CPA Resume Sample - Professional Accountant

Save, fill-In The Blanks, Print, Done!

Download CPA Resume Sample - Professional Accountant

Microsoft Word (.docx)Or select the format you want and we convert it for you for free:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (23.9 kB)

- Language: English

- We recommend downloading this file onto your computer.

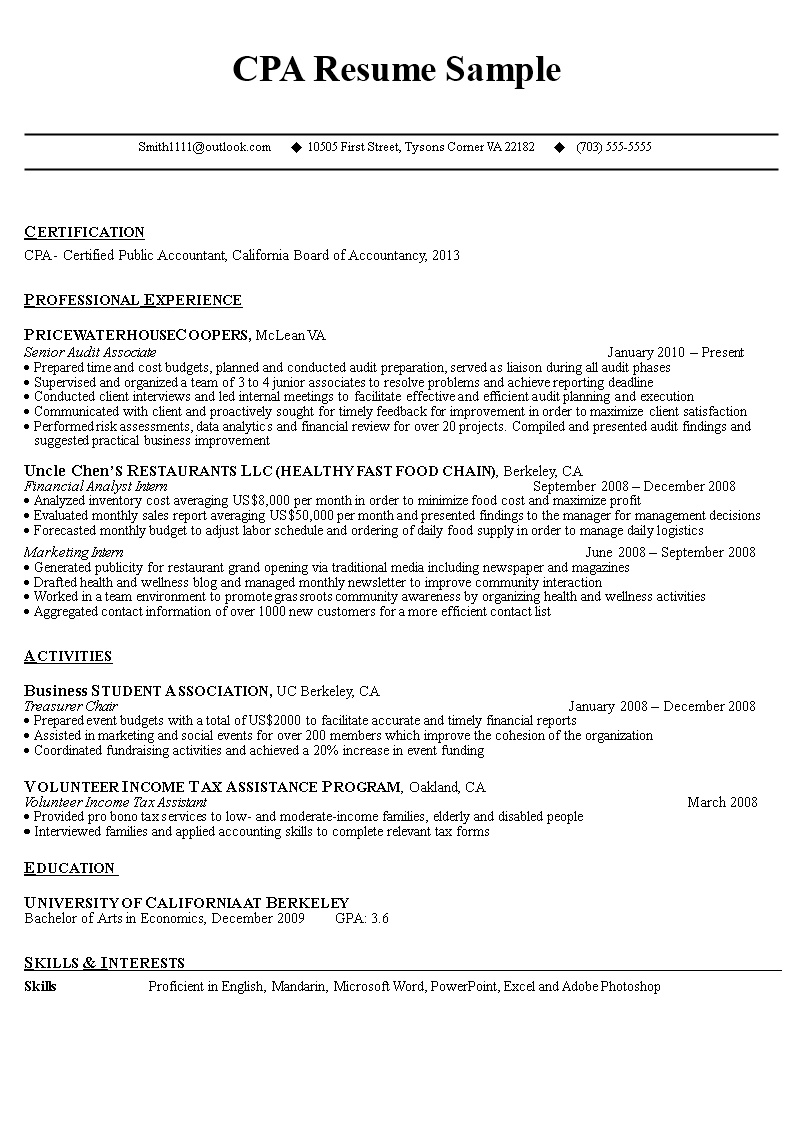

How do you make your resume stand out from the rest? What should be included in a resume summary for a CPA? Our template provides all the necessary sections for a professional accountant's resume, including a detailed summary, work history, and education section. It also includes a skills section to help you highlight the key skills you have to offer. Download our sample template now and start filling up your resume!

A Certified Public Accountant (CPA) Professional Accountant resume is a document that outlines the qualifications, skills, and professional experience of an accountant who has achieved the CPA certification. A CPA credential is highly regarded in the field of accounting and finance, and individuals who hold this certification are often sought after for various accounting and financial roles, including public accounting, auditing, tax preparation, financial analysis, and more.

Here are the key components typically found in a CPA Professional Accountant resume:

- Contact Information: This section includes your name, address, phone number, and email address. You may also include a LinkedIn profile or other professional online presence.

- Summary or Objective: A brief section at the beginning of the resume that provides an overview of your career goals and highlights your key qualifications as a CPA professional accountant.

- CPA Certification: Clearly state that you are a Certified Public Accountant and include your CPA license number and the state in which you are licensed.

- Professional Experience: This is often the most substantial section of the resume. It includes a detailed list of your work history, including the names of employers, job titles, employment dates, and descriptions of your key responsibilities and accomplishments. Be sure to emphasize any roles related to accounting, auditing, tax, or finance.

- Audit and Assurance: If you have experience in audit and assurance services, provide details about the types of audits you've conducted (e.g., financial statement audits, internal audits), industries served, and any significant findings or recommendations.

- Taxation: If you have tax experience, mention your proficiency in tax preparation, compliance, and planning. Highlight any experience with corporate, individual, or international taxation.

- Financial Analysis: Describe your skills in financial analysis, including budgeting, forecasting, financial statement analysis, and risk assessment.

- Regulatory Compliance: Emphasize your knowledge of accounting principles and standards, as well as your ability to ensure compliance with relevant regulations and reporting requirements.

- Software Proficiency: Mention your proficiency with accounting software (e.g., QuickBooks, SAP, Oracle) and any specific tools or technologies relevant to your roles.

- Education: Provide details about your educational background, including the name of the institution, degree(s) earned, major(s), graduation date, and any honors or awards received.

- Professional Certifications: In addition to your CPA certification, list any other relevant certifications, such as Certified Management Accountant (CMA) or Chartered Financial Analyst (CFA).

- Skills: Highlight key skills relevant to accounting and finance, such as financial reporting, tax compliance, auditing, and proficiency in spreadsheet and accounting software.

- Professional Affiliations: Mention any professional organizations you belong to, such as the American Institute of Certified Public Accountants (AICPA).

- References: You can include a line indicating that references are available upon request. Be prepared to provide references when requested by potential employers.

A well-crafted CPA Professional Accountant resume should emphasize your expertise in accounting and finance, your ability to adhere to professional standards, and your track record of success in relevant roles. It's essential to tailor your resume to the specific job you are applying for and highlight the skills and experiences that align with the job requirements.

Download this sample CPA Professional Accountant resume now and get the job you want. This sample resume includes everything you need to get noticed and hired. It's tailored to the CPA profession and is professionally written.

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- Excel Templates

Where do I find templates for Excel? How do I create a template in Excel? Check these editable and printable Excel Templates and download them directly! - GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately!

cheese