Retail Banking Operations CV template

Save, fill-In The Blanks, Print, Done!

Download Retail Banking Operations CV template

Adobe Acrobat (.pdf)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (44.54 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to draft a Retail Banking Operations CV that will impress when you are applying for a new Retail job? Download this Retail Banking Operations CV template now!

There are a few basic requirements for a Resume, for example, the resume should contain the following:

This Retail Banking Operations CV template will grab your future employer its attention. After downloading and filling in the blanks, you can customize every detail and appearance of your resume and finish.

In order to achieve this, you just have to be a little more creative and follow the local business conventions. Also bright up your past jobs and duties performed. Often they are looking for someone who wants to learn and who has transferable skills like:

- Leadership skills;

- Can do-will do mentality;

- Ability to communicate;

- Ability to multi-task;

- Hard work ethics;

- Creativity;

- Problem-solving ability.

- brief, preferably one page in length;

- clean, error-free, and easy to read;

- structured and written to highlight your strengths;

- immediately clear about your name and the position you are seeking.

Completing your Retail Banking Operations CV has never been easier, and will be finished within in minutes... Download it now!

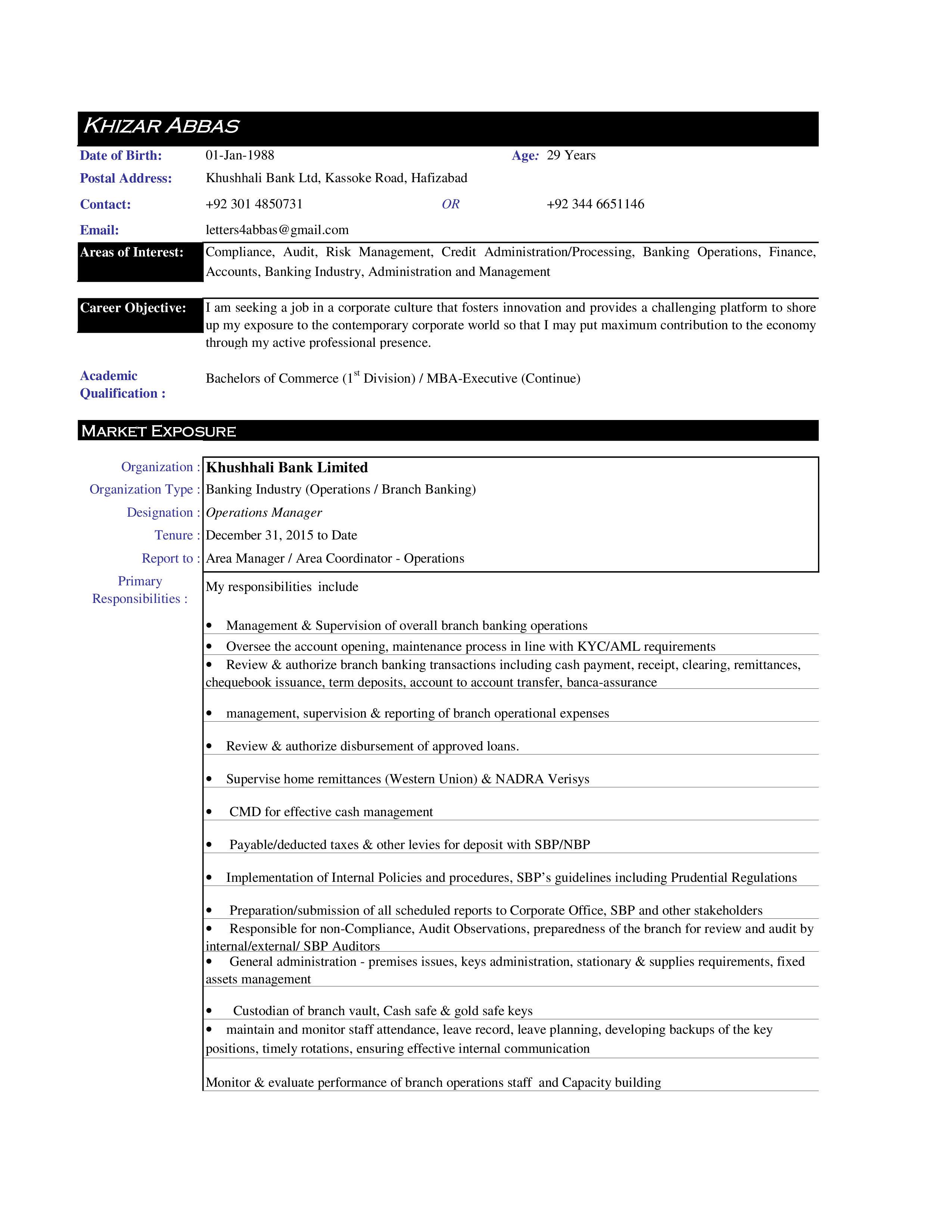

• Supervise home remittances (Western Union) NADRA Verisys • CMD for effective cash management • Payable/deducted taxes other levies for deposit with SBP/NBP • Implementation of Internal Policies and procedures, SBP’s guidelines including Prudential Regulations • Preparation/submission of all scheduled reports to Corporate Office, SBP and other stakeholders • Responsible for non-Compliance, Audit Observations, preparedness of the branch for review and audit by internal/external/ SBP Auditors • General administration - premises issues, keys administration, stationary supplies requirements, fixed assets management • Custodian of branch vault, Cash safe gold safe keys • maintain and monitor staff attendance, leave record, leave planning, developing backups of the key positions, timely rotations, ensuring effective internal communication Monitor evaluate performance of branch operations staff and Capacity building Market Exposure Organization : Khushhali Bank Limited Organization Type : Banking Industry(Credit Administration Division) Designation : Credit Administration Officer Tenure : February 15, 2011 to December 30, 2015 Report to : Manager Credit Administration (Corporate Office)/ Operation Manager Primary My responsibilities include Responsibilities : • Responsible to Processing of Micro, Small and Medium Loans(MSME) against the collateral/security documents of PG, Gold, NSC, KBL-TDC, Agri-Passbook ensuring Credit related Compliance with Bank’s Credit Policy, Prudential Regulations, MFI ordinance • Credit History/exposure of applicant through Warning Bulletin/Credit History Assessment Report/ SBP eCIB/ PMN MF CIB • To identify service quality laps and severe nature non-compliance • Ensure and maintain data/record /information for audit trial after validation Additional responsibilities of CSO include: A/C opening and maintenance ensuring KYC/CDD/AML, issuance of Cheque book, DD/PO/BC/CDR, other remittance instruments, handling local clearing/OBC/IBC and online t

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese