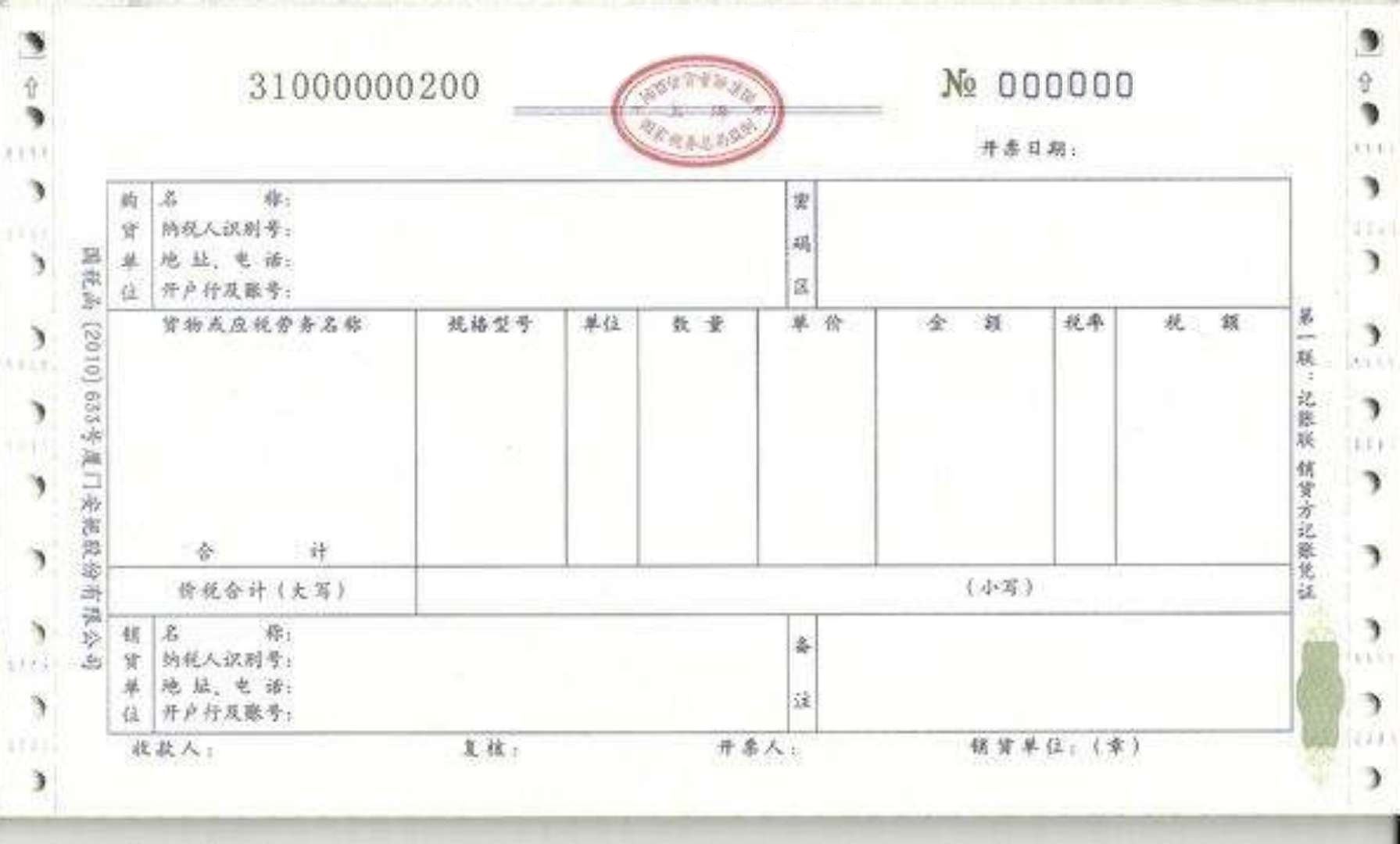

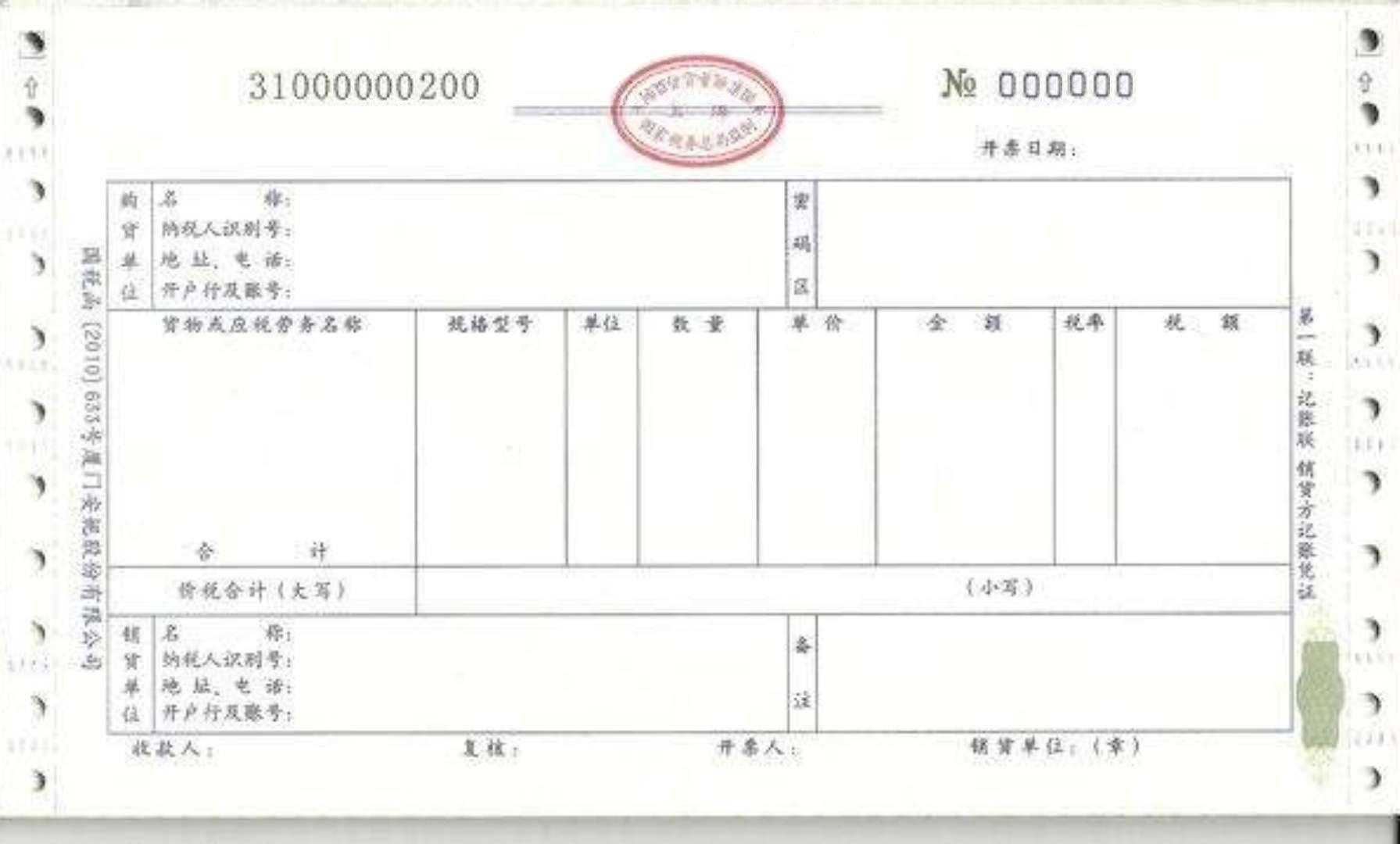

Chinese invoice 发票

Save, fill-In The Blanks, Print, Done!

Download Chinese invoice 发票

(.pptx)Other languages available:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (183.5 kB)

- Language: English

- We recommend downloading this file onto your computer.

What does a Chinese invoice look like? Do you need a Chinese invoice sample? Please download our free generic Chinese invoice (发票 or fapiao) now!

If you are dealing with Chinse companies, and you need to receive a Tax invoice, this is what you could expect. This types of Fapiao you need to get at the local Chinese tax office. After receiving the Fapiao pre-numbered paper and your digital key, you can print those Fapiao's with a special dot matrix printer that you will need to acquire.

If you are a foreigner in China, certain benefits-in-kind are provided to Chinese national employees individuals are exempt from tax provided that the amounts are reasonable and substantiated by official invoices/receipts and other supporting documentation. These include the following:

- rental of accommodation

- meals and laundry

- relocation

- language training (for the employee only)

- children’s education expenses in China

- home leave travels (up to two trips a year for the employee only).

You could provide the Chinese Fapiao to your employer on a monthly basis to receive these benefits.

A Fapiao is a receipt but not an invoice due to the fact it is not a proof of payment. You can make this conclusion also from the fact that a Fapiao almost never includes a list of the services or products bought.

A Fapiao is a document for registering revenue generation in China. Fapioas are registered with the relevant tax authority. The tax authority audits the issuance of Fapiaos, in order to determine the appropriate amount of tax payable.

Try out our online free and premium Professional templates, forms, and contracts today.

Save, fill-In the blanks, print …and done!

Download this free Chinese 发票 or fapiao now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Invoice Templates

What exactly is an invoice, and what is the difference between the terms “receipt” and “bill”? Check out our Invoice, Bill & Receipt templates.

Read moreLatest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese