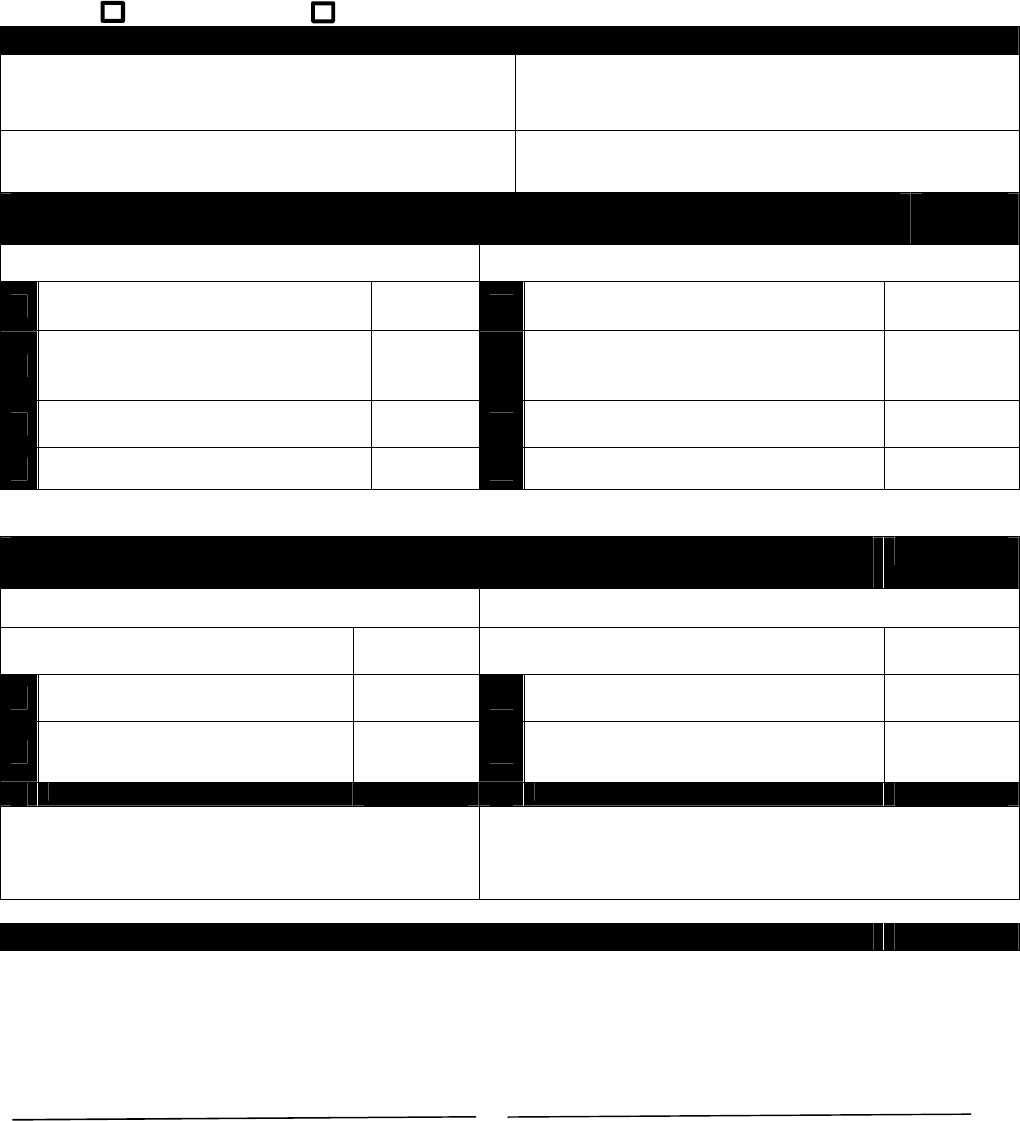

HTML Preview Employee Health Payroll Deduction Form page number 1.

Employee Health Savings Account Payroll

Deduction Authorization Form

Use this form to withhold money from your semi-monthly paycheck and deposit it into your Health

Equity health savings account (HSA) on a pre-tax basis. You must be enrolled in High Deductible

Health Plan (HDHP) before you can start a payroll deduction.

I wish to:

Begin a deduction Stop my deduction Effective date ________________________

Section 1: Employee Information

Name (Last, First, Middle initial)

Last 4 digits of SS number or employee ID

Phone E-mail

Section 2: Calculate You Maximum HSA Contribution

Use the worksheet below to determine how much you can contribute to your HSA in 2016.

Individual Family

A

Maximum contribution in your HSA

for 2016:

$3,350

A

Maximum contribution in your HSA for

2016:

$6,750

B

Are you age 55 or older?

If NO, write $0.

If YES, write $1,000.

B

Are you age 55 or older?

If NO, write $0.

If YES, write $1,000.

C

How much your employer will

contribute in 2016*:

C

How much your employer will

contribute in 2016*:

D

A + B - C =

This is the most you can contribute in 2016.

D

A + B - C =

This is the most you can contribute in 2016.

*Individual will receive $250/yr and Family will receive $500/yr if you are an active employee enrolled all 12

months. Please check with your insurance representative if you have questions.

Section 3: Calculate Your Per-paycheck HSA Contribution

Continue the worksheet to determine how much you will contribute to your HSA per paycheck.

Individual Family

Total from D

Total from D

E

Number of paychecks you will

receive in 2016 (

24 for a full year

):

E

Number of paychecks you will receive

in 2016 (

24 for a full year

):

F

D ÷ E =

This is the most you can contribute per

paycheck.

F

D ÷ E =

This is the most you can contribute per

paycheck.

Amount you elect to contribute to your HSA per

paycheck (can be any amount up to or less than F):

Amount you elect to contribute to your HSA per paycheck

(can be any amount up to or less than F):

If your contributions exceed the amount in box D, you risk paying IRS tax penalties.

Section 4: Employee’s Signature

Required

By signing this form, I am requesting that payroll deductions be started or changed as shown in Section 3 above

and agree to the preceding terms. I understand there are maximum limits I can contribute to my HSA per IRS

rules and I may be liable for tax penalties if I exceed this amount.

Employee’s signature Date