Sales Tax.pdf

Save, fill-In The Blanks, Print, Done!

Download Sales Tax.pdf

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (22.73 kB)

- Language: English

- We recommend downloading this file onto your computer.

Great sales efforts can make a business! However, the opposite is also true. Therefore, it's important to take your sales serious right from the start. Certainly, have a look at this . This sales template will capture your audience's attention.

For those who work in Sales, it's important that they always work with the latest updated sales templates in order to grow the business faster! Therefore we invite you to check out and download our basic or advanced sales templates. They are intuitive and in several kinds of formats, such as PDF, WORD, XLS (EXCEL including formulas and can calculate sums automatically), etc.

Using this template guarantees that you will save time, cost and efforts and enables you to grow the business faster! After downloading and filling in the blanks, you can easily customize e.g. visuals, typography, details, and appearance of your .

Download this template now!

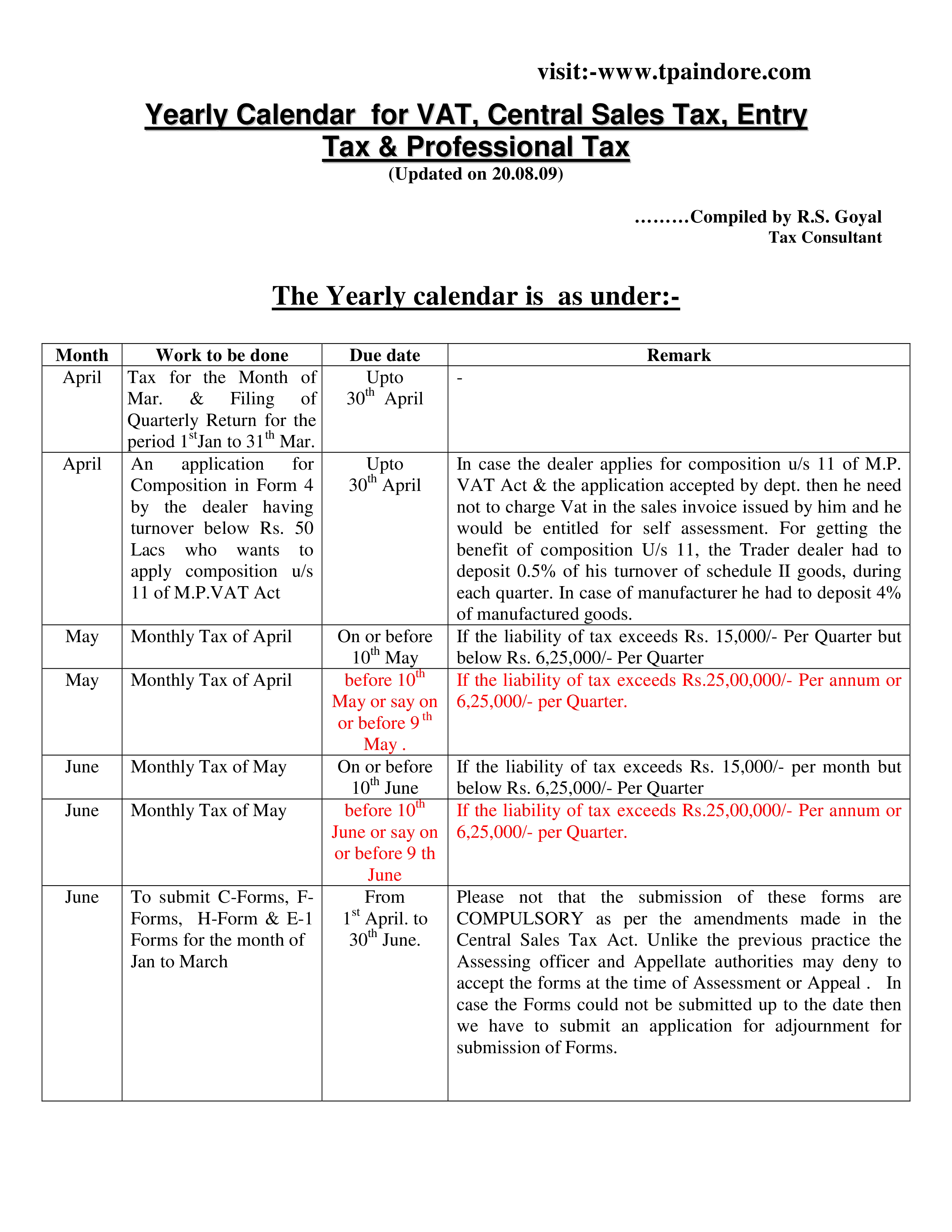

visit:-www.tpaindore.com Yearly Calendar for VAT, Central Sales Tax, Entry Tax Professional Tax (Updated on 20.08.09) ………Compiled by R.S.. 40 Lacs Monthly Tax of Oct. On or before 10th Nov. Monthly Tax of Oct. before 10th Nov or say on or before 9 th Nov. Monthly Tax of Nov. On or before 10th Dec. Monthly Tax of Nov. before 10th Dec. or say on or before 9 th Dec. To submit C-Forms, F- From 1st Oct. Forms, H-Form E-1 to th Forms for the month of 30 Dec. July to Sept.. Quarterly Tax Filing of Quarterly Return for the period 1st Oct to 31th Dec.. Upto 30th Jan Remark Please note that if there is any mistake in filing of all the four quarters filed by the dealer, it can be rectified by filing revised quarterly returns along with tax due thereon.. - visit:-www.tpaindore.com Month Feb. Work to be done Monthly Tax of Jan. Due date On or before 10th Feb before 10th Feb. or say on or before 9 th Feb. On or before 10th March before 10th Mar. or say on or before 9 th Mar. to Upto 31st March Feb. Monthly Tax of Jan. March Monthly Tax of Feb March Monthly Tax of Feb March Tax from 1st Mar. 25th March March To submit C-Forms, FForms, H-Form E-1 Forms for the month of Oct. to Dec.. From 1st Jan. to 30th March Remark If the liability of tax exceeds Rs..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese