Promissory Note - Installment Note Short Form

Save, fill-In The Blanks, Print, Done!

Download Promissory Note - Installment Note Short Form

Today: USD 2.99

Download It Now

Available premium file formats:

Microsoft Word (.docx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (25 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

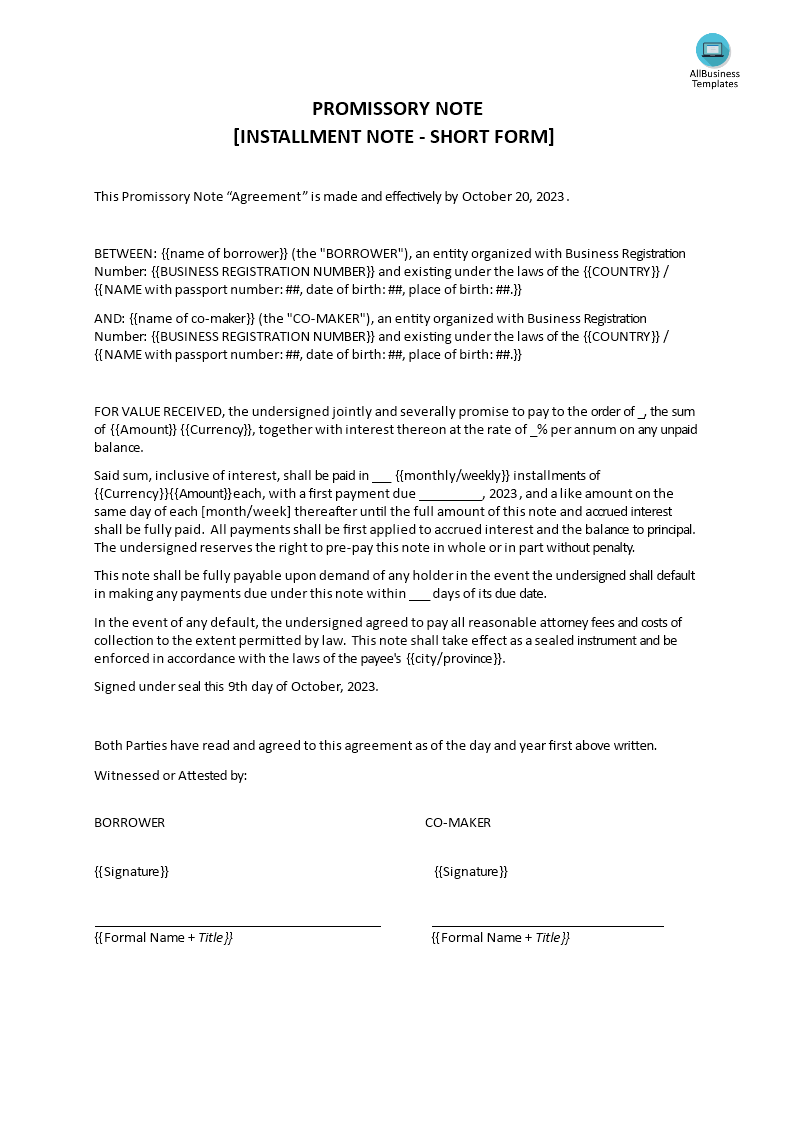

Do you need a Promissory Note-Installment Note Short Form? What should you include in a short promissory note? We have a variety of promissory note templates for installment notes, including short forms. Our templates are easy to use and can be customized to fit your needs. Download this well-crafted Promissory Note-Installment Note Short Form template that suits your needs!

A promissory note for installment note short form is a legal document that outlines the terms and conditions of a loan agreement between a lender (the party providing the loan) and a borrower (the party receiving the loan). This particular type of promissory note is designed for loans that are to be repaid in installments, meaning that the borrower agrees to make a series of scheduled payments to the lender over time until the loan is fully repaid.

Here are the key elements typically included in a promissory note for installment note short form:

- Names and Contact Information: The names and contact information (addresses) of both the lender and the borrower.

- Principal Amount: The principal amount of the loan, which represents the initial amount borrowed by the borrower.

- Interest Rate: The annual interest rate or the interest rate per installment that the borrower agrees to pay on the outstanding balance of the loan.

- Installment Payments: Details of the installment payments, including:

- The total number of installments to be made.

- The amount of each installment.

- The due date of each installment.

- Maturity Date: The final due date by which the borrower must repay the entire outstanding balance, including principal and interest.

- Late Payment Terms: The terms and consequences for late payments, including any applicable late fees or penalties.

- Prepayment: Information about whether the borrower is allowed to make prepayments (pay off the loan before the maturity date) and, if so, any associated terms or penalties.

- Security Interest: If the loan is secured by collateral (such as real estate or personal property), a description of the collateral and the terms related to the security interest.

- Governing Law: The state or jurisdiction whose laws will govern the promissory note and any disputes related to it.

- Acceleration Clause: A provision that allows the lender to demand immediate repayment of the entire outstanding balance if the borrower fails to meet certain conditions or defaults on the loan.

- Confession of Judgment: In some cases, the note may include a confession of judgment clause, which allows the lender to obtain a legal judgment against the borrower in the event of default without going through a formal legal process.

- Signatures and Date: Spaces for the signatures of both the lender and the borrower, as well as the date when the promissory note is executed.

A Promissory Note - Installment Note Short Form is a legally binding document, and both parties should fully understand its terms and implications before signing. It's essential to consult with legal counsel or seek professional advice when creating or entering into such agreements, especially for significant loans or complex lending arrangements.

Download this professional Promissory Note - Installment Note Short Form template now!

For more business templates? Just browse through our database and website! You will have instant access to thousands of free and premium business templates, legal agreements, documents, forms, letters, reports, plans, resumes, etc., which are all used by professionals in your industry. All business templates are ready-made, easy to find, wisely structured and intuitive.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese