HTML Preview Sales Tax.pdf page number 1.

visit:-www.tpaindore.com

Y

Y

e

e

a

a

r

r

l

l

y

y

C

C

a

a

l

l

e

e

n

n

d

d

a

a

r

r

f

f

o

o

r

r

V

V

A

A

T

T

,

,

C

C

e

e

n

n

t

t

r

r

a

a

l

l

S

S

a

a

l

l

e

e

s

s

T

T

a

a

x

x

,

,

E

E

n

n

t

t

r

r

y

y

T

T

a

a

x

x

&

&

P

P

r

r

o

o

f

f

e

e

s

s

s

s

i

i

o

o

n

n

a

a

l

l

T

T

a

a

x

x

(Updated on 20.08.09)

………Compiled by R.S. Goyal

Tax Consultant

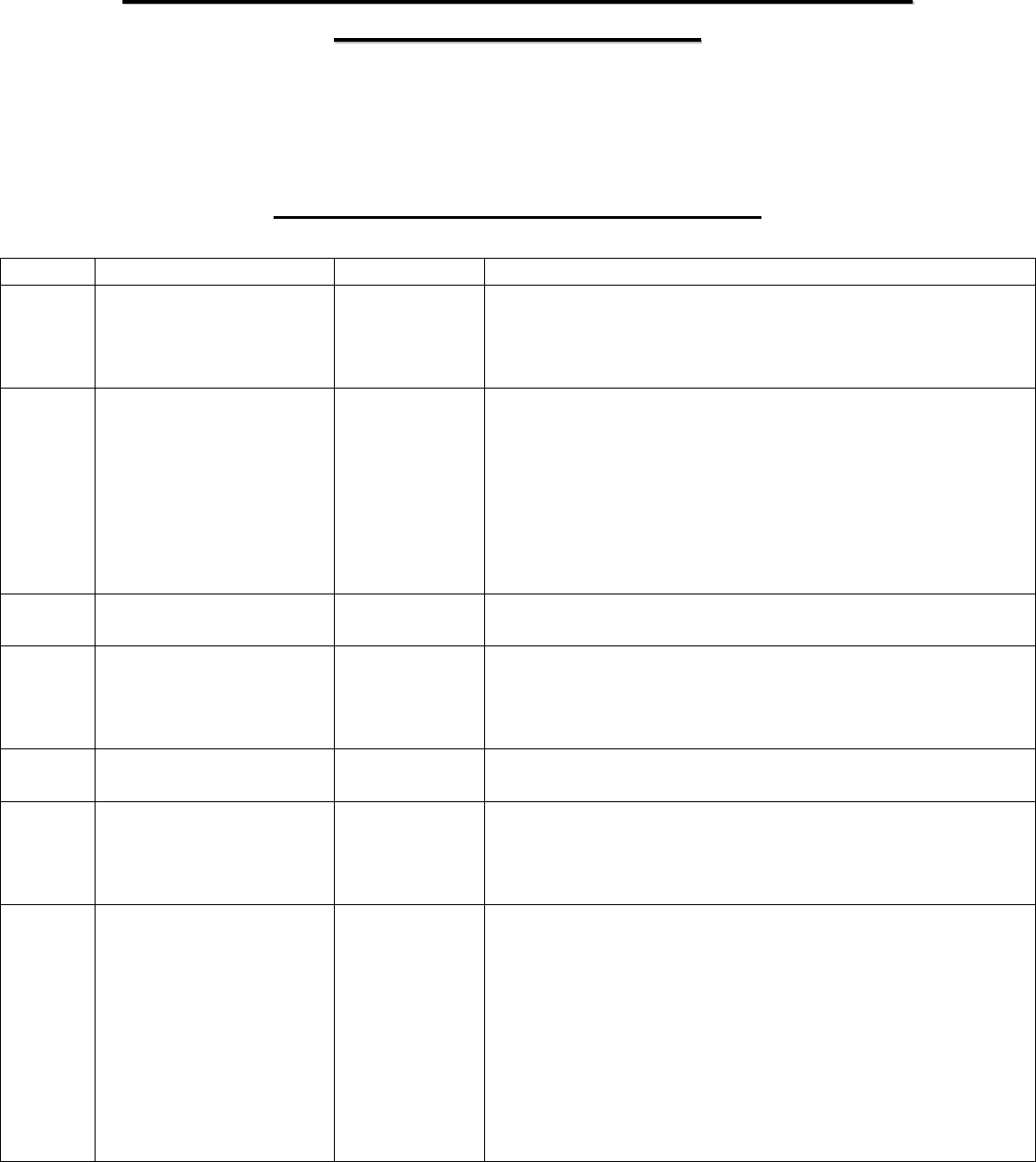

The Yearly calendar is as under:-

Month Work to be done Due date Remark

April Tax for the Month of

Mar. & Filing of

Quarterly Return for the

period 1

st

Jan to 31

th

Mar.

Upto

30

th

April

-

April An application for

Composition in Form 4

by the dealer having

turnover below Rs. 50

Lacs who wants to

apply composition u/s

11 of M.P.VAT Act

Upto

30

th

April

In case the dealer applies for composition u/s 11 of M.P.

VAT Act & the application accepted by dept. then he need

not to charge Vat in the sales invoice issued by him and he

would be entitled for self assessment. For getting the

benefit of composition U/s 11, the Trader dealer had to

deposit 0.5% of his turnover of schedule II goods, during

each quarter. In case of manufacturer he had to deposit 4%

of manufactured goods.

May Monthly Tax of April On or before

10

th

May

If the liability of tax exceeds Rs. 15,000/- Per Quarter but

below Rs. 6,25,000/- Per Quarter

May Monthly Tax of April before 10

th

May or say on

or before 9

th

May .

If the liability of tax exceeds Rs.25,00,000/- Per annum or

6,25,000/- per Quarter.

June Monthly Tax of May On or before

10

th

June

If the liability of tax exceeds Rs. 15,000/- per month but

below Rs. 6,25,000/- Per Quarter

June Monthly Tax of May before 10

th

June or say on

or before 9 th

June

If the liability of tax exceeds Rs.25,00,000/- Per annum or

6,25,000/- per Quarter.

June To submit C-Forms, F-

Forms, H-Form & E-1

Forms for the month of

Jan to March

From

1

st

April. to

30

th

June.

Please not that the submission of these forms are

COMPULSORY as per the amendments made in the

Central Sales Tax Act. Unlike the previous practice the

Assessing officer and Appellate authorities may deny to

accept the forms at the time of Assessment or Appeal . In

case the Forms could not be submitted up to the date then

we have to submit an application for adjournment for

submission of Forms.