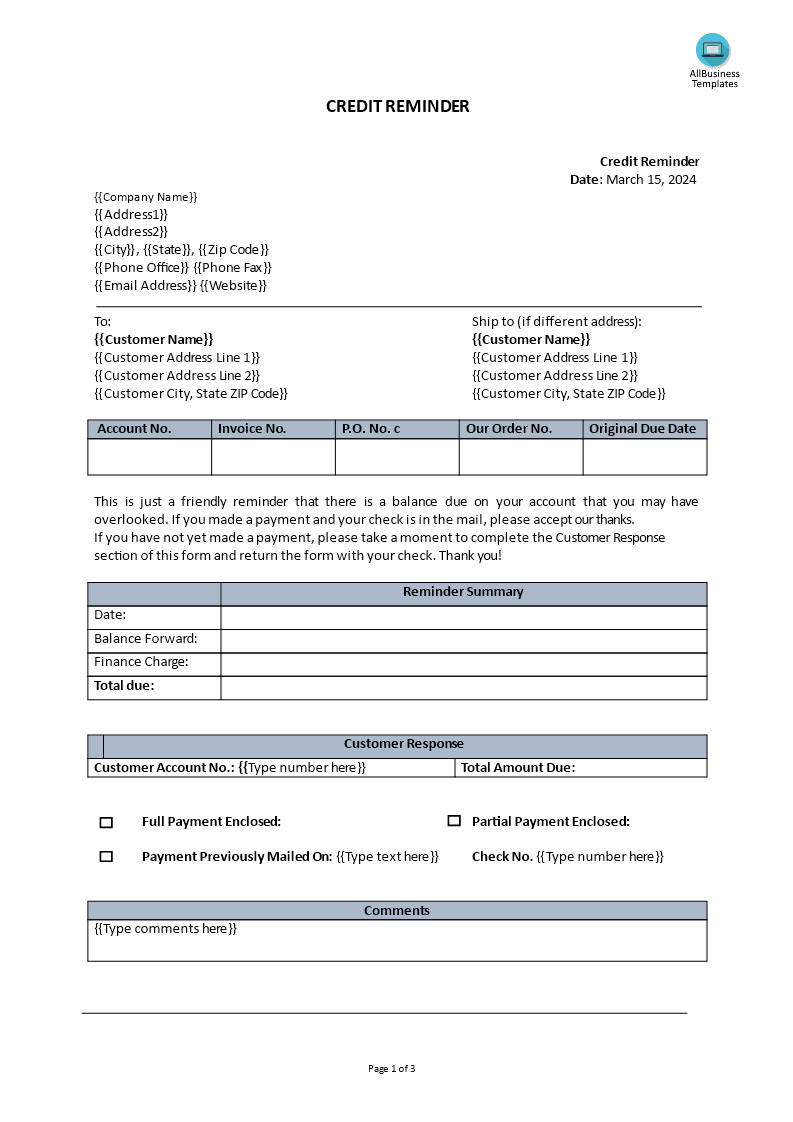

Credit Reminder

Save, fill-In The Blanks, Print, Done!

Download Credit Reminder

Today: USD 1.49

Download It Now

Available premium file formats:

Microsoft Word (.docx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (29.27 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

What should I write in a payment reminder message? Do you need a template to remind you about a credit card payment? Our credit reminder template can help you stay on top of your payments and avoid any late fees. Download this professional Credit Reminder template

now!

A credit reminder typically refers to a notification or communication sent by a lender or creditor to remind a borrower or debtor about an upcoming payment that is due on a credit account. These reminders serve as a means to prompt the borrower to make their payment on time and avoid late fees, penalties, or negative impacts on their credit score.

Why is the credit reminder important?

Credit reminders are important for several reasons:

- Timely Payments: They help ensure that borrowers make their payments on time. Timely payments are crucial for maintaining a good credit score and avoiding late fees or penalties.

- Financial Responsibility: By reminding borrowers of their upcoming payments, credit reminders encourage financial responsibility and accountability.

- Avoiding Negative Consequences: Missing a payment deadline can have various negative consequences, including a decrease in credit score, imposition of late fees, and potential damage to one's financial reputation. Credit reminders help borrowers avoid these consequences by prompting them to make payments on time.

- Maintaining Good Credit Score: Consistently making payments on time is one of the key factors in building and maintaining a positive credit history and credit score. Credit reminders play a crucial role in ensuring that borrowers stay on track with their payments.

- Communication: Credit reminders also serve as a form of communication between lenders or creditors and borrowers. They provide clear information about payment due dates, amounts owed, and payment methods, helping to facilitate smooth transactions and reduce misunderstandings.

Overall, credit reminders play a vital role in promoting financial wellness, encouraging responsible borrowing behavior, and maintaining positive relationships between borrowers and lenders.

Click directly on 'Open with Google Docs' or download our sample credit reminder template as a Word template now to enhance efficiency! Your success in delivering a well-structured and effective credit reminder awaits.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese