Mortgage authorization letter template

Save, fill-In The Blanks, Print, Done!

Download Mortgage authorization letter template

Microsoft Word (.docx)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (38.92 kB)

- Language: English

- We recommend downloading this file onto your computer.

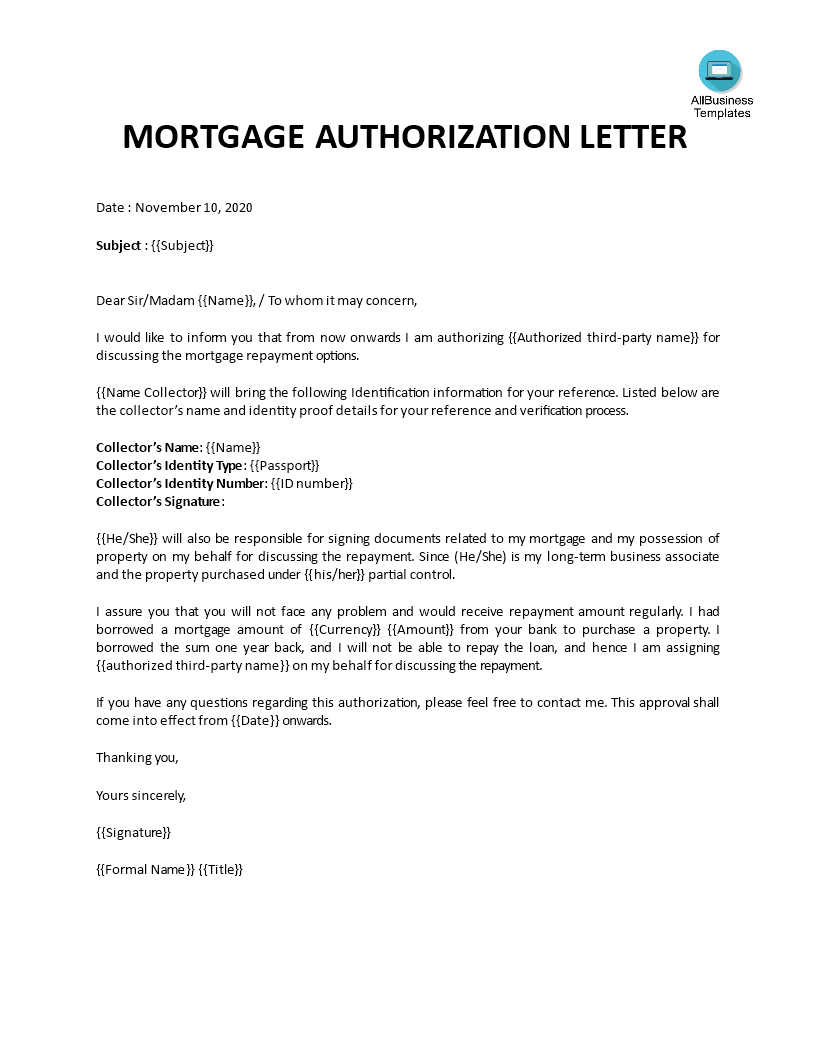

How to write an Authorization letter for discussing mortgage repayment options? We provide a professional Mortgage authorization letter sample that fits your needs!

There are many rules to follow when writing a formal Authorization letter for a mortgage or loan repayment template, such as:

Step 1: Type your address

Type your address and telephone number, flush left on the top of the page. It is not necessary to include your name or title here, as it will be included in the closing.

Step 2: Type the date

Type the date, in the format: month, day, and year on one line below your address and telephone number, flush left.

Step 3: Type the recipient's contact information and salutation

Although you might not have the name of the bank official that will assist you in the bank, it's ok to mention the department and the bank branch's contact information. Make sure to include the title, and address on one line, flush left. Type the recipient's personal title and full name in the salutation, one line after the recipient's address, flush left, followed by a colon. Leave one line blank after the salutation. Here is a suggestion: use the recipient's full name unless you usually refer to the individual by a first name.

Step 4: Compose the letter

In the first paragraph of the letter's body, you state the purpose of the letter: authorization for a mortgage loan repayment. In the paragraphs following, you can use examples to support your main argument. Also inform the receiver about the documents that will be provided together with this letter, to support your request. In the final paragraph, you need to summarize the purpose of your letter and suggest a suitable course of action to follow, for example, provide the necessary documents or discuss repayment possibilities. Do not indent the paragraphs. But instead, leave an empty line between each paragraph.

Step 5: Close the letter

Close the letter without indentation, leaving three or four lines for your signature between the closing and your typed name and title.

As you know, communicating in a professional manner will get you respect and will bring you new opportunities in life and business. Therefore, we support you by providing this Housing Loan authorization letter template and you will see you will save time and increase your effectiveness. Please note this template is provided for guidance only. Letters and other correspondence should be edited and modified to fit your personal situation.

If you feel overwhelmed by all this information, just download this formal Mortgage authorization letter template now, good luck!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Christmas Templates

It's Christmas... Be prepared with nice Christmas letters, invitations, social posts etc and check out these Christmas templates now! - GDPR Compliance Templates

What You Need To Be DPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Drop Shipping Agreement

How to start drop shipping? Do you need a Drop shipping Agreement? Check out our Dropshipping Agreement templates now! - Excel Templates

Where to find usefl Excel templates? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly!

cheese