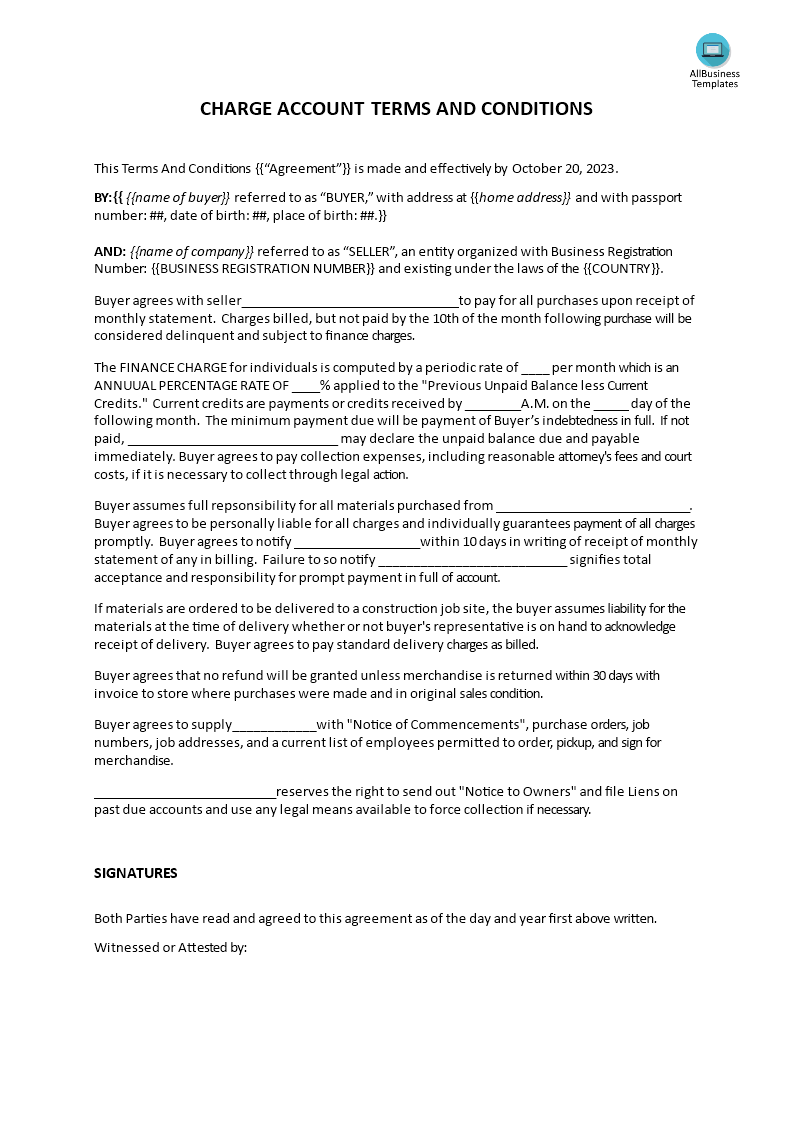

Charge Account Terms and Conditions

Save, fill-In The Blanks, Print, Done!

Download Charge Account Terms and Conditions

Today: USD 2.99

Download It Now

Available premium file formats:

Microsoft Word (.docx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (24.31 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

Do you need a

Charge Account Terms and Conditions? How do the payment terms and conditions work? We have you covered with our professionally written charge account terms and conditions template. This template has everything you need to ensure clarity and protect your business. Plus, it's easy to use and customize.

A Charge Account Terms and Conditions is a legally binding document that outlines the terms, rules, and conditions under which a customer or business is granted access to a credit account by a creditor or financial institution. These terms and conditions are essential for establishing the credit relationship, defining the rights and responsibilities of both parties, and ensuring that the credit arrangement is properly managed. The content of a Charge Account Terms and Conditions can vary depending on the specific credit agreement and the lending institution, but it typically includes the following key elements:

- Account Information:

- Account Holder's Name and Contact Information: The name, address, and contact details of the account holder (the individual or business receiving credit).

- Creditor's Name and Contact Information: The name and contact details of the creditor or financial institution extending credit.

- Account Terms:

- Credit Limit: The maximum amount of credit extended to the account holder.

- Account Number: A unique identifier for the credit account.

- Interest Rate: The annual percentage rate (APR) or interest rate charged on outstanding balances.

- Grace Period: If applicable, the period during which interest is not charged if the balance is paid in full.

- Payment Terms:

- Minimum Payment: The minimum amount that must be paid each billing cycle to keep the account in good standing.

- Due Date: The date by which payments must be received to avoid late fees or penalties.

- Late Payment Fees: Information on the fees and penalties imposed for late payments.

- Payment Allocation: How payments are applied to outstanding balances (e.g., to interest, fees, or principal).

- Fees and Charges:

- Annual Fees: If applicable, any annual fees associated with the credit account.

- Transaction Fees: Details about fees for specific transactions, such as cash advances or balance transfers.

- Overlimit Fees: Information on fees for exceeding the credit limit.

- Foreign Transaction Fees: If applicable, fees for transactions made in foreign currencies or outside the country.

- Billing and Statements:

- Statement Frequency: How often the account holder will receive statements.

- Statement Content: An explanation of what information is included in each statement, such as transaction details, outstanding balances, and payment due dates.

- Account Use and Restrictions:

- Permitted Use: Information on how the credit account can be used and any restrictions (e.g., business expenses only).

- Authorized Users: Procedures for adding or removing authorized users on the account.

- Security Measures: Steps to protect the account from unauthorized use, including password or PIN requirements.

- Default and Remedies:

- Default Conditions: The circumstances under which the account holder is considered in default.

- Remedies: The actions the creditor can take in the event of default, such as reporting to credit bureaus or pursuing legal action.

- Termination Process: Steps and notifications are required to close the account.

A Charge Account Terms and Conditions agreement is a legally binding contract, and both parties are expected to adhere to the terms outlined therein.

Download this professional

Charge Account Terms and Conditions template now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese