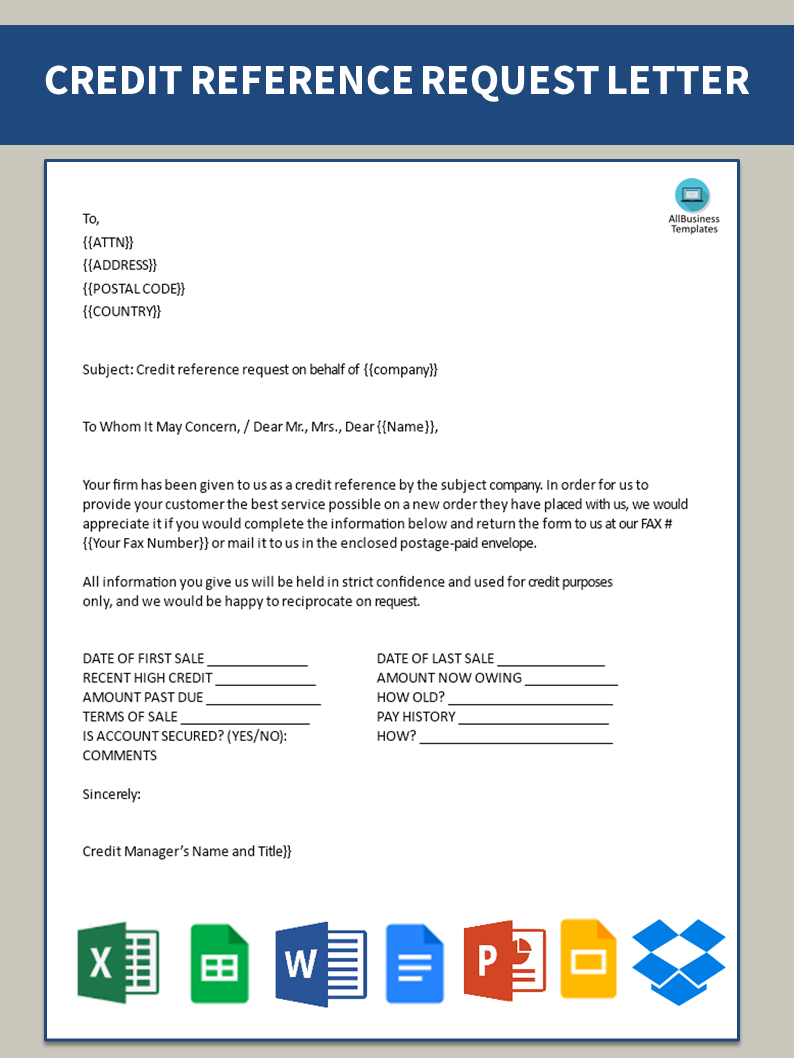

Company Credit Reference Letter

Save, fill-In The Blanks, Print, Done!

Download Company Credit Reference Letter

Microsoft Word (.docx)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (35.53 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to write a Company Credit Reference Letter to business relations? What is the purpose of a letter of reference for a company credit? You can use this template to request a company credit reference letter from a potential lender or business partner. The letter should include the company's contact information, the length of time they have been in business, and any outstanding debts or obligations. Download this template now and get started!

A company credit reference letter is a document that provides information about the creditworthiness and financial stability of a business. It is often requested by a company's suppliers, vendors, or financial institutions when the business is applying for credit or establishing new credit terms. This letter serves as a reference and helps the requesting party assess the credit risk associated with the business.

Key components of a company credit reference letter may include:

- Introduction:

- The letter typically starts with a formal introduction, including the name and address of the company providing the reference.

- Details of the Referenced Company:

- Include information about the company for which the credit reference is being provided. This may include the company name, address, industry, and any other relevant details.

- Length of Relationship:

- Indicate how long the reference provider has been in a business relationship with the company. A longer positive history often reflects favorably on the creditworthiness of the company.

- Credit Terms and Payment History:

- Describe the credit terms extended to the company, including any credit limits, payment terms, and the history of payments. Highlight the company's track record of paying bills on time.

- Financial Stability:

- Provide an assessment of the financial stability of the company. This may include information about the company's profitability, liquidity, and overall financial health.

- Business Practices:

- Comment on the business practices of the company. This could include reliability, consistency, and any other factors that might impact the credit relationship.

- Any Issues or Concerns:

- If there are any concerns or issues related to the company's creditworthiness, they should be mentioned in the letter. It's important to provide an honest assessment.

- Contact Information:

- Include the contact information of the person or department that can be reached for further clarification or additional information.

- Authorization:

- Sometimes, the reference letter includes a statement confirming that the information provided is accurate and that the reference provider has the authority to disclose it.

It's important for the Company Credit Reference Letter to be accurate, honest, and comprehensive. Businesses often rely on these letters to make informed decisions about extending credit, so providing a clear and thorough assessment is crucial. Additionally, the letter may be subject to legal and ethical considerations, so it's important to ensure that the information disclosed complies with applicable laws and regulations.

Feel free to download this intuitive Company Credit Reference Letter template that is available in several kinds of formats or try any other of our basic or advanced templates, forms or documents. Do not reinvent the wheel and start making your letter and form from scratch. Make sure you find useful resources, study them first, before you start your own letter. This ready-made Request For Credit Reference Letter example can help you to focus on those issues that are the most important. If you need more Request For Credit Reference Letters in DOCX format that you can easily customize, check out these templates:

This Company Credit Reference Letter and Trade reference form is easy to edit, fully customizable, and downloadable using various devices. After sending this Trade Reference Form, he/she will always be thankful to you for helping him/her. Download this Company Credit Reference Letter template now for your own benefit!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Reference Letters

How to write a personal reference letter? How are professional references different from character references? Check out several professional reference letters here.

Read moreRelated templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese