CoGS Calculator

Save, fill-In The Blanks, Print, Done!

Download CoGS Calculator

Microsoft Spreadsheet (.xls)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (42 kB)

- Language: English

- We recommend downloading this file onto your computer.

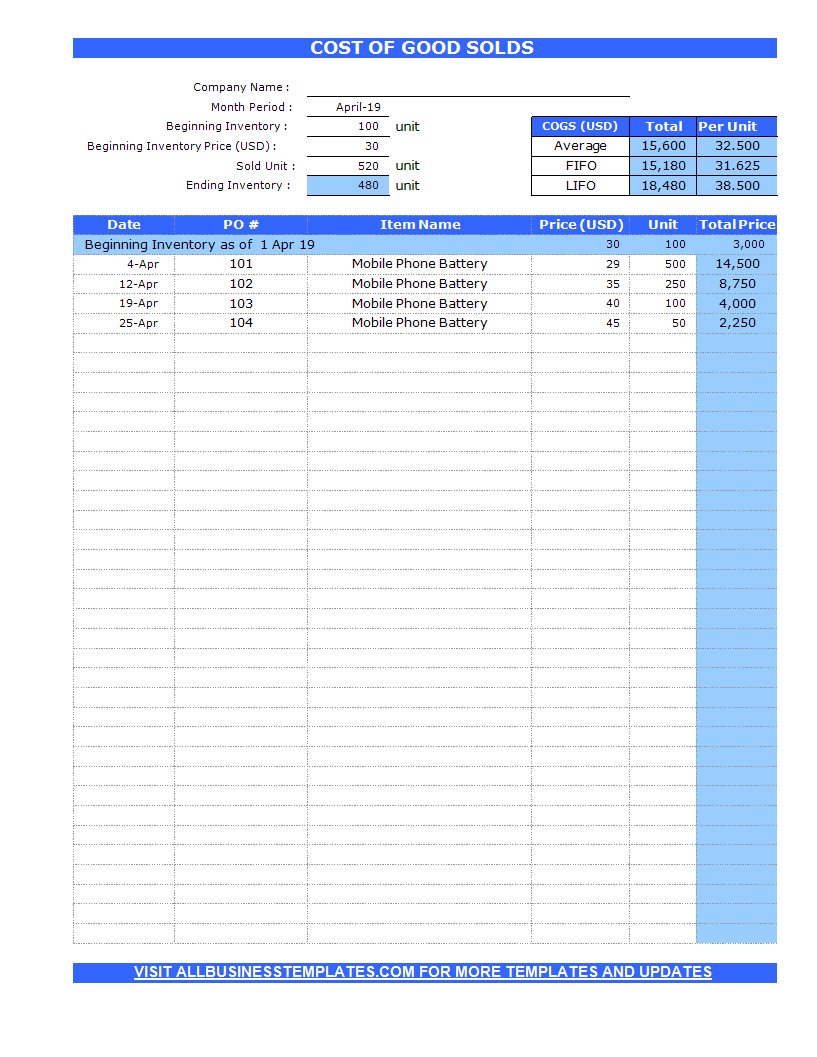

How to calculate CoGS in Excel? An easy way to create your Cost of Goods Sold spreadsheet is by downloading this example CoGS Calculator Excel spreadsheet template now!

When you are conducting a sales business, you’re going to need to keep track of all goods that your company sells over some periods of time. By doing so, you will be able to determine the total profit that could be gained by your company. And since every inventory or goods has its cost, calculating the cost of good that was sold by the company is the key to determining the company’s profit. And all of that stuff above could be calculated by using the Cost of Goods Sold or CoGS calculator. You can make them through excel and apply them to your daily business.

CoGs Calculator is an excel template which can assist you to calculate the overall cost of inventory that was sold by one’s company.

Using the CoGS calculator is rather complicated and intricate but nonetheless doable and effective. The first thing you need to do is to fill out the summary of the data including company name, month period, beginning inventory, beginning price of the inventory and sold the unit. Ending inventory will be calculated automatically. Next, fill out the Date column with the weekly period of selling and also the overall products sold at that week under the PO# column. Fill out the name of the goods along with the price and the sold items. And lastly, fill sold quantity and its unit price. You will see your item CoGS calculated in blue cells automatically based on 3 methods, Average, FIFO (First In First Out), and LIFO (Last In First Out) methods.

When using the periodic method of inventory, Cost of Goods Sold is calculated using the following equation:

Beginning Inventory + Inventory Purchases – End Inventory = Cost of Goods Sold

The cost of goods sold formula is calculated by adding purchases for the period to the beginning inventory and subtracting the ending inventory for the period.

This equation makes perfect sense when you look at it piece by piece.

Beginning inventory, plus the amount of inventory purchased over the period gives you the total amount of inventory that could have been sold (sometimes known, understandably, as Cost of Goods Available for Sale).

We then assume that, if an item isn’t in inventory at the end of the period, it must have been sold. (And conversely, if an item is in ending inventory, it obviously wasn’t sold, hence the subtraction of the ending inventory balance when calculating CoGS).

What is the Cost of Goods Sold?

Cost of goods sold is a calculation of all the costs involved in selling a product. Calculating the cost of goods sold for products you manufacture or sell can be complicated, depending on the number of products and the complexity of the manufacturing process.

Cost of goods sold is a required calculation as part of your business tax return. It reduces your business income, and thus your business taxes, so it's important to get it right. m isn’t in inventory at the end of the period, it must have been sold. (And conversely, if an item is in ending inventory, it obviously wasn’t sold, hence the subtraction of the ending inventory balance when calculating CoGS).

Cost of Goods Sold and Inventory

The calculation of the cost of goods sold is focused on the value of inventory. If you are selling a physical product, inventory is what you sell. Your business inventory might be items you have purchased from a wholesaler or that you have made yourself and are reselling. You might also keep an inventory of parts or materials for products that you make. Inventory is an asset, with a specific value.

The process of calculating the cost of goods sold starts with the inventory at the beginning of the year and ends with the inventory at the end of the year. Many businesses have a process of "taking inventory" at these times to determine their value.

Our Excel templates are grid-based files designed to organize information and perform calculations with scalable entries.

This Excel template is a great way to increase your productivity and performance. It gives you access to do remarkable new things with Excel, even if you only have a basic understanding of working with formula’s and spreadsheets.

Download this CoGS Calculator Excel spreadsheet now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese