Retail Banking Sales Resume

Save, fill-In The Blanks, Print, Done!

Download Retail Banking Sales Resume

Microsoft Word (.doc)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (19.5 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to grab your futures employers’ attention when you are applying for a new job? How to draft a that will impress it's readers! Download this Retail Banking Sales Resume template now!

There are a few basic requirements for a Resume. Every resume should contain the following:

This template will grab your future employer its attention. After downloading and filling in the blanks, you can customize every detail and appearance of your resume and finish.

You just have to be a little more creative and follow the local business conventions. Also bright up your past jobs and duties performed. Often they are looking for someone who wants to learn and who has transferable skills like:

- Leadership skills;

- Can do-will do mentality;

- Ability to communicate;

- Ability to multi-task;

- Hard work ethics;

- Creativity;

- Problem-solving ability.

- brief, preferably one page in length;

- clean, error-free, and easy to read;

- structured and written to highlight your strengths;

- immediately clear about your name and the position you are seeking.

Completing your has never been easier, and will be finished within in minutes... Download it now!

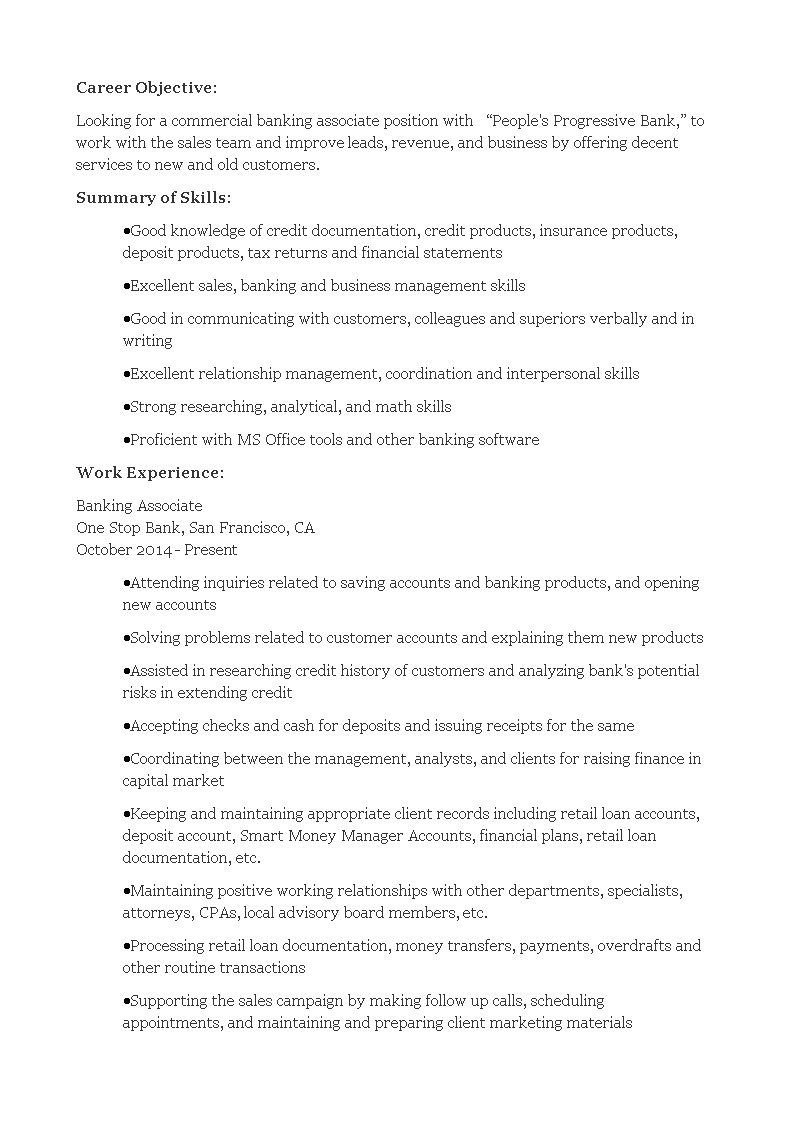

Summary of Skills: Good knowledge of credit documentation, credit products, insurance products, deposit products, tax returns and financial statements Excellent sales, banking and business management skills Good in communicating with customers, colleagues and superiors verbally and in writing Excellent relationship management, coordination and interpersonal skills Strong researching, analytical, and math skills Proficient with MS Office tools and other banking software Work Experience: Banking Associate One Stop Bank, San Francisco, CA October 2014 - Present Attending inquiries related to saving accounts and banking products, and opening new accounts Solving problems related to customer accounts and explaining them new products Assisted in researching credit history of customers and analyzing bank s potential risks in extending credit Accepting checks and cash for deposits and issuing receipts for the same Coordinating between the management, analysts, and clients for raising finance in capital market Keeping and maintaining appropriate client records including retail loan accounts, deposit account, Smart Money Manager Accounts, financial plans, retail loan documentation, etc..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese