Amortization Schedule Calculator

Save, fill-In The Blanks, Print, Done!

Download Amortization Schedule Calculator

Microsoft Spreadsheet (.xls)Or select the format you want and we convert it for you for free:

Other languages available:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (114 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to make a Amortization Schedule Calculator in Excel? An easy way to create your spreadsheet is by downloading this example Amortization Schedule Calculator Excel spreadsheet template now!

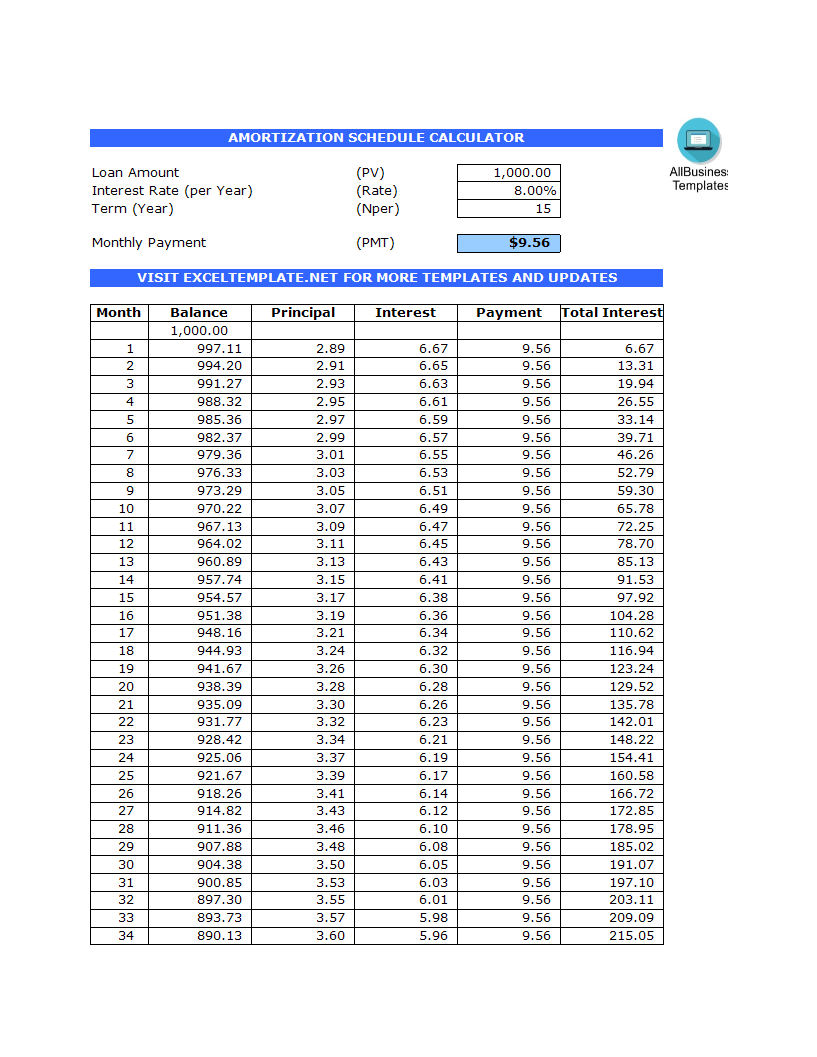

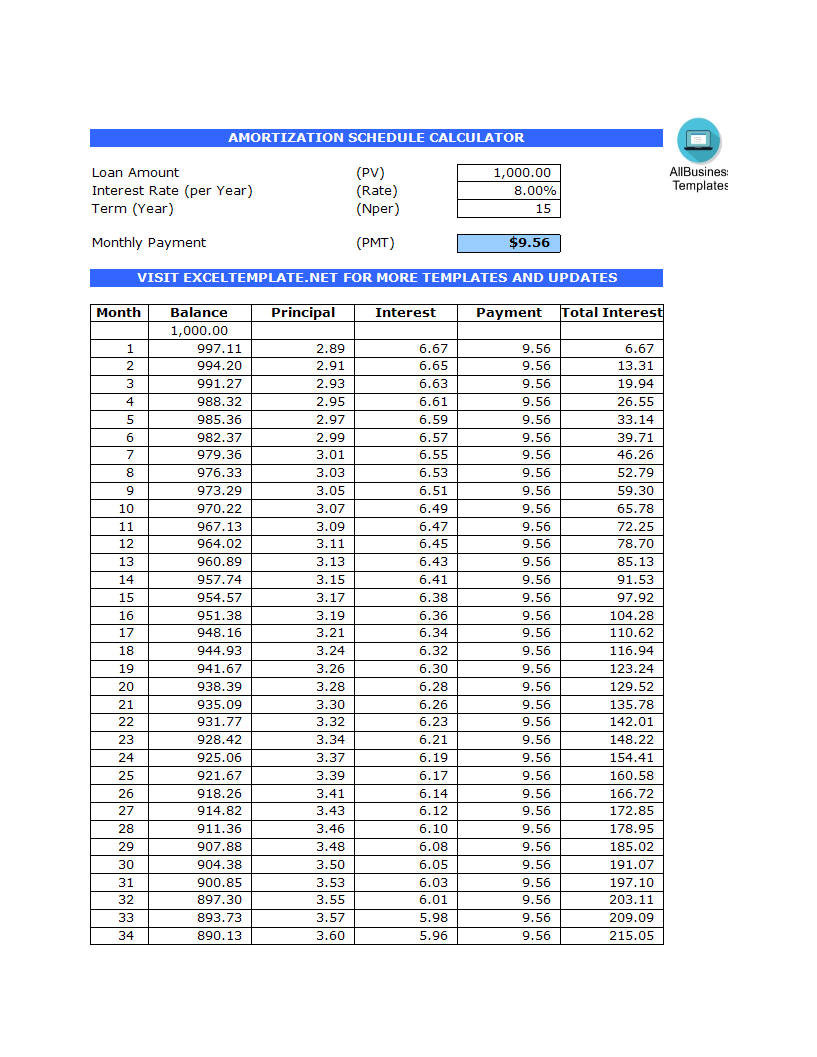

What is amortization?

According to Wikipedia "Amortization refers to the process of paying off a debt (often from a loan or mortgage) over time through regular payments. A portion of each payment is for interest while the remaining amount is applied towards the principal balance."

Further, "an amortization schedule is a table detailing each periodic payment on an amortizing loan (typically a mortgage), as generated by an amortization calculator."

Our amortization schedule calculator will help you to figure out the payment on a loan and will provide you the interest and principal breakdown per payment as well as the annual interest, principal and loan balance after each payment.It shows you how much part of each payment is allocated to interest and to principal.

An amortization schedule is a table detailing every single payment during the life of the loan. Each of these loan payments are split into interest and principal. Principal is the borrowed money, and interest is the amount paid to the lender for borrowing the principal.

An amortization schedule calculator shows:

- How much principal and interest are paid in any particular payment.

- How much total principal and interest have been paid at a specified date.

- How much principal you owe on the mortgage at a specified date.

- How much time you will chop off the end of the mortgage by making one or more extra payments.

This means you can use the mortgage amortization calculator to:

- Determine how much principal you owe now, or will owe at a future date.

- Determine how much extra you would need to pay every month to repay the mortgage in, say, 22 years instead of 30 years.

- See how much interest you have paid over the life of the mortgage, or during a particular year, though this may vary based on when the lender receives your payments.

- Figure how much equity you have.

This Excel template is a great way to increase your productivity and performance. It gives you access to do remarkable new things with Excel, even if you only have a basic understanding of working with formula’s and spreadsheets. If time or quality is of the essence, this ready-made presentation can certainly help you out!

Download this Amortization Schedule Calculator Excel spreadsheet now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese