Authorization to Release Account Information

Save, fill-In The Blanks, Print, Done!

Download Authorization to Release Account Information

Today: USD 2.99

Download It Now

Available premium file formats:

Microsoft Word (.docx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (23.6 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

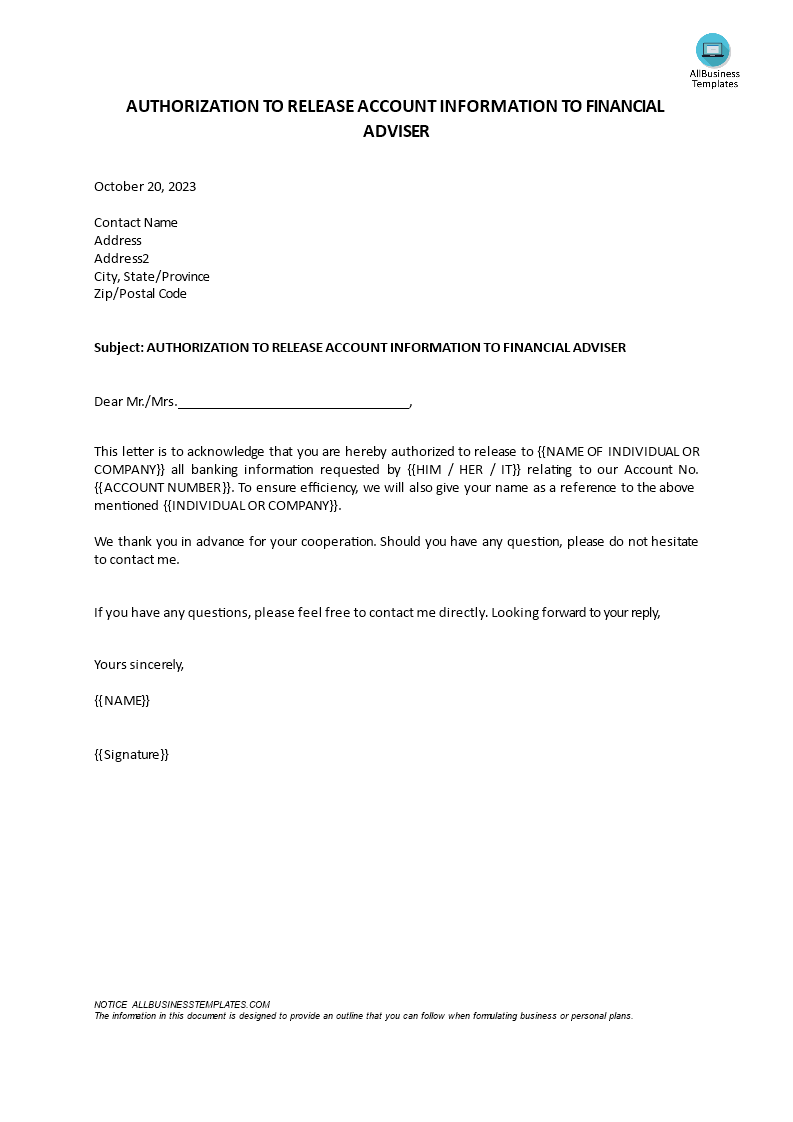

How to write an authorization to release account information? Why do I need a letter of authorization to access my account information? This template can be used to request the release of account information. It includes the necessary information to authorize the release of account information such as the client's name, account number, and signature. Download this Authorization to Release Account Information now!

An authorization to release account information is a legal document that grants permission for a specific individual or entity to access and obtain information about a person's financial or account records. This authorization is typically required when a person wants to allow a third party, such as a financial institution, accountant, attorney, or government agency, to access their financial information.

Key points regarding an Authorization to Release Account Information include:

- Consent: It serves as the account holder's consent to release specified information to the designated third party.

- Information Scope: The document outlines the specific type of information that can be accessed and disclosed. This may include bank statements, transaction history, account balances, tax records, and other financial information.

- Designated Recipient: The authorization specifies the name and contact information of the individual or entity authorized to receive the information. This could be a person's attorney, an accountant, a government agency, or any other party with a legitimate need for the information.

- Duration: The document may specify the duration for which the authorization is valid. It can be a one-time authorization for a specific purpose or an ongoing authorization.

- Revocable: Most authorizations are revocable, meaning that the account holder can revoke or cancel the authorization at any time. This is often done in writing to the entity that initially received the authorization.

- Privacy Protection: Authorization to Release Account Information is used to protect the privacy and confidentiality of an individual's financial data. It ensures that sensitive information is not disclosed without the account holder's explicit permission.

Common situations where an Authorization to Release Account Information might be used include:

- Allowing an accountant or tax professional to access financial records for tax preparation.

- Granting permission to a mortgage lender to verify financial information during the home-buying process.

- Authorizing a family member or trusted friend to access account information on behalf of an elderly or incapacitated individual.

- Providing consent to a government agency to access financial records for purposes such as determining eligibility for benefits or conducting an investigation.

The specific requirements and format of an Authorization to Release Account Information can vary by jurisdiction and the institution or entity involved. In many cases, institutions have their own standard forms for such authorizations, and individuals may need to complete and sign these forms to grant permission.

Download this professional legal Authorization to Release Account Information template if you find yourself in this situation and save yourself time, and effort and probably reduce some of the lawyer fees! Using our legal templates will help you reach the next level of success in your education, work, and business! However, we still recommend you to consider consulting a local law firm in case of doubt to support you in this matter.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese