Checklist: For Drafting Limited Partnership Agreement

Save, fill-In The Blanks, Print, Done!

Download Checklist: For Drafting Limited Partnership Agreement

Today: USD 1.99

Download It Now

Available premium file formats:

Microsoft Word (.docx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (35.6 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

What should you include in a limited partnership agreement? How can you draft a partnership agreement with the information you need? Our Limited Partnership Agreement Template is a professionally written document that covers all the necessary elements for setting up a successful limited partnership. It is easy to use and customized for your needs. Download this sample agreement template now!

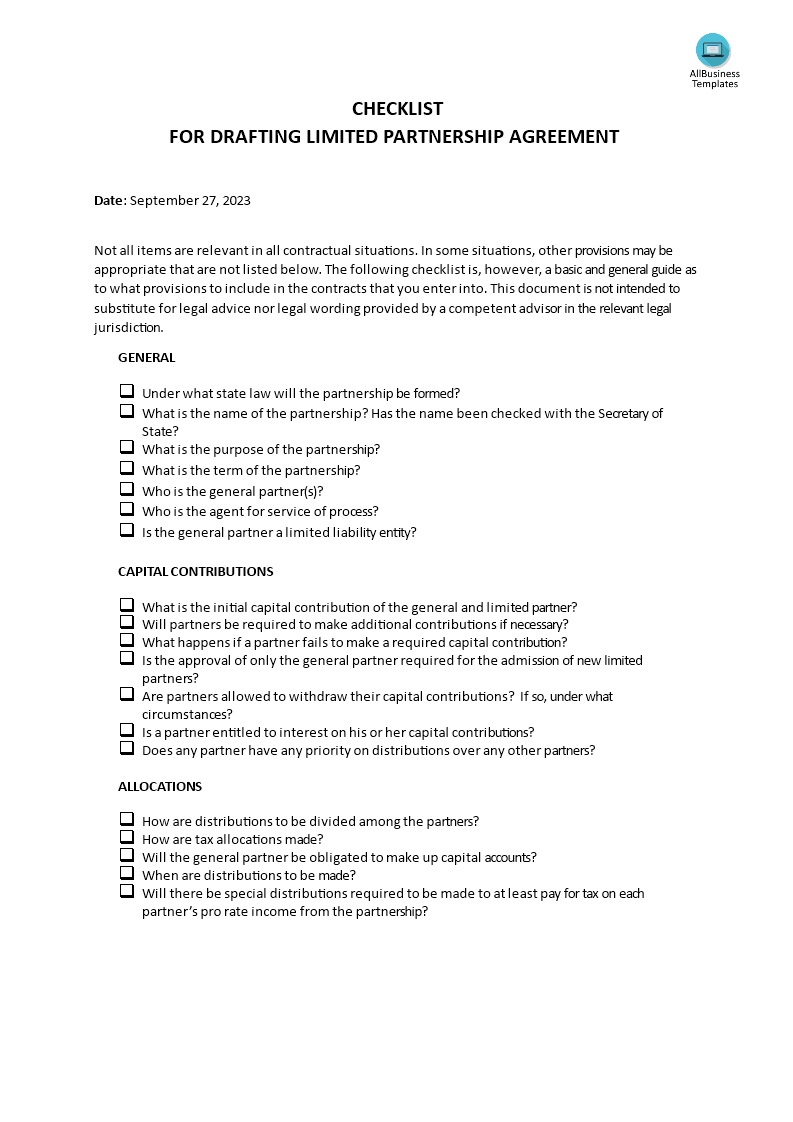

Drafting a Limited Partnership Agreement is an important step when establishing a limited partnership (LP). This legally binding document outlines the rights, responsibilities, and obligations of the partners within the LP structure. To help ensure that your Limited Partnership Agreement is comprehensive and covers all necessary aspects, here is a checklist to guide you through the drafting process:

- Parties and Effective Date:

- Identify the full legal names and addresses of all general and limited partners.

- Specify the effective date of the agreement.

- Recitals:

- Include a brief introduction or recitals section explaining the purpose and objectives of the limited partnership.

- Name and Principal Place of Business:

- State the legal name of the limited partnership.

- Provide the principal place of business or registered office address.

- Business Purpose:

- Clearly outline the specific business activities or purposes for which the LP is formed.

- General Partner Information:

- Identify the general partner(s), including their rights and responsibilities.

- Specify whether the general partner is an individual or an entity.

- Limited Partner Information:

- Identify the limited partner(s), including their rights, responsibilities, and capital contributions.

- Capital Contributions:

- Detail the amount of capital each partner is contributing to the LP.

- Specify any agreed-upon methods for additional capital contributions.

- Allocation of Profits and Losses:

- Describe how profits and losses will be allocated among partners.

- Outline any special allocation provisions, if applicable.

- Distributions:

- Explain the timing and method of distributions to partners, including any preferences or priorities.

- Management and Decision-Making:

- Define the management structure of the LP.

- Specify voting rights, decision-making processes, and any reserved powers of the general partner.

- Limited Partner Liability:

- Clarify the limited liability protection afforded to limited partners.

- Include language to maintain limited liability status.

- Term and Dissolution:

- Specify the term of the limited partnership.

- Outline the conditions under which the LP may be dissolved or extended.

- Transfer of Interests:

- Detail the process for transferring or selling partnership interests.

- Include any restrictions on transfers or rights of first refusal.

- Withdrawal and Removal of Partners:

- Describe the procedures for a partner's withdrawal or removal from the partnership.

- Capital Accounts:

- Explain how capital accounts will be maintained and adjusted over time.

- Books and Records:

- Specify the record-keeping and financial reporting requirements of the LP.

- Tax Matters:

- Address tax-related issues, such as tax allocations and elections (e.g., Section 754 elections).

- Indemnification and Liability:

- Outline indemnification provisions to protect partners from certain liabilities.

- Dispute Resolution:

- Include provisions for resolving disputes among partners, including mediation or arbitration procedures.

- Amendment and Governing Law:

- Explain how the agreement can be amended.

- Specify the governing law under which the agreement will be interpreted.

- Execution and Signatures:

- Include signature lines for all partners, and require their signatures to make the agreement legally binding.

- Exhibits and Attachments:

- Attach any necessary exhibits, such as a schedule of capital contributions or a management chart.

- Compliance with State Laws:

- Ensure that the agreement complies with the specific legal requirements and regulations of the state in which the LP is formed.

- Legal Counsel Review:

- Consider having the agreement reviewed by legal counsel to ensure compliance with applicable laws and regulations.

- Filing and Record-Keeping:

- After finalizing the agreement, file it with the appropriate state authorities and maintain copies for all partners.

Drafting a Limited Partnership Agreement is a critical step in establishing and governing the operations of an LP. It's important to customize the agreement to the specific needs and goals of the partnership, and seeking legal advice can be valuable in ensuring that the document meets all legal requirements and adequately addresses the interests of all partners involved.

We support you by providing this Checklist: For Drafting Limited Partnership Agreement template and you will see you will save time and increase your effectiveness. This comes with the benefit you will be inspired and motivated to finish the job.

Using our business templates guarantees you will save time, cost, and effort and helps you to reach the next level of success in your education, work, and business!

Download this professional Checklist: For Drafting Limited Partnership Agreement template now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Christmas Templates

It's Christmas... Be prepared with nice Christmas letters, invitations, social posts etc and check out these Christmas templates now! - GDPR Compliance Templates

What You Need To Be DPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here. - Drop Shipping Agreement

How to start drop shipping? Do you need a Drop shipping Agreement? Check out our Dropshipping Agreement templates now! - Excel Templates

Where to find usefl Excel templates? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly!

cheese