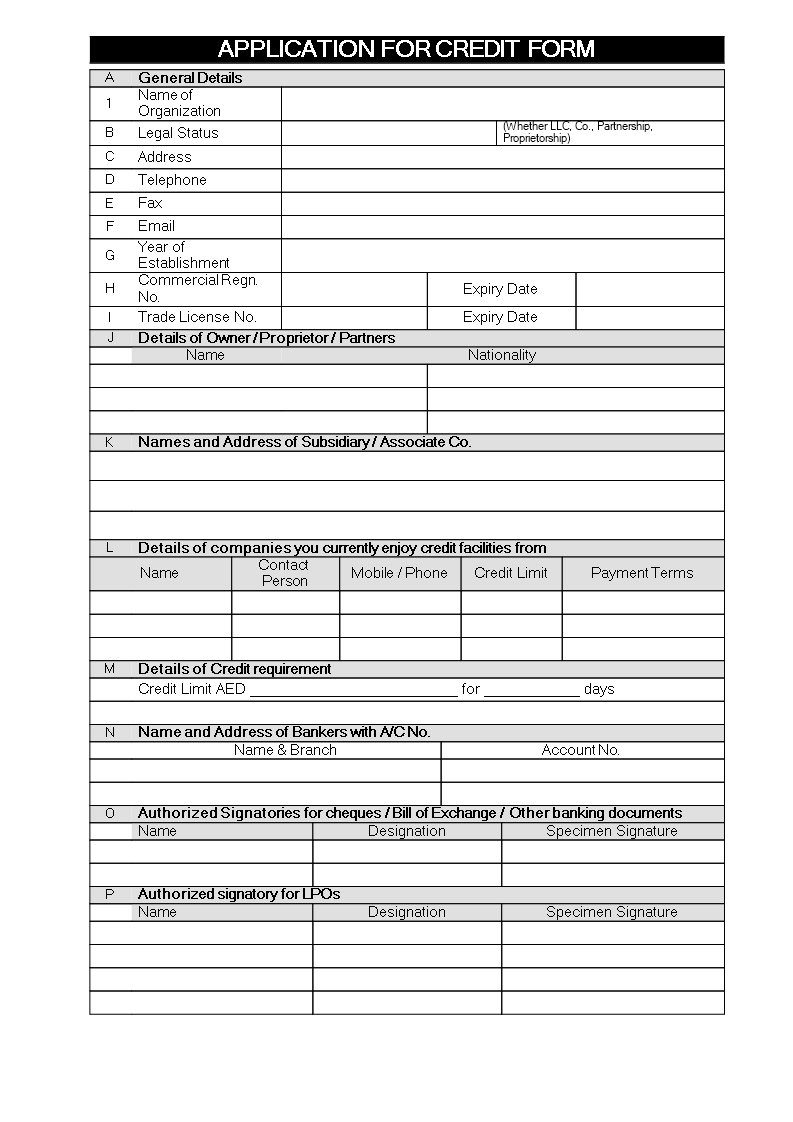

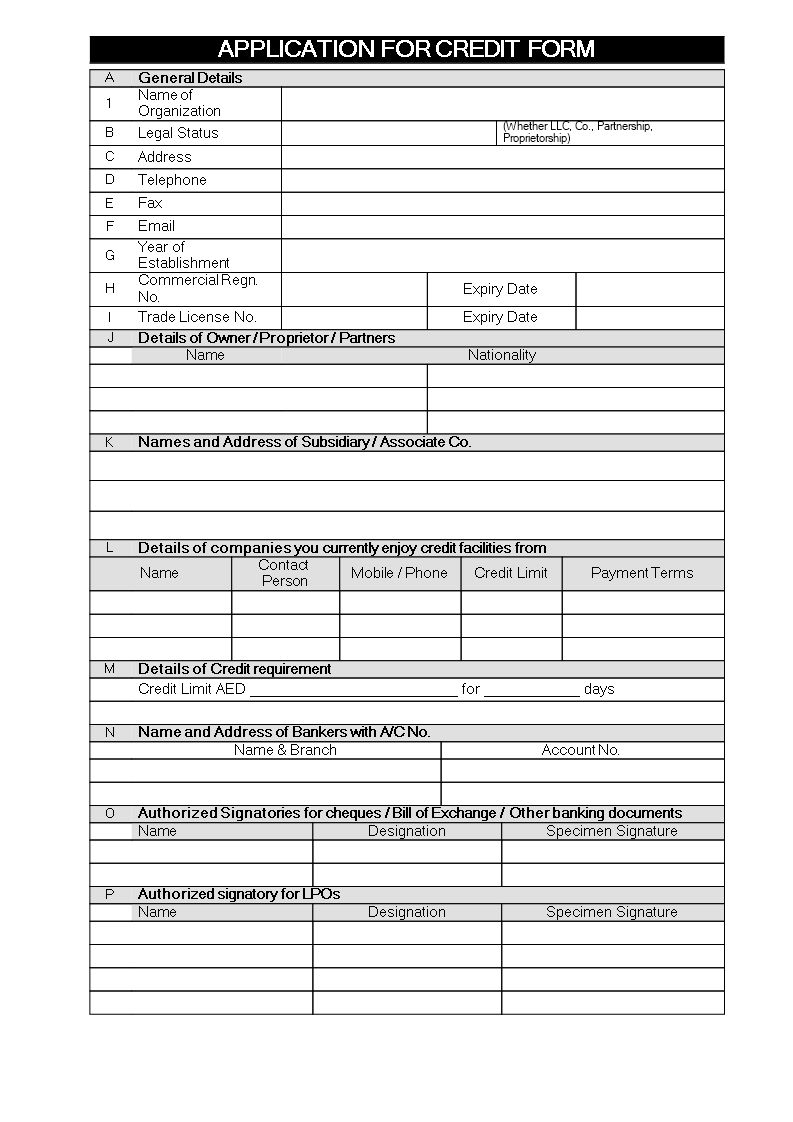

Blank credit application form for business

Save, fill-In The Blanks, Print, Done!

Download Blank credit application form for business

Microsoft Word (.docx)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (21.75 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to create a credit application template? What is a Credit Application in Business?

Creating a Business Credit Application Form is essential for evaluating the creditworthiness of potential clients. This form collects key financial and personal information, enabling informed decisions about extending credit. Download our professional template now to simplify this process and ensure consistency.

Importance of Accurate Financial Communication

Accurate financial communication is crucial for managing finances and seeking funds from investors or lenders. Maintaining clear accounting records is vital for daily operations and business growth. Our template will help you consistently track your business's financial status.

Key Elements of a Business Credit Application Form

A Business Credit Application Form is used by lenders, suppliers, and vendors to collect information from credit applicants. It evaluates creditworthiness and determines suitable credit terms, such as limits and interest rates, while establishing a formal agreement between the lender and borrower.

Streamlined Credit Application Process

A standardized form helps streamline the credit application process. Typical elements include:

- Business Information: Name, address, phone number, and industry type.

- Contact Information: Name, address, phone number, and email.

- Operational Details: Number of employees, trade payment references, and bank references.

- Principal Details: Identifying details of the business's owners or principals.

- Financial Information: Bankruptcy history, financial ratios, profitability, debt levels, and cash flows.

Transitioning to digital workflows, including online credit applications, offers several benefits:

- Efficiency: Streamlines the process and reduces errors.

- Accessibility: Makes it easier to apply and manage applications.

- Cost-Effective: Reduces the need for paper-based processes.

- Steps to Fill Out a Business Credit Application

- Review the Credit Agreement: Understand the terms and conditions.

- Input Personal and Business Details: Provide accurate information.

- Provide Employment and Financial Information: Demonstrate financial stability.

- Submit the Application: Review for errors, sign, and submit.

- Wait for Feedback: The lender will respond with approval, requests for more information, or a rejection.

Download this editable blank Credit Application Form in Microsoft Word (.docx) or open in Google Docs now and streamline your credit application process! For more templates, browse our website and gain instant access to thousands of ready-made, easy-to-find, and intuitive business documents, forms, and letters.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Business Credit Application Forms

How to create a Business Credit Application Form? Check out our Credit Application Form templates here.

Read moreRelated templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese