Notice to Stop Credit Charge

Save, fill-In The Blanks, Print, Done!

Download Notice to Stop Credit Charge

Microsoft Word (.docx)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (24.08 kB)

- Language: English

- We recommend downloading this file onto your computer.

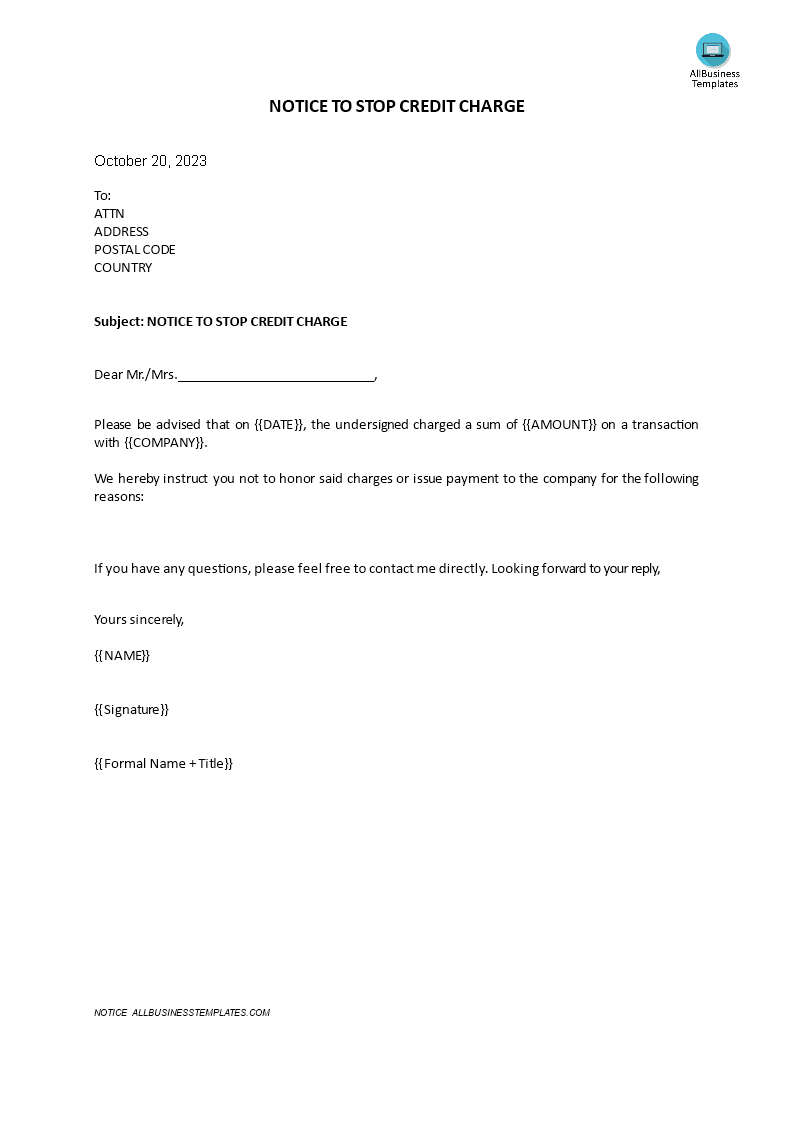

Do you need a notice letter template to stop the credit charges? What should I include in a stop payment letter? You can download a sample template here. This template will help you to draft a professional letter that clearly outlines the details of your request. The letter should be sent directly to the credit card issuer. We provide a well-crafted Notice to Stop Credit Charge template that suits your needs!

A notice letter to stop credit charge, also known as a "stop payment letter" or "credit card dispute letter," is a written communication that a credit cardholder sends to their credit card issuer or bank to request the cancellation or stoppage of a specific credit card charge or transaction. This type of letter is typically used when the cardholder identifies an unauthorized or erroneous charge on their credit card statement and wishes to dispute it. The letter serves as a formal request to investigate the charge and, if necessary, block or reverse it.

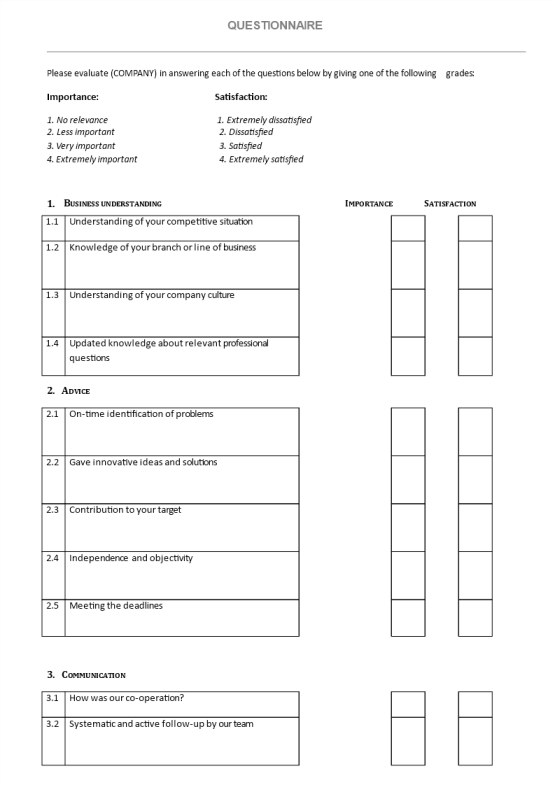

Here are the key elements typically included in a notice letter to stop a credit card charge:

- Date: The date when the letter is written and sent.

- Cardholder Information: The cardholder's name, address, and contact information.

- Credit Card Information: Details about the credit card, including the card number, expiration date, and the name of the issuing bank or credit card company.

- Statement Details: Specific details related to the credit card charge being disputed, including:

- Transaction date.

- Description of the charge (e.g., merchant name, purchase details).

- Transaction amount.

- Reason for Dispute: A clear and concise explanation of why the cardholder is disputing the charge. Common reasons include:

- Unauthorized or fraudulent transaction.

- Billing error or incorrect charge.

- Non-receipt of goods or services.

- Duplicate charge.

- Supporting Documentation: If applicable, any supporting documents that can help substantiate the dispute. This may include copies of receipts, invoices, or any communication with the merchant regarding the disputed charge.

- Request for Investigation: A statement requesting that the credit card issuer or bank investigate the disputed charge and take appropriate action, which may include blocking the charge temporarily during the investigation.

- Statement of Liability: A statement that the cardholder is not liable for the disputed charge while the investigation is ongoing, in accordance with applicable consumer protection laws.

- Contact Information: Contact details for the cardholder, including a phone number and email address, so that the credit card issuer can reach out for further information or updates.

- Acknowledgment: A request for acknowledgment of receipt of the letter and an indication of when the cardholder can expect a response or resolution from the credit card issuer.

- Signature: The letter should be signed by the cardholder to confirm its authenticity.

It's important to send the notice letter promptly upon identifying the unauthorized or erroneous charge and to keep copies of all correspondence for your records.

Download this professional Notice to Stop Credit Charge template now!

For more business templates? Just browse through our database and website! You will have instant access to thousands of free and premium business templates, legal agreements, documents, forms, letters, reports, plans, resumes, etc., which are all used by professionals in your industry. All business templates are ready-made, easy to find, wisely structured, and intuitive.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese