Final Notice Bad Check

Save, fill-In The Blanks, Print, Done!

Download Final Notice Bad Check

Today: USD 2.99

Download It Now

Available premium file formats:

Microsoft Word (.docx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (24.95 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

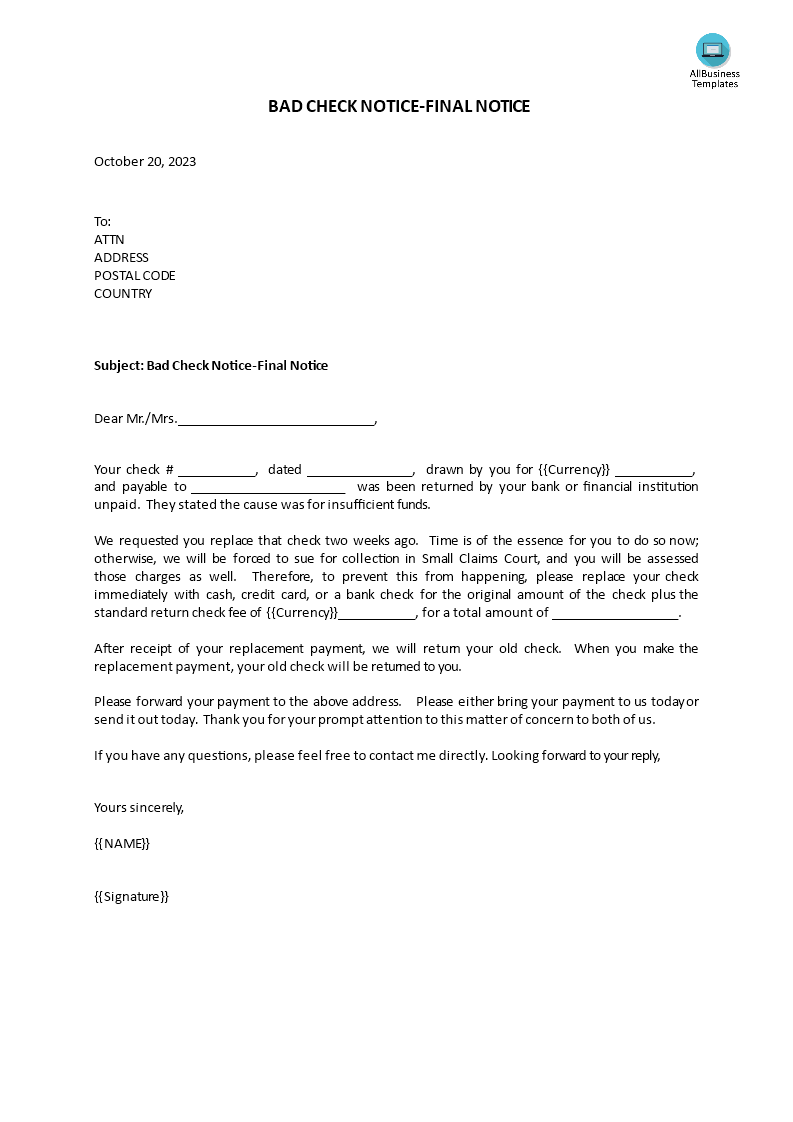

Do you need a Final Notice Bad Check? What does the term bad check mean? You can use this template to send a final notice bad check to an individual or a company that you wrote a check to, but have not paid you back. Download this template that is fully customizable and can be used to quickly and easily create a professional Final Notice Bad Check.

A Final Notice Bad Check, also known as a "final demand letter for payment" or simply a "final notice," is a written communication sent by a payee or a business to a check writer or account holder who has issued a check that bounced or was returned due to insufficient funds in their bank account. This notice is typically sent after previous attempts to collect the owed funds have been unsuccessful.

Here are the key elements typically found in a Final Notice Bad Check:

- Explanation: The notice explains that a check issued by the recipient has been returned unpaid due to insufficient funds or other reasons.

- Amount Owed: It states the exact amount of money that is owed, including the original check amount, any fees or charges incurred as a result of the bounced check, and any additional penalties or interest that may have accrued.

- Payment Instructions: The notice provides clear instructions on how and where to make the payment. This may include specifying acceptable forms of payment (e.g., cash, cashier's check, money order) and the deadline by which the payment must be received.

- Contact Information: Contact details for the payee or the payee's representative (such as a collection agency) are provided for inquiries and correspondence related to the bounced check.

- Consequences: The notice may outline the potential consequences of not making the required payment, such as legal action, reporting the incident to credit bureaus, or further collection efforts.

- Additional Information: Sometimes, the notice may include additional information about the bounced check, such as the check number, date of issuance, and the name of the bank where the check was drawn.

A Final Notice Bad Check is typically the last attempt to resolve the matter amicably before the payee or business takes further legal action to recover the owed funds. If the check writer does not respond to the final notice or fails to make the required payment by the specified deadline, the payee may pursue legal remedies, such as filing a civil lawsuit or reporting the incident to law enforcement, depending on local laws and regulations.

Download this professional Final Notice Bad Check Notice template now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese