Expense Statement 2024

Save, fill-In The Blanks, Print, Done!

Download Expense Statement 2024

Today: USD 4.99

Download It Now

Available premium file formats:

Microsoft Spreadsheet (.xlsx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (146.82 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

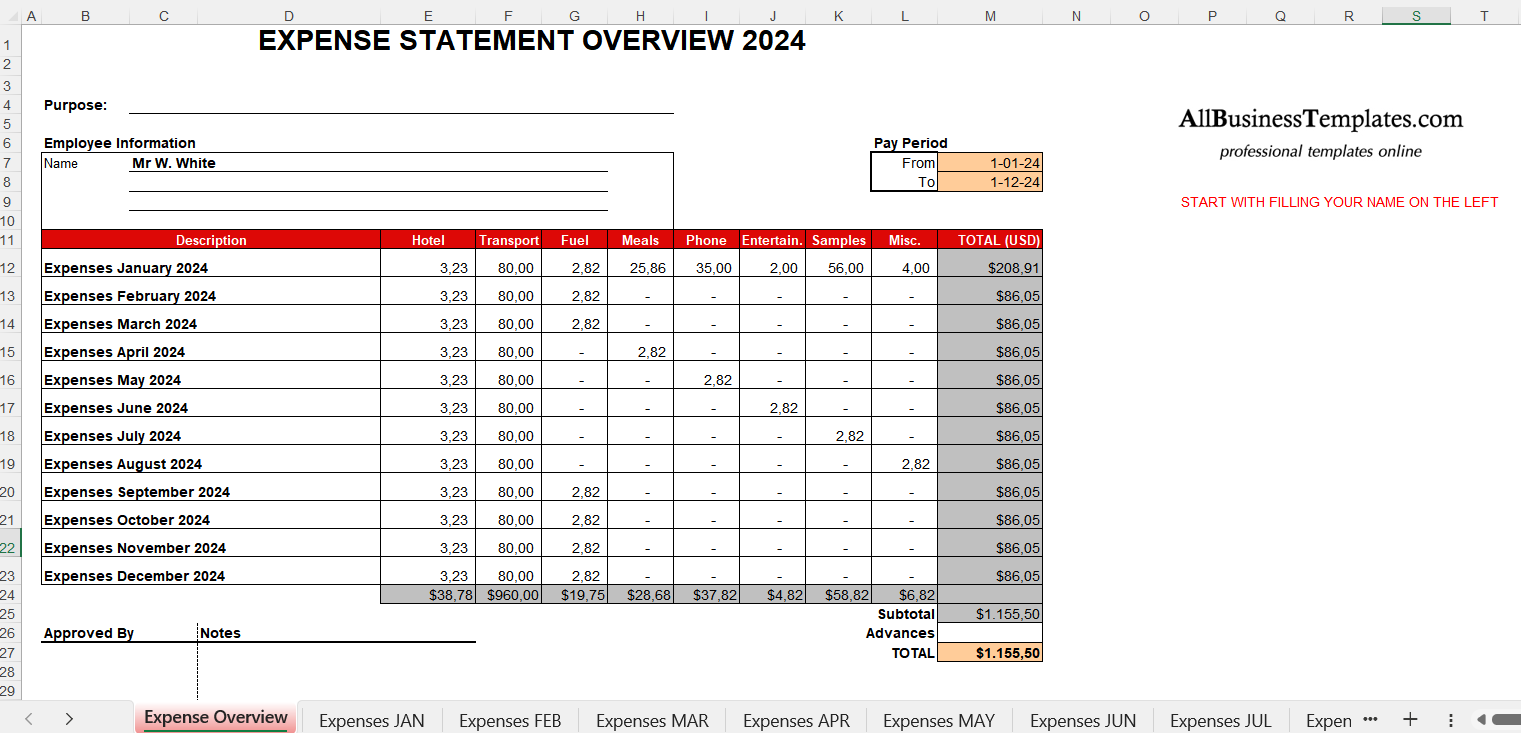

Are you searching for an Expense Statement spreadsheet to manage your business expenses for 2024? Download our Business Expense Auto-calculation spreadsheet for 12 months (MS Excel and Google Sheets) now!

Creating a personalized business expenses template in Excel or Google Sheets is an easy way to track your expenses. Microsoft Excel is a popular and cost-effective tool for creating a digital budget.

By creating a budget template in MS Excel and Google Sheets, you can tailor your budget to monitor your monthly income and expenses. Although the budgeting process may initially seem daunting, this guide will assist you in creating your own Excel budget.

The Excel sheet provides a simple business budget that categorizes all business expenses. We offer an advanced 13-tab Microsoft Excel template that allows you to:

Manage twelve months of business expense spreadsheets to monitor your monthly business expenses;

- Utilize 4 currencies (e.g., USD, EUR, HKD, CNY, etc.); and

- Include several subcategories (transport, hotel, samples, etc.).

- This spreadsheet consists of two parts: one is a detailed page for each month, and the other is a comprehensive summary of each month with total expenses spent on items such as meals, hotel, transport, samples, misc, etc. (which can be easily modified).

Tracking your business expenses is crucial for maintaining solid business records, enabling effective expense management. It allows you to observe your business's growth, create financial statements, track deductible expenses, prepare tax returns, and substantiate your tax return claims.

Initially, you should implement a tracking system by providing it to your employees and authorizing monthly expenses. Pay special attention to five types of expense receipts:

- Business Travel: Authorities often scrutinize business travels. They may require additional details to justify the expenses as purely business-related. Keeping receipts helps provide a record of your business activities while away.

- Meals and Entertainment: Regular business meetings in hotels, cafes, or restaurants offer opportunities to discuss business and build relationships. Keep track of these expenses daily and note the attendees and purpose of the meeting on the back of the receipt.

- Vehicle-Related Expenses: Record the details of business use of your vehicle and apply a percentage of the usage as related expenses.

- Receipts for Gifts: When purchasing gifts for business relations, such as tickets to a sports event, categorize the expenses appropriately based on whether you attend the event with the recipient. Note these details on the receipt.

- Home Office Receipts: If you operate your business from home, calculate the percentage of your home used for business and apply that percentage to home-related expenses. You may be eligible for tax breaks, depending on your country of residence and business.

Ensure that any expenses used for both private and business purposes are appropriately allocated. For example, if you have a phone line used for both personal and business calls, deduct the percentage used for business. Similarly, fuel mileage costs are 100% deductible, but be sure to keep all receipts and maintain a log of your business mileage.

This expense spreadsheet automatically generates an annual report each time you update the monthly expenses for all defined subcategories. The subcategories are comprehensive, but you can easily add, remove, and modify them.

Explore our online Free and Premium Professional templates, forms, and contracts today. By creating your version based on this pre-made template, you can start tracking your finances immediately! Save, fill in the blanks, print, and you're done!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese