Corporation Buy Sell Agreement Form

Save, fill-In The Blanks, Print, Done!

Download Corporation Buy Sell Agreement Form

Today: USD 1.49

Download It Now

Available premium file formats:

Microsoft Word (.docx)- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (35.92 kB)

- Language: English

- You will receive a link to download the file as soon as your payment goes through.

- We recommend downloading this file onto your computer.

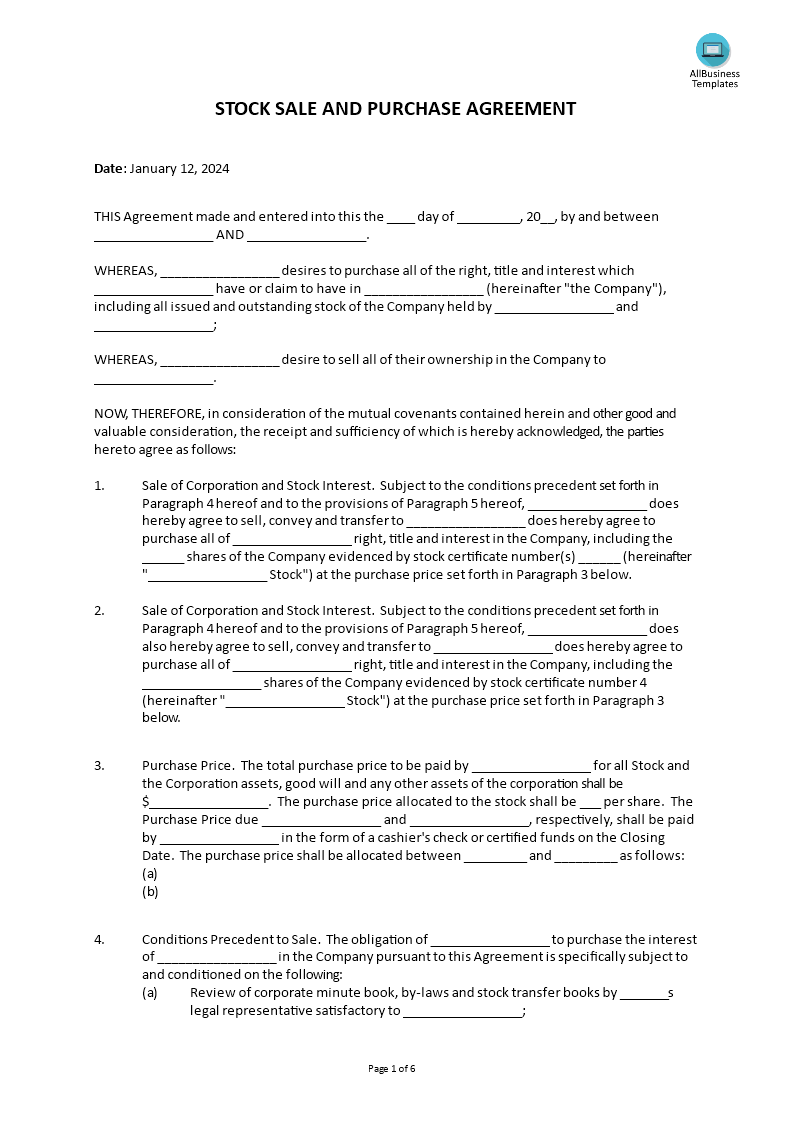

What are the steps involved in writing a buy-sell agreement? Is a corporate buy-sell agreement form needed for your business? Download our corporation buy-sell agreement form template, which is comprehensive and easy to use. It is specifically designed for corporations and can be used to create a legally binding agreement between shareholders.

A Corporation Buy-Sell Agreement Form, also known as a Buyout Agreement or Business Continuation Agreement, is a legal document used by business owners to establish the terms and conditions for the sale or transfer of a company's ownership interest in the event of certain triggering events. These events may include the death, disability, retirement, or voluntary departure of a shareholder or partner. The agreement helps ensure a smooth transition of ownership, prevent disputes, and provide financial protection for all parties involved.

Key components typically addressed in a Corporation Buy-Sell Agreement Form:

- Identification of Parties:

- Full legal names, addresses, and roles of the business owners or shareholders involved.

- Triggering Events:

- Clearly defined events that trigger the buy-sell provisions, such as death, disability, retirement, voluntary departure, or other specified events.

- Purchase Price:

- How the purchase price for the ownership interest will be determined (e.g., fair market value, fixed price, or appraisal).

- The payment terms may include lump-sum payments, installment payments, or financing arrangements.

- Funding Mechanisms:

- The method used to fund the purchase, may include life insurance policies, installment payments, sinking funds, or other financial instruments.

- Valuation Method:

- Specific details on how the business or ownership interest will be valued, including the frequency of valuations and the criteria used.

- Terms of Sale:

- The terms and conditions of the sale, including any restrictions on the transfer of ownership and any rights of first refusal.

- Financing Arrangements:

- If the agreement involves installment payments, details about the terms, interest rates, and repayment schedule.

- Restrictions on Transfers:

- Any restrictions on the ability of a shareholder to sell or transfer their ownership interest to third parties.

- Rights and Obligations:

- The rights and obligations of the remaining shareholders or partners in the event of a triggering event.

- Dispute Resolution:

- Procedures for resolving disputes related to the buy-sell agreement, such as mediation or arbitration.

- Continuity of Management:

- Provisions for maintaining business operations and management continuity in the event of a triggering event.

- Tax Considerations:

- Consider tax implications for both the seller and the buyer in the event of a sale.

Corporation Buy-Sell Agreement Forms are crucial for closely held corporations or businesses with multiple owners, as they provide a legal framework for the orderly transfer of ownership and help prevent potential conflicts.

Download this corporation buy and sell agreement form template

now and enhance your business!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese