HTML Preview Personal Financial Statement Format page number 1.

OMB APPROVAL NO.: 3245-0188

EXPIRATION DATE: 01/31/2018

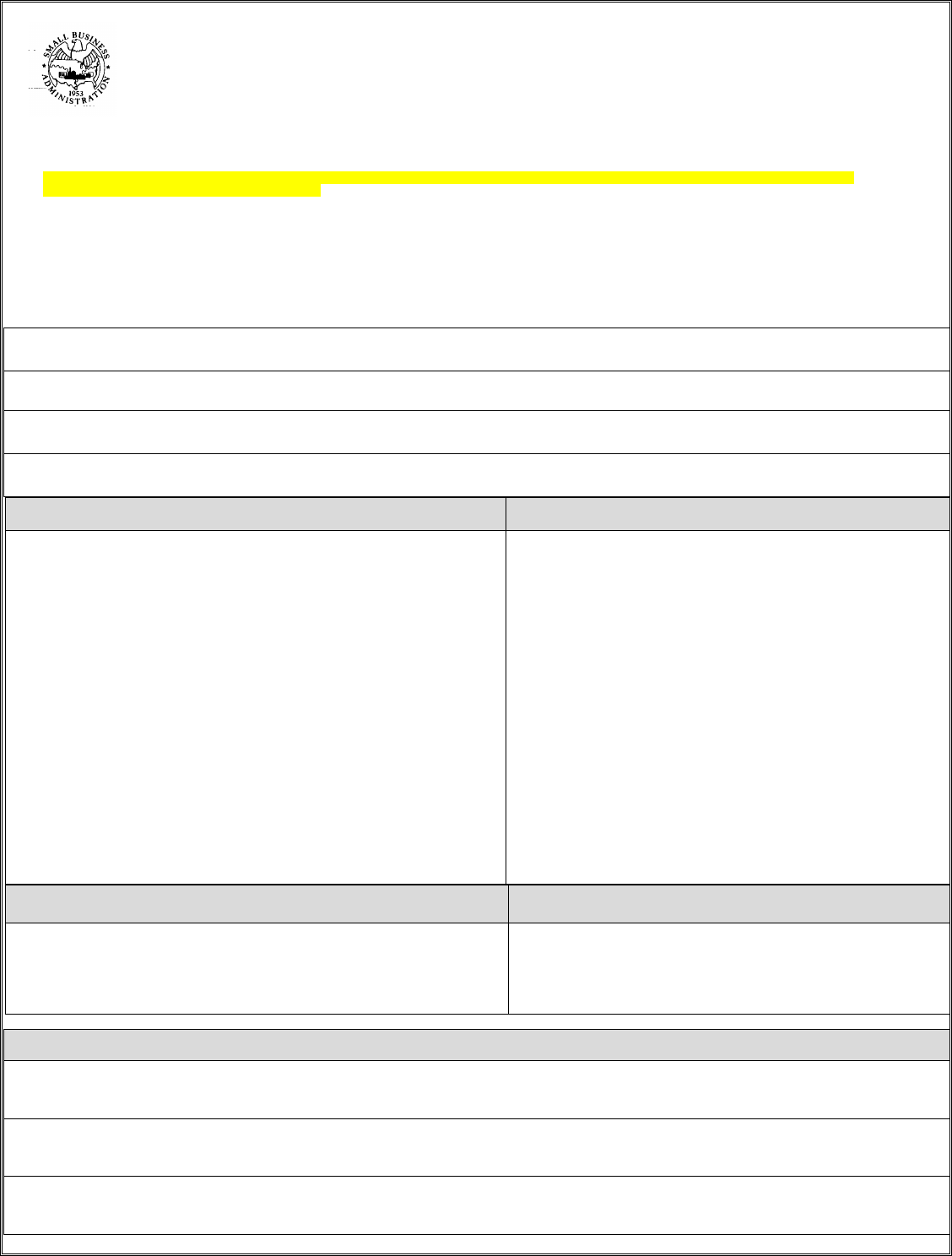

PERSONAL FINANCIAL STATEMENT

7(a) / 504 LOANS AND SURETY BONDS

U.S. SMALL BUSINESS ADMINISTRATION As of ________________, ________

SBA uses the information required by this Form 413 as one of a number of data sources in analyzing the repayment ability and creditworthiness of an application for an

SBA guaranteed 7(a) or 504 loan or a guaranteed surety.

Complete this form for: (1) each proprietor; (2) general partner; (3) managing member of a limited liability company (LLC); (4) each owner of 20% or more of the equity of

the Applicant (including the assets of the owner’s spouse and any minor children); and (5) any person providing a guaranty on the loan

Return completed form to:

For 7(a) loans: the lender processing the application for SBA guaranty

For 504 loans: the Certified Development Company (CDC) processing the application for SBA guaranty

For Surety Bonds: the Surety Company or Agent processing the application for surety bond guaranty

Description of Other Income in Section 1.

*Alimony or child support payments should not be disclosed in “Other Income” unless it is desired to have such payments counted toward total income.

SBA Form 413 (7a/504/SBG) (09-14) Previous Editions Obsolete Page 1

Name Business Phone

Home Address Home Phone

City, State, & Zip Code

Business Name of Applicant

ASSETS (Omit Cents) LIABILITIES (Omit Cents)

Cash on Hand & in banks…………………………$ ________________

Savings Accounts…………………………………..$ ________________

IRA or Other Retirement Account………………...$ ________________

(Describe in Section 5)

Accounts & Notes Receivable…………………….$ ________________

(Describe in Section 5)

Life Insurance – Cash Surrender Value Only……$ ________________

(Describe in Section 8)

Stocks and Bonds…………………………………..$ ________________

(Describe in Section 3)

Real Estate…………………………………………..$ ________________

(Describe in Section 4)

Automobiles…………………………………………$ ________________

(Describe in Section 5, and include

Year/Make/Model)

Other Personal Property……………………………$ ________________

(Describe in Section 5)

Other Assets………………………………………….$ _______________

(Describe in Section 5)

Total Assets $ ________________

Accounts Payable……………………………$ ______________

Notes Payable to Banks and Others……….$ ______________

(Describe in Section 2)

Installment Account (Auto)…………………..$ ______________

Mo. Payments $ ___________

Installment Account (Other)………………....$ ______________

Mo. Payments $ ___________

Loan(s) Against Life Insurance……………...$ ______________

Mortgages on Real Estate…………………...$ ______________

(Describe in Section 4)

Unpaid Taxes………………………………….$ _____________

(Describe in Section 6)

Other Liabilities………………………………..$ _____________

(Describe in Section 7)

Total Liabilities………………………………....$ _____________

Net Worth……………………………………….$ _____________

Total Liabilities & Net Worth $ _____________

*Must equal total in assets column.

Section 1. Source of Income. Contingent Liabilities

Salary………………………………………………….$ ________________

Net Investment Income……………………………...$ ________________

Real Estate Income………………………………….$ ________________

Other Income (Describe below)*…………………...$ ________________

As Endorser or Co-Maker…………………….$ _____________

Legal Claims & Judgments…………………..$ _____________

Provision for Federal Income Tax…………....$_____________

Other Special Debt…………………………….$ _____________

0

0

0

0