Different depreciation methods comparison

Save, fill-In The Blanks, Print, Done!

Download Different depreciation methods comparison

Microsoft Spreadsheet (.xlsx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (33.29 kB)

- Language: English

- We recommend downloading this file onto your computer.

Whether you manage the finances at your work or at home, adequate communication is essential and important. Accurately keeping track of financial data is not only critical for running the day-to-day operations of your small or medium-sized business, but it is also important when seeking funds from investors or lenders to grow your business to the next level.

Using this depreciation schedule template in excel template guarantees that you will save time, cost and efforts and enables you to reach the next level of success in your project, education, work, and business. Download it now!

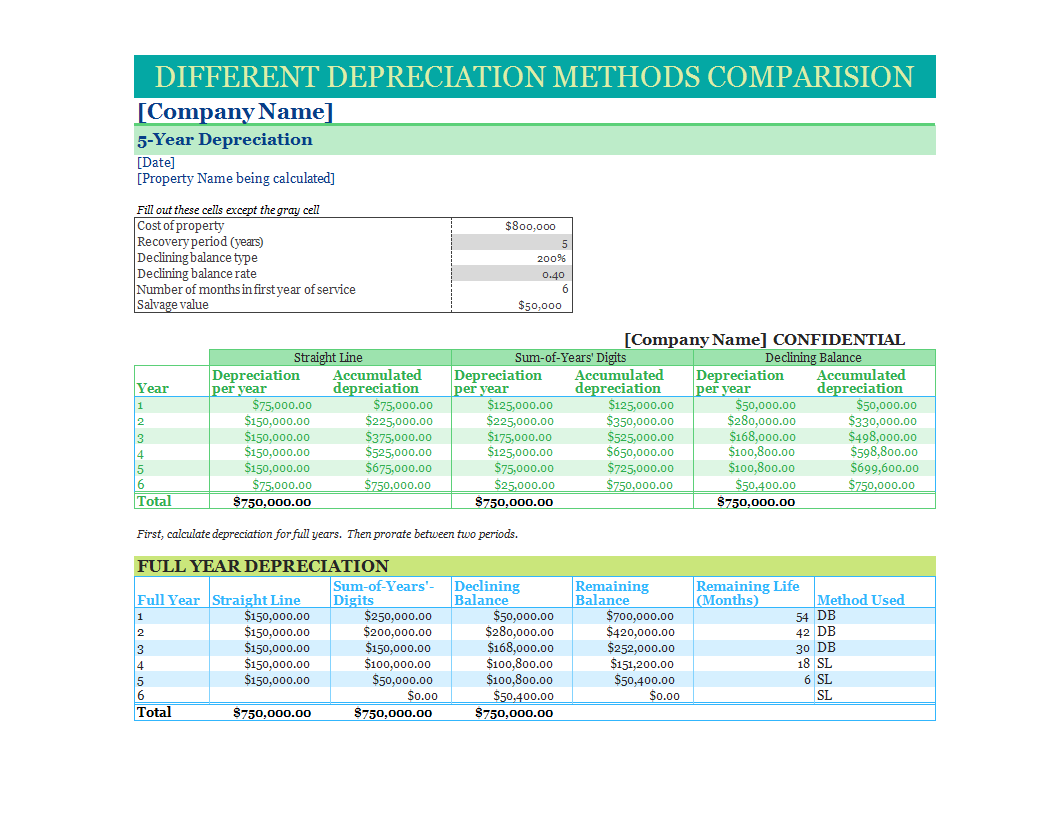

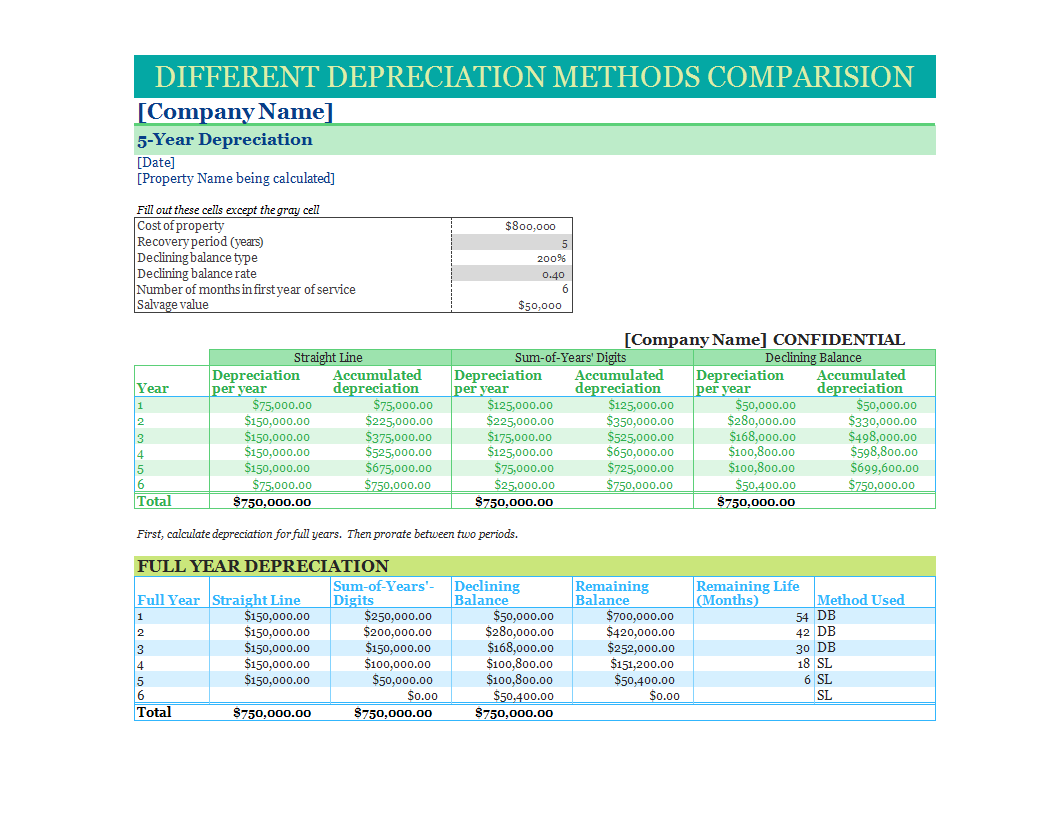

DIFFERENT DEPRECIATION METHODS COMPARISION

Company Name 5-Year Depreciation,,, , Date ,,, , Property Name being calculated ,,, ,,,, ,Fill out these cells except the gray cell,,, ,Cost of property,,800000,, ,Recovery period (years),,5,, ,Declining balance type,,200 ,, ,Declining balance rate,,"0,4",, ,Number of months in first year of service,,6,, ,Salvage value,,50000,, ,,,, ,,,, Company Name CONFIDENTIAL ,Straight Line,Sum-of-Years Digits,Declining Balance, ,Year,Depreciation per year ,Accumulated depreciation,Depreciation per year ,Accumulated depreciation,Depreciation per year ,Accumulated depreciation ,1,75000,75000,125000,125000,50000,50000 ,2,150000,225000,225000,350000,280000,330000 ,3,150000,375000,175000,525000,168000,498000 ,4,150000,525000,125000,650000,100800,598800 ,5,150000,675000,75000,725000,100800,699600 ,6,75000,750000,25000,750000,50400,750000 ,Total,750000,750000,750000, ,,,, ,"First, calculate depreciation for full years..

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese