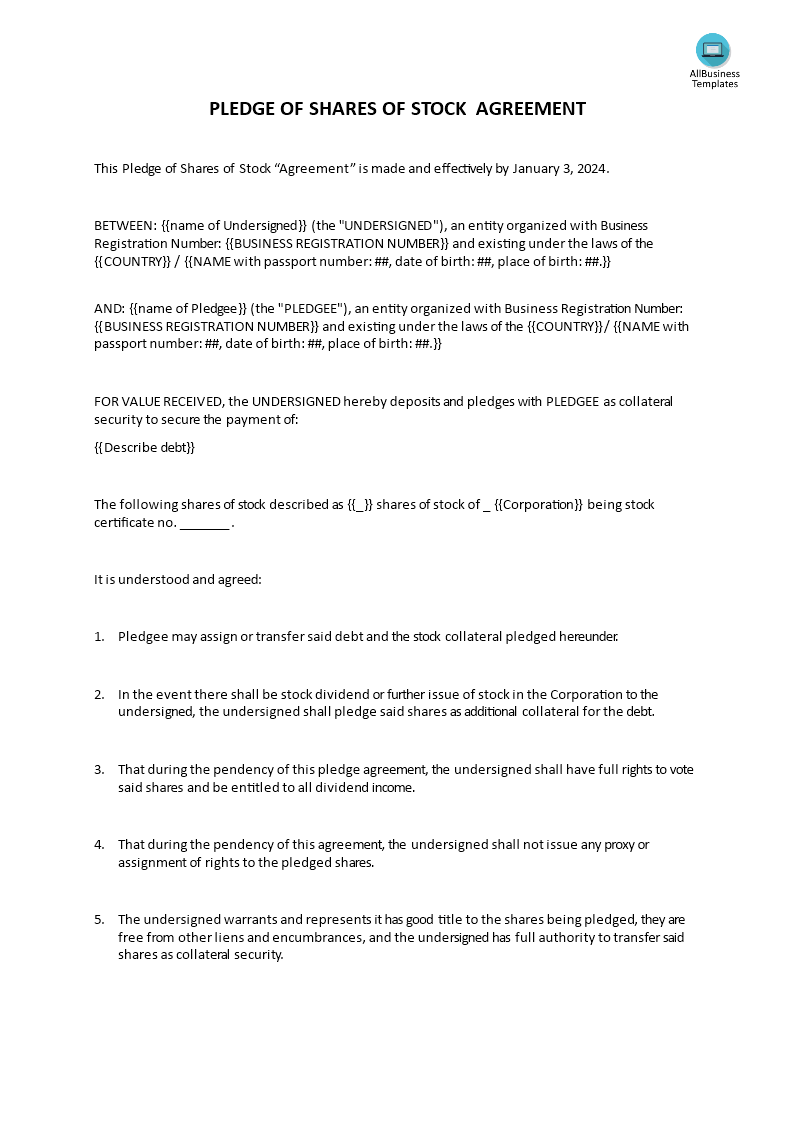

Pledge of Shares of stock

Save, fill-In The Blanks, Print, Done!

Download Pledge of Shares of stock

Today: USD 1.99

Download It Now

Available premium file formats:

Microsoft Word (.docx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (28.36 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

Do you need a

pledge of shares of stock? What are the pros and cons of pledging shares? Our template is designed to help you quickly and easily create a legally binding agreement. It includes all the necessary information to document the pledging of shares accurately. We provide a well-crafted pledge of shares of stock template that

suits your needs!

Pledging of shares of stocks is a financial practice where an individual or entity uses their ownership of publicly traded stocks as collateral to secure a loan or other financial arrangements. This process is similar to pledging shares of a publicly traded company, as described in the previous response, but it specifically involves the stocks or equities of a company rather than the company's shares themselves.

Why is the pledge of shares of stock important?

The pledge of shares of stock is a legal and financial mechanism where an individual or entity offers their shares of stock in a company as collateral to secure a loan or fulfill other financial obligations. This process involves the transfer of the legal title of the shares to the lender while the pledgor (owner of the shares) retains the beneficial ownership. The importance of the pledge of shares of stock lies in several key aspects:

- Securing Loans:

- Pledging shares of stock is a common practice to secure loans. Lenders may require collateral to mitigate the risk associated with lending money. Pledged shares serve as security, allowing the borrower to access financing.

- Access to Capital:

- For businesses and individuals, pledging shares can be a way to access capital without selling the shares. It allows the owner to maintain ownership and potential benefits (dividends, voting rights) while leveraging the value of the shares for financial needs.

- Liquidity for Shareholders:

- Shareholders may pledge their shares to raise liquidity for personal or business purposes without selling the shares outright. This is particularly relevant for individuals with a significant stake in a company who wish to maintain ownership while accessing funds.

- Business Expansion:

- Companies may pledge their own shares as part of a broader strategy for business expansion or investment. Pledging shares can provide the necessary funds for acquisitions, capital expenditures, or other growth initiatives.

- Debt Restructuring:

- The pledge of shares can be a component of debt restructuring efforts. Companies facing financial challenges may use this mechanism to secure additional financing or negotiate more favorable terms with existing creditors.

- Mergers and Acquisitions:

- Pledging shares can be relevant in mergers and acquisitions. It may be used to demonstrate financial strength or secure financing during negotiations.

- Maintaining Control:

- Unlike selling shares, pledging allows the shareholder or company to maintain control and ownership rights. This is particularly important for majority shareholders or founders who want to retain control over decision-making.

- Risk Mitigation for Lenders:

- Lenders benefit from the pledge of shares as it provides a form of security. In the event of default by the borrower, the lender can exercise their rights over the pledged shares, either by selling them to recover the loan amount or becoming a shareholder with certain rights.

- Legal Enforceability:

- The pledge of shares involves legal agreements and documentation, making it a legally enforceable mechanism. This provides a structured framework for the relationship between the borrower and the lender, outlining the rights and obligations of each party.

- Flexibility in the Use of Funds:

- Pledging shares offers flexibility in how the funds are used. Unlike specific-purpose loans, the proceeds from the pledge can often be used for various business or personal needs.

It's crucial for parties involved in a pledge of shares arrangement to carefully review and understand the terms of the agreement, as failure to meet obligations could result in the transfer of ownership or other adverse consequences.

Download this professional

pledge of shares of stock template now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese