Credit Application Form For Business Loan

Save, fill-In The Blanks, Print, Done!

Download Credit Application Form For Business Loan

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (205.77 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to make a Business Credit Loan Application Form? An easy way to start is to download this Credit Application Form For Business Loan template now!

A business loan application template is a document which provides the framework of a business loan application. Such an application is made on behalf of a business enterprise or a company to any institution, both government and non-government, in order to raise money for business activities. A business loan application template must be precise and businesslike.

You may need extra funds to help your business grow. Or perhaps you're a lender. A Business Loan Application Form can help everyone move the process along, and ensure that all the necessary terms are covered, and the application form provides the information to a potential lender so that they can decide whether to make a loan.

Some businesses operate 24/7, but it is entirely possible for it to run out of money due to unforeseen circumstances. It may be due to inadequate capital or a sudden drop in demand. Business owners may have to borrow money from banks so they can have something to use and make up for the extra amount they lost.

A business loan allows the companies to have higher chances of success. Before a bank gives out a business loan to a company, it evaluates the company’s financial history, the level of risk and amount of debt it has.

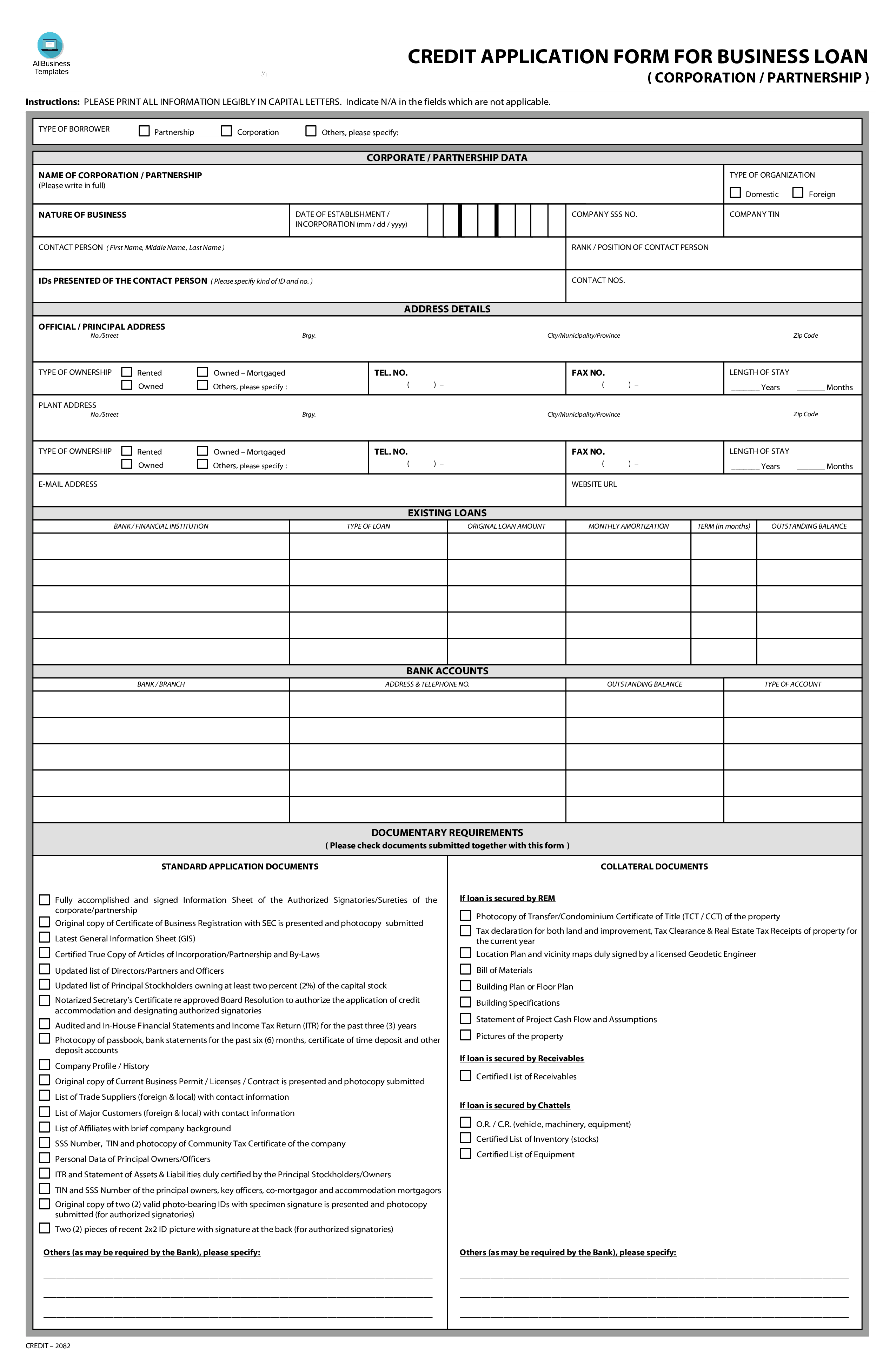

Key Components of our Business Credit Application Form

Business Information:

- Name, address, phone number, and email address of the business.

- Type of business (corporation, partnership, sole proprietorship, LLC).

- Years in business and relevant tax IDs.

- Personal details of the business owner(s) or principal(s), including social security numbers and home addresses.

- Banking Information: Details of the business’s bank accounts, including account numbers and bank contact information.

- Trade References: Contact information for trade references that can vouch for the business’s credit history.

- Credit Request Details: The amount of credit requested and the purpose for which it will be used.

- Legal Clauses and Agreements: Terms and conditions, including payment deadlines, interest rates, and credit limits.

- Business credit application personal guarantee: A clause ensuring repayment, enhancing the security of the credit extended.

- Consent for credit checks and authorization to verify provided information.

- Benefits of Using a Business Credit Application Form Template

Using this business credit application form template offers numerous advantages:

- Efficiency: A ready-made template saves time and effort in drafting the document.

- Consistency: Ensures all necessary information is collected uniformly.

- Professionalism: A well-structured form presents a professional image to clients.

- Legal Compliance: Helps ensure that all legal requirements are met.

Steps to Customize Your Business Credit Application Form

- Download the Template: Start with a business credit application form pdf or printable business credit application form to ensure you have a structured base.

- Personalize the Information: Tailor the form to include specific details about your business and the type of credit you offer.

- Include Your Logo and Branding: Make the document look official by adding your company’s logo and branding elements.

- Review Legal Clauses: Ensure that all legal terms and conditions are clearly stated and comply with local regulations.

Additional Related Documents

When preparing a credit application, consider incorporating these related documents to support your process:

- Credit Policy: Outlines the overall criteria and procedures for granting credit.

- Terms and Conditions of Sale: Specifies the terms under which products or services are sold.

- Personal Guarantee Forms: Provide additional security for credit transactions, especially with smaller businesses or startups.

- Loan Agreement: Used if the credit application leads to a more structured financing arrangement.

Advantages of AllBusinessTemplates.com

- Professionally Prepared Templates: Ensures your applications are thorough and legally sound.

- Customization: Easily tailor templates to fit your business needs.

- Time Efficiency: Streamlines document creation, allowing you to focus on other critical aspects of your business.

- Legal Compliance: Keeps your processes in line with current financial regulations and laws.

Now we provide this standardized Credit Application Form For Business Loan template with text and formatting to help you finish your document faster. If time or quality is of the essence, this ready-made template can help you to save time and to focus on what really matters!

Our Templates have helped many people to reach the next level of their success. Download this Credit Application Form For Business Loan template now for your own benefit now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Business Credit Application Forms

How to create a Business Credit Application Form? Check out our Credit Application Form templates here.

Read moreRelated templates

Latest templates

Latest topics

- Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Influencer Marketing Templates

What makes a good influencer? Check out our effective and useful Influencer Marketing Templates here!

cheese