Personal Tax Calendar

Save, fill-In The Blanks, Print, Done!

Download Personal Tax Calendar

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (583.3 kB)

- Language: English

- We recommend downloading this file onto your computer.

Do you need a Personal Tax Calendar? Have a look at this example Calendar!

Customizing your own calendar template is easy. It can be further edited via your own computer after you downloaded it. In our collection, you'll find a variety of monthly or yearly calendar templates that are ready for a free download and after some customization, ready to use in your home, office or school.

Choose from professionally designed templates for Microsoft Excel and Word, PDF, and Google Docs. Options include printable calendars with landscape or portrait.

If this Calendar is not the right one for you, you can find other designs by browsing through our collection of free printable calendars and calendar templates or continue browsing below to find other schedules, planners, etc...

Each printable calendar is a professional-looking template in MS Word, Excel, PDF format.

Download your free printable Personal Tax Calendar template now!

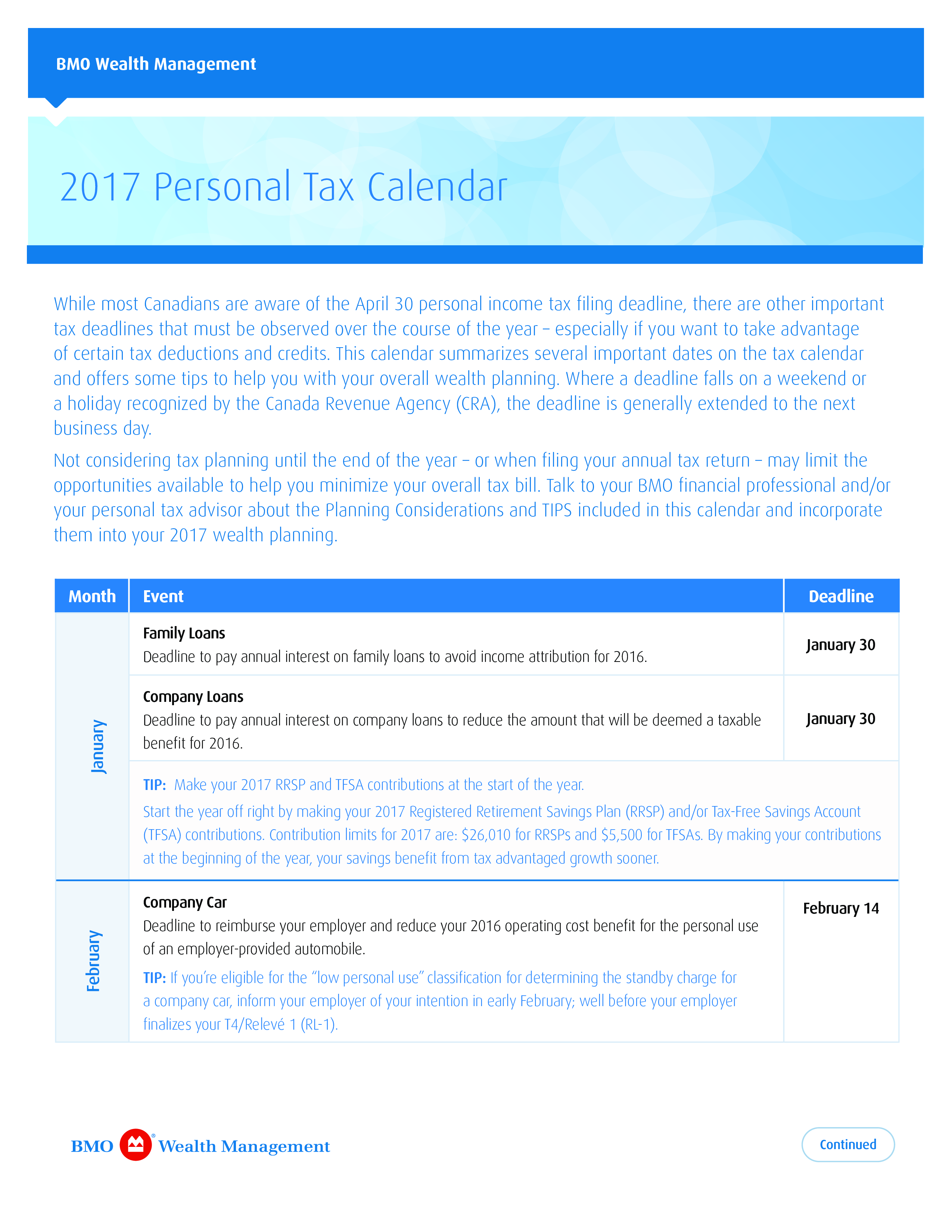

BMO Wealth Management 2017 Personal Tax Calendar While most Canadians are aware of the April 30 personal income tax filing deadline, there are other important tax deadlines that must be observed over the course of the year – especially if you want to take advantage of certain tax deductions and credits.. Continued BMO Wealth Management February Month 2017 Personal Tax Calendar Event T4/RL-1, T4A/RL-2 and T5/RL-3 Tax Slips Deadline for employers to issue 2016 T4/RL-1 slips (Statement of Remuneration Paid) to employees, and for financial institutions to send T4A/RL-2 (Statement of Pension, Retirement, Annuity, and Other Income) and T5/RL-3 (Statement of Investment Income) tax slips.. FBAR Reporting for U.S. Citizens Deadline for U.S. citizens to file a 2016 Report of Foreign Bank and Financial Accounts (FBAR) FinCEN Form 114 with the IRS to provide details on any foreign bank accounts and other financial accounts held outside the U.S. Please note that the deadline can be extended by six months to October 15, 2017.. Some common income-splitting strategies to consider include: • An interest-bearing loan at the prescribed interest rate to family members in a lower tax bracket • Pension income-splitting between spouses (or common-law partners) • Gifts to adult children or other adult family members (other than a spouse or common-law partner) and October September August • Gifts to a minor child – directly or through a trust structure – to acquire investments that generate only capital gains.. For donations made after 2015 that exceed 200, the calculation of the federal charitable donation tax credit will allow higher income donors to claim a federal tax credit at a rate of 33 (versus 29 ), but only on the portion of donations made from income that is subject to the new 33 top marginal tax rate that came into effect on January 1, 2016..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Influencer Marketing Templates

What makes a good influencer? Check out our effective and useful Influencer Marketing Templates here! - House Cleaning Schedule Daily Weekly Monthly

Cleanliness is not just about what’s outside; it reflects what’s inside." Check out our House Cleaning Schedule Daily Weekly Monthly templates here. - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs...

cheese