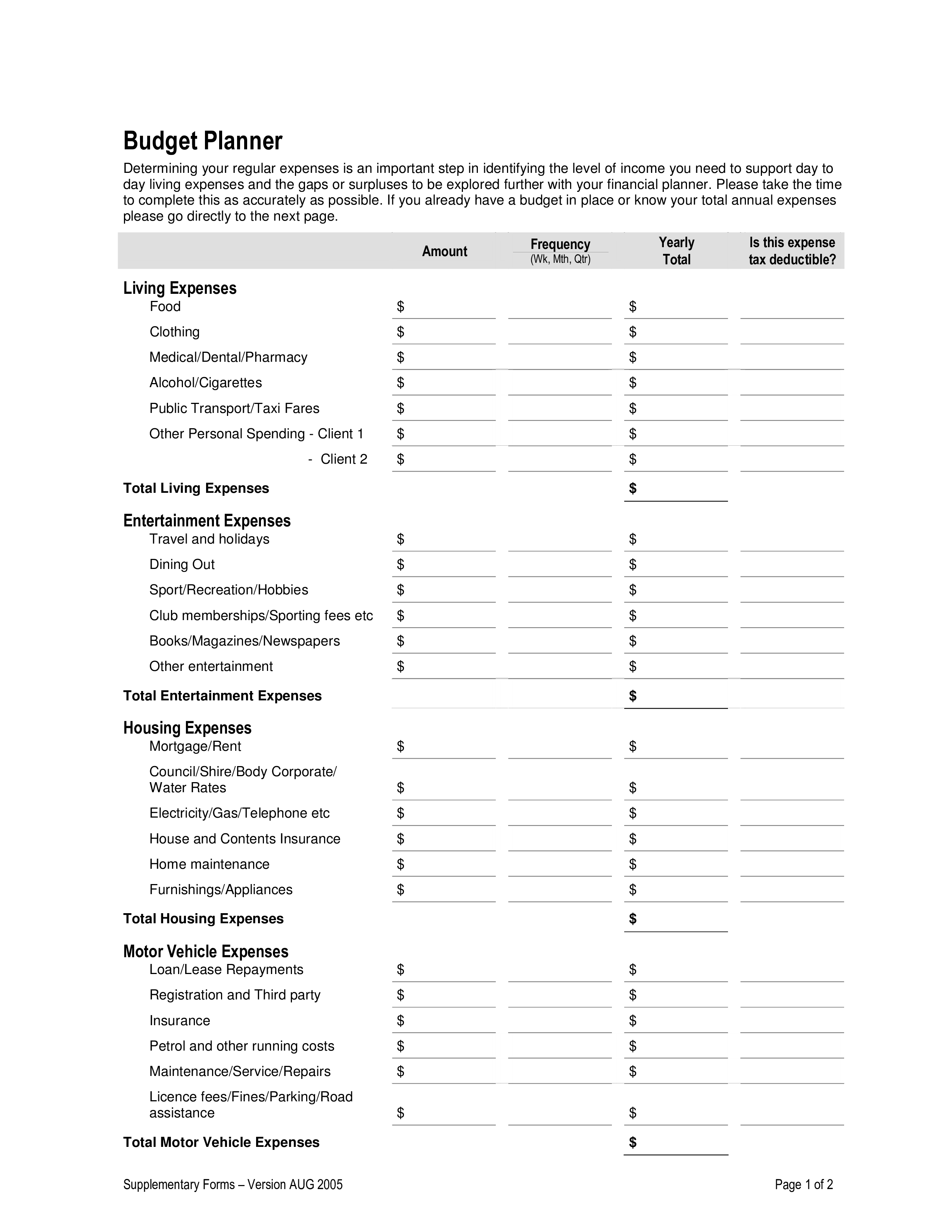

Yearly Budget Planner

Save, fill-In The Blanks, Print, Done!

Download Yearly Budget Planner

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (80.34 kB)

- Language: English

- We recommend downloading this file onto your computer.

Feel free to download our basic or advanced finance templates, they are intuitive and in several kinds of formats, such as PDF, WORD, PPT, XLS (Excel includes formulas and can calculate sums automatically), etc. Using this Yearly Budget Planner financial template guarantees that you will save time, cost and efforts and enables you to reach the next level of success in your project, education, work, and business!

Download this professional Yearly Budget Planner template now! Looking for more?

Our collection of financial documents, templates, forms, and spreadsheets includes templates designed specifically for small business owners, private individuals, or Finance Staff. Find financial projections to calculate your startup expenses, payroll costs, sales forecast, cash flow, income statement, balance sheet, break-even analysis, financial ratios, cost of goods sold, amortization and depreciation for your company. These financial templates also work with OpenOffice and Google Spreadsheets, so if you are operating your business on a very tight budget, hopefully, you'll be able to make these financial templates work for you as well.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese