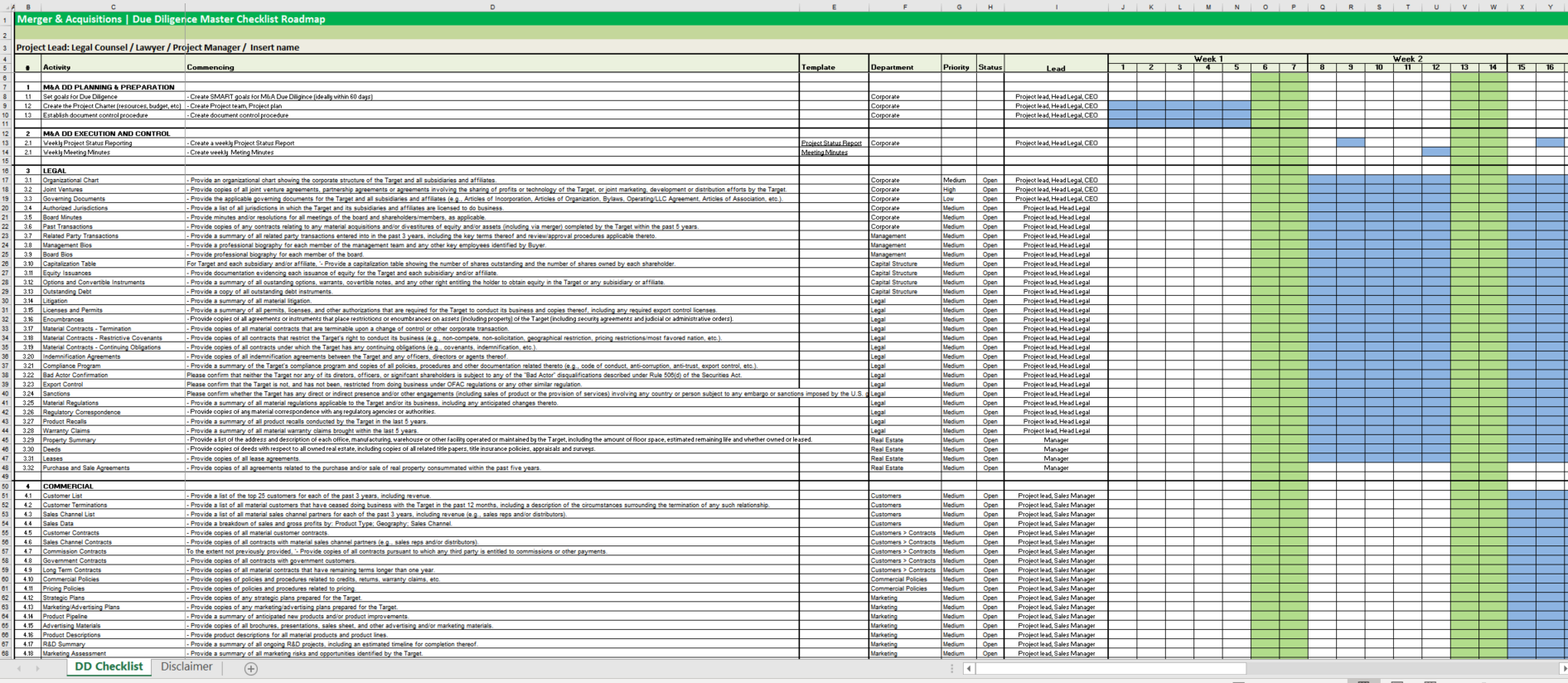

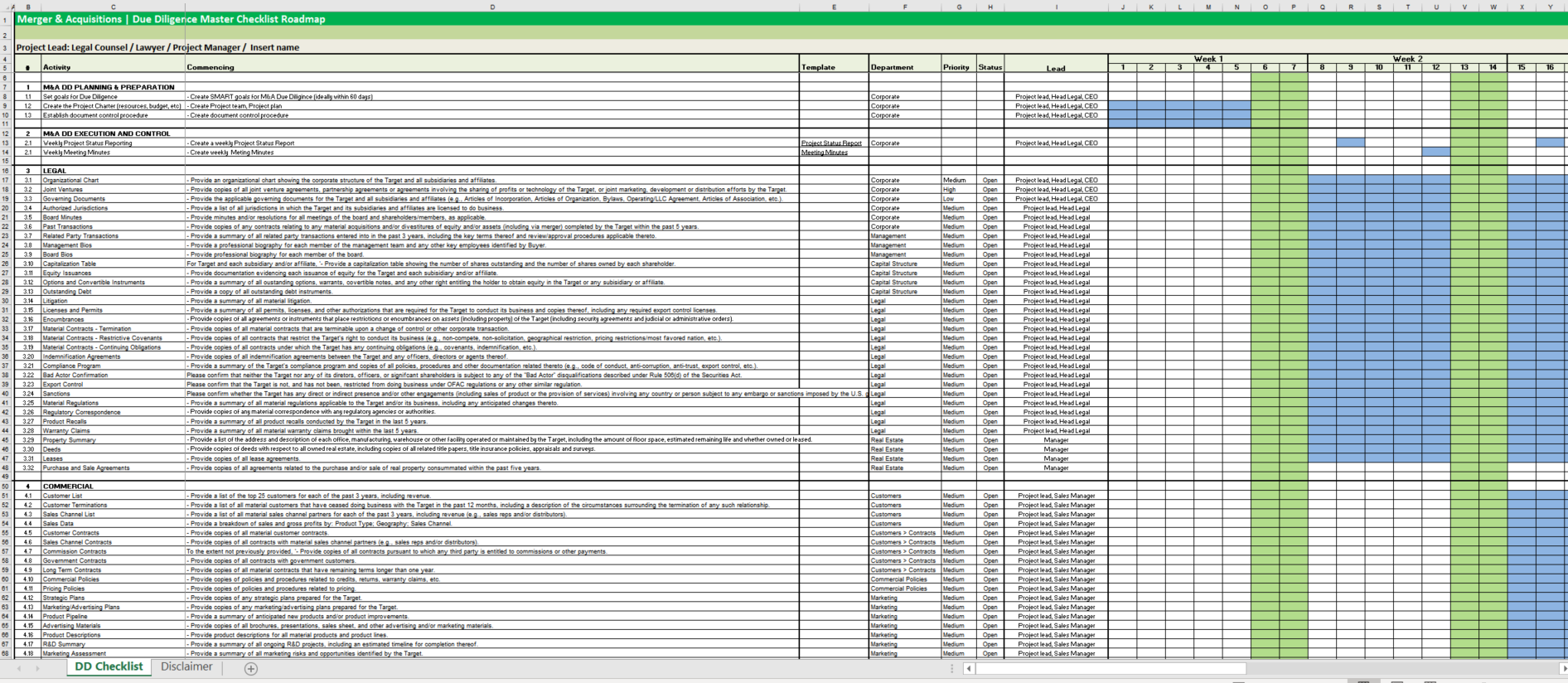

Merger & Acquisition Due Diligence Master Planning

Save, fill-In The Blanks, Print, Done!

Download Merger & Acquisition Due Diligence Master Planning

Microsoft Spreadsheet (.xlsx)Other languages available:

- This Document Has Been Certified by a Professional

- 100% customizable

- This is a digital download (98.97 kB)

- Language: English

- We recommend downloading this file onto your computer.

How to make a Merger & Acquisition Due Diligence Planning in Excel? An easy way to create one is by downloading this example Merger Acquisition DD Excel spreadsheet template now!

This Excel spreadsheet is a grid-based planning file and designed to organize an M&A due diligence project with all parties involved. This overview is created by M&A professionals from all over the world and gives a generic roadmap that is according to business needs. The planning period is 60 days, which is a common timeframe for an M&A due diligence.

This Due Diligence Checklist is intended to provide a thorough wide-ranging list of initial due diligence requests that can be used for any target in any type of transaction. The timeframe is 60 days. However, due to all the information needs, this can take longer. Especially for that reason, it's important to make a good project planning, so you will be able to ask all necessary details in time and can finish a successful Due Diligence within the estimated lead time. The following activities have to be considered:

M&A DD PLANNING & PREPARATION

- Set goals for Due Diligence

- Create the Project Charter (resources, budget, etc)

- Establish document control procedure

- M&A DD EXECUTION AND CONTROL

- Weekly Project Status Reporting

- Weekly Meeting Minutes

- LEGAL M&A ACTIVITIES

- Organizational Chart

- Joint Ventures

- Governing Documents

- Authorized Jurisdictions

- Board Minutes

- Past Transactions

- Related Party Transactions

- Management Bios

- Board Bios

- Capitalization Table

- Equity Issuances

- Options and Convertible Instruments

- Outstanding Debt

- Litigation

- Licenses and Permits

- Encumbrances

- Material Contracts - Termination

- Material Contracts - Restrictive Covenants

- Material Contracts - Continuing Obligations

- Indemnification Agreements

- Compliance Program

- Bad Actor Confirmation

- Export Control

- Sanctions

- Material Regulations

- Regulatory Correspondence

- Product Recalls

- Warranty Claims

- Property Summary

- Deeds

- Leases

- Purchase and Sale Agreements

INTELLECTUAL PROPERTY

- Patents and Trademarks

- Domain Names

- Licensing Agreements - Incoming

- Licensing Agreements - Outgoing

- Jointly-Owned IP

- Infringement

- IP Restrictions

- IP Litigation

- IP Development

IT INFRASTRUCTURE M&A ACTIVITIES

- IT Projects

- Key IT Resources

- Software

- Material Software

- Hardware

- Material Hardware

- Technical Architecture

- System Networks

- Hardware Configurations

- IT Support Services

- IT Maintenance

- IT Contracts

- IT Services

- Growth

- IT Acquisition

- Help Desk

- IT Strategy

- Automation

- Web-based Applications

- Security Protocols

- Disaster Recovery

- Data Privacy

- Sensitive Information

- Stress Test Results

- Other IT Security Testing

- Summary of Security Issues

- Data Storage

- Data Encryption

- E-mail Vulnerabilities

- Anti-Virus Protection

- Attacks/Intrusions

- Mobile Device Security

- COMMERCIAL M&A ACTIVITIES

- Customer List

- Customer Terminations

- Sales Channel List

- Sales Data

- Customer Contracts

- Sales Channel Contracts

- Commission Contracts

- Government Contracts

- Long Term Contracts

- Commercial Policies

- Pricing Policies

- Strategic Plans

- Marketing/Advertising Plans

- Product Pipeline

- Advertising Materials

- Product Descriptions

- R&D Summary

- Marketing Assessment

- Supplier List

- Supplier Contracts

- Subcontractor Contracts

- Supplier Onboarding Process

FINANCIAL M&A ACTIVITIES

- Financial Statements - Audited

- Financial Statements - Unaudited

- Off-Balance Sheet Transactions

- Contingent Liabilities

- Prepaid Expenses

- Audit Letters

- Accounting Policies

- Changes to Accounting Policies

- Budgets

- Projections

- Cash Management

- Investment Policies

- Hedging

- Accounts Receivable - Aging

- Inventory

- Bad Debts

- Reserves

- Credit Support Obligations

- Bank Statements

- Capital Expenditures - Past

- Capital Expenditures - Planned

- Fixed Assets

- Equipment

- Insurance Policies

- Insurance Claims Summary

HUMAN RESOURCES M&A ACTIVITIES

- Employment Agreements

- Consulting Agreements

- Compensation Arrangements

- Collective Bargaining Agreements

- Confidentiality and IP Agreements

- Severance Agreements

- Recruiting Arrangements

- Benefits Summary

- Benefit Plans

- Compensation Policy

- Bonus Plans

- Stock Option Plans

- Stock Option Awards

- Pension Plans

- Employee Litigation

- Judgments and Awards

- Disciplinary Proceedings

- Investigations

- Headcount

- Suspended Employees

- Dismissed Employees

- Absentee Reports

- Disabled Employees

- Employee Policies

- Hiring Policies

- Changes to Employee Policies

- Employee Loans

ENVIRONMENTAL & SAFETY M&A ACTIVITIES

- Environmental Summary

- Environmental Litigation

- Environmental Remediation

- Enforcement Actions

- Environmental Reserves

- Hazardous Substances

- Regulatory Correspondence

- Material Losses

- Audit Results - Environmental

- Environmental Reports

- Off-site Liabilities

- Environmental Permits

- Storage Tanks

- Waste Management

- Employee Safety

- Employee Litigation

- Audit Results - Safety

- Accidents

- Workers' Compensation Claims

- Material Safety Data Sheets

- Emergency Response Procedures

TAX M&A ACTIVITIES

- Audit Results

- Property Tax Summary

- Tax Returns

- Correspondence with Taxing Authorities

- Tax Sharing Arrangements

- Deferred Taxes

- Tax Policies

- R&D Credits

- Tax Assets

- Sale and Leaseback Transactions

- Overseas Tax

- Base Cost Adjustments

- Tax Planning

- Employment Taxes

M&A PROJECT CLOSURE

- Address any remaining areas with questions

- Perform post-project review

Initial requests solicit general information to provide a broad overview of the target and it's business and operations and planning is customizable to meet the specific circumstances of your M&A deal. This M&A spreadsheet helps to turn effort into results, for yourself or your organization, by making everything a little easier to increase your productivity! Especially, if time or quality is of the essence, this ready-made worksheet certainly helps you out! Just download this file directly to your computer, open it, modify it, save it as an XLSX or PDF or print it directly.

You will see that finishing such an Excel spreadsheet has never been easier and a great way to increase your performance.

Download this Merger & Acquisition Due Diligence Master Planning Excel sheet now!

DISCLAIMER

Nothing on this site shall be considered legal advice and no attorney-client relationship is established.

Leave a Reply. If you have any questions or remarks, feel free to post them below.

Related templates

Latest templates

Latest topics

- GDPR Compliance Templates

What do you need to become GDPR compliant? Are you looking for useful GDPR document templates to make you compliant? All these compliance documents will be available to download instantly... - Google Docs Templates

How to create documents in Google Docs? We provide Google Docs compatible template and these are the reasons why it's useful to work with Google Docs... - IT Security Standards Kit

What are IT Security Standards? Check out our collection of this newly updated IT Security Kit Standard templates, including policies, controls, processes, checklists, procedures and other documents. - Letter Format

How to format a letter? Here is a brief overview of common letter formats and templates in USA and UK and get inspirited immediately! - Google Sheets Templates

How to work with Google Sheets templates? Where to download useful Google Sheets templates? Check out our samples here.

cheese