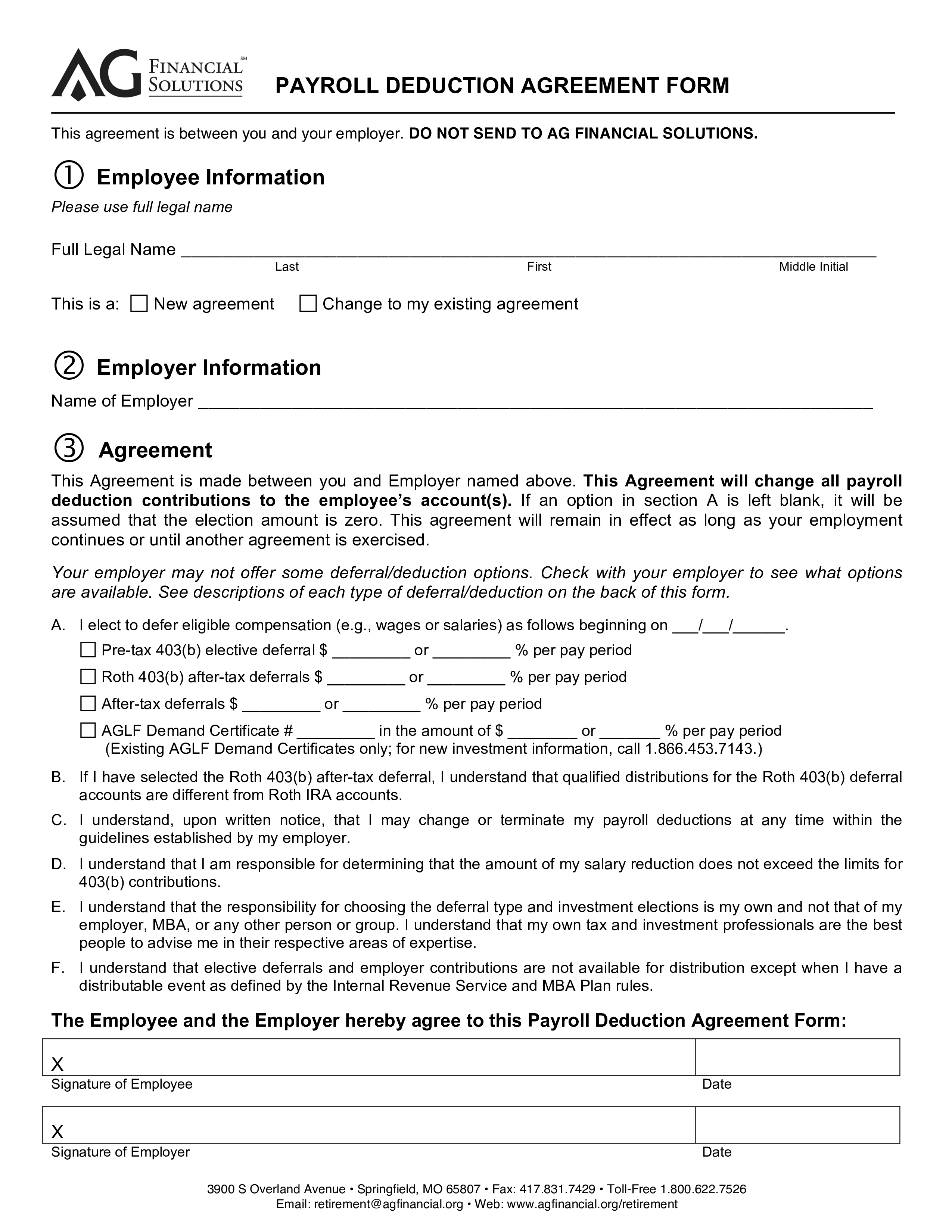

Payroll Deduction Agreement Form

Save, fill-In The Blanks, Print, Done!

Download Payroll Deduction Agreement Form

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (172.63 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to draft a proper Payroll Deduction Agreement Form? Download this Payroll Deduction Agreement Form template that will perfectly suit your needs!

Legal communication is essential to individuals and companies to ensure truthful, accurate information exchange and enable morally-correct decision making. This is important to give consideration on how to communicate and how to remain lawful in your day-to-day business activities. Therefore, communication in situations that involve legal complications, request extra attention. Using our easy-to-modify Payroll Deduction Agreement Form helps to make a perfect document for any kind of personalized legal matter.

Legal professionals are in need of templates more than any other industry. Our trustworthy legal templates are all drafted and screened by legal professionals that have experience in special law-related fields and are actively involved in legal issues around the topic. This Payroll Deduction Agreement Form template covers the most important subjects and will help you to structure and communicate in a professional and legal way with those involved.

Download this professional legal Payroll Deduction Agreement Form template now and save yourself time, efforts and possibly reduce the lawyer-fees in order to become more successful.

Using our legal templates will help you to deal with the situation! However, this Legal template will help you dealing with this legal matter, we still recommend you to consider to find legal support in case you have doubts dealing with it the right way.

Pre-tax 403(b) elective deferral or per pay period Roth 403(b) after-tax deferrals or per pay period After-tax deferrals or per pay period AGLF Demand Certificate in the amount of or per pay period (Existing AGLF Demand Certificates only for new investment information, call 1.866.453.7143.) B.. The Employee and the Employer hereby agree to this Payroll Deduction Agreement Form: X Signature of Employee Date X Signature of Employer Date 3900 S Overland Avenue • Springfield, MO 65807 • Fax: 417.831.7429 • Toll-Free 1.800.622.7526 Email: retirement agfinancial.org • Web: www.agfinancial.org/retirement

403(b) Plan Contribution Types All contributions to your 403(b), whether deferred from taxes or after-tax deposits, must be from ministry earned income and are subject to legal limits..

Also interested in other Legal templates? AllBusinessTemplates is the #1 source for Legal templates! Just search on our website and have instant access to thousands of free and premium legal agreements, contract, documents, forms, letters, etc used on a daily basis by professionals in your industry.

For example Real estate forms, Employment forms, General release bank account, Power of attorney, Joint Venture Agreement, Letter of intent, Last will & testament, Secrecy Agreement, Articles of Incorporation of Company, Agreement with Accountant, Purchase contract, Agreement for permission to sublet and much more. All business templates are easy to find, crafted by professionals, ready to use, easy to customize and intuitive. Pay close attention to the available legal template by browsing through the list. Take the time to review and choose the variety of legal templates to suits your needs.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese