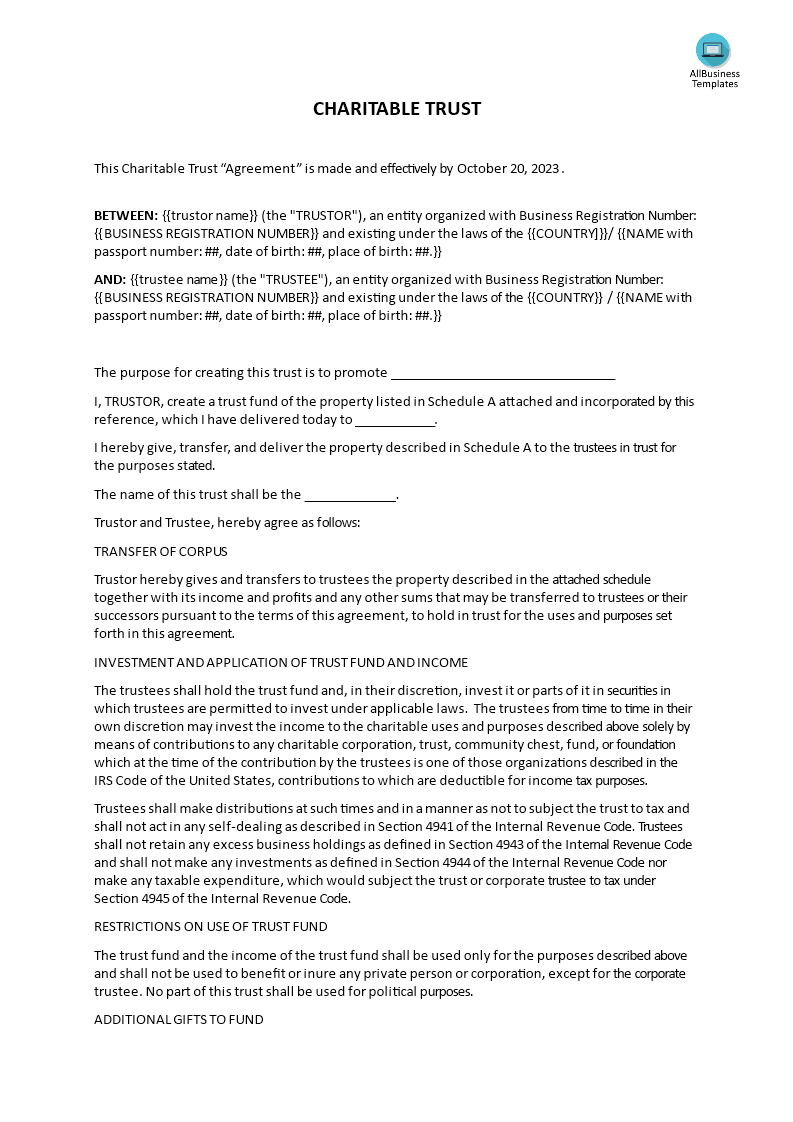

Charitable Trust Agreement

Save, fill-In The Blanks, Print, Done!

Download Charitable Trust Agreement

Today: USD 2.99

Download It Now

Available premium file formats:

Microsoft Word (.docx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (26.84 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

How to write a Charitable trust? Do you need a Charitable trust? We provide a well-crafted Charitable trust template that suits your needs. Download this professional legal Charitable Trust template if you find yourself in this situation and save yourself time, and effort and possibly reduce the lawyer fees!

A charitable trust agreement, often referred to as a "charitable trust," is a legal document that establishes a trust with the primary purpose of supporting charitable organizations or causes. This type of trust is created by a settlor (the person who establishes the trust) to benefit one or more charitable organizations and, in some cases, individual beneficiaries as well.

Here are the key elements and features of a charitable trust agreement:

- The settlor: The settlor is the individual or entity that creates the charitable trust. They fund the trust with assets, such as cash, securities, real estate, or other property.

- Trustee: The trustee is responsible for managing and administering the trust assets and ensuring that the trust's charitable purposes are fulfilled. Trustees have a legal duty to act in the best interests of the trust and its beneficiaries.

- Charitable Purpose: The primary purpose of a charitable trust is to support charitable organizations or causes. This can include funding education, medical research, poverty alleviation, religious activities, cultural institutions, and various other charitable endeavors.

- Beneficiaries: In a charitable trust, the beneficiaries are typically charitable organizations recognized as tax-exempt under relevant tax laws. These organizations receive distributions from the trust to further their charitable missions.

- Duration: Charitable trusts can be established as either revocable or irrevocable. In a revocable trust, the settlor retains the ability to make changes or revoke the trust during their lifetime. In an irrevocable trust, the terms are generally set and cannot be altered once the trust is established.

- Distribution of Income: The trust agreement specifies how the trust income (e.g., interest, dividends, rental income) is to be distributed to the designated charitable beneficiaries. Typically, a percentage of the income is distributed on a regular basis.

- Distribution of Principal: Depending on the terms of the trust, distributions of the trust's principal (the initial assets contributed to the trust) may also be made to charitable beneficiaries, either during the settlor's lifetime or after their passing.

- Tax Benefits: Charitable trusts may offer tax benefits to the settlor, including income tax deductions for contributions to the trust. Additionally, since the trust assets are used for charitable purposes, they may be exempt from certain taxes.

- Reporting Requirements: Charitable trusts are subject to reporting requirements to ensure compliance with applicable tax laws and regulations. Trustees are responsible for fulfilling these reporting obligations.

- Termination or Dissolution: The trust agreement may outline the conditions under which the trust may be terminated or dissolved, such as achieving specific charitable objectives or reaching a predetermined date.

Charitable trust agreements are commonly used in estate planning and philanthropy to support causes or organizations that align with the settlor's charitable goals and values. It's essential to work with legal and financial professionals experienced in estate planning and charitable giving when creating a charitable trust to ensure compliance with relevant laws and to maximize the intended charitable impact.

Download this legal Charitable Trust template now if you ask yourself this question!

Also interested in other Legal templates? Just search on our website and have instant access to thousands of free and premium legal agreements, contracts, documents, forms, letters, etc., which are used by professionals in your industry.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese