HTML Preview Annual Business Expense Report page number 1.

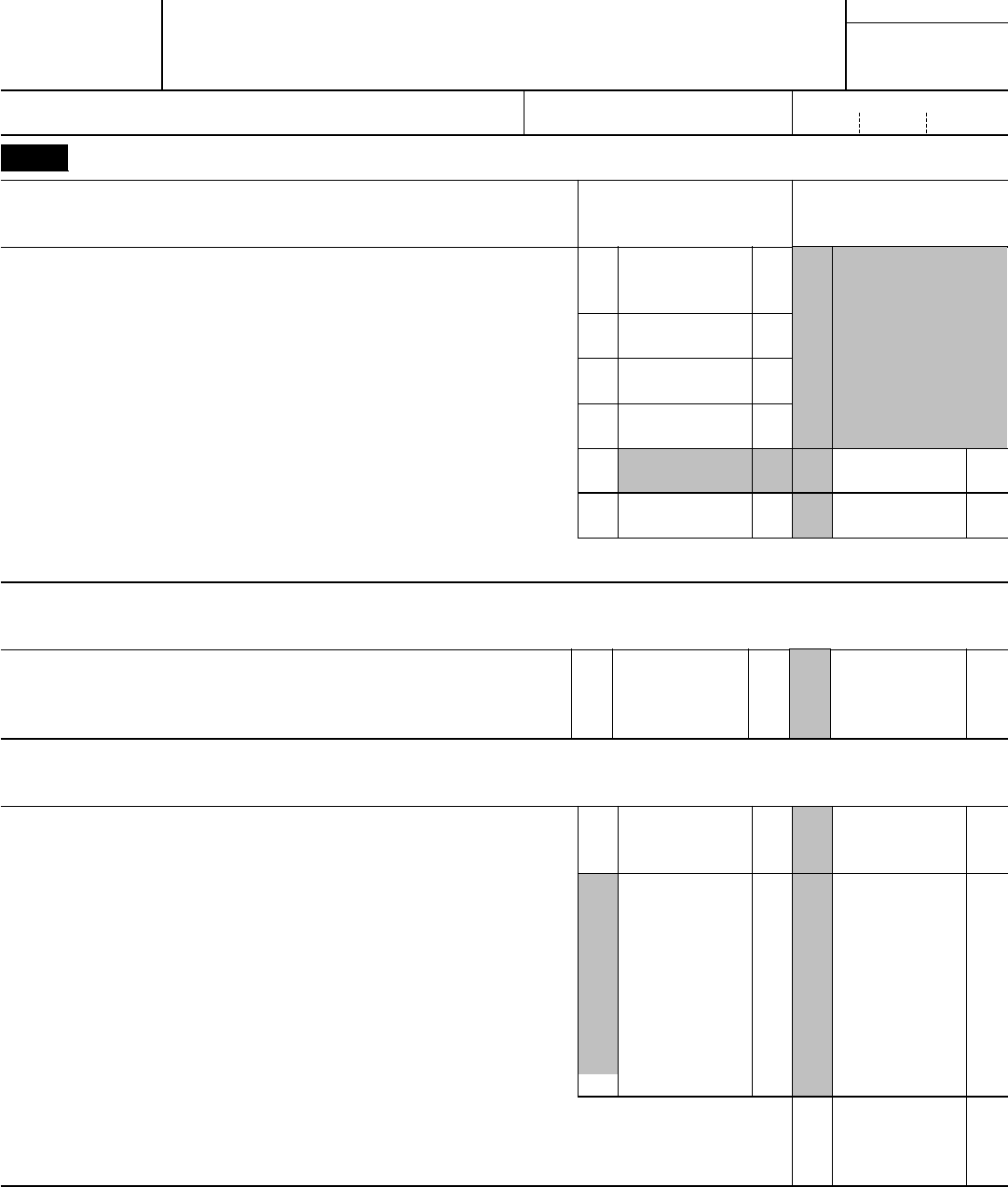

Form 2106

Department of the Treasury

Internal Revenue Service (99)

Employee Business Expenses

▶

Attach to Form 1040 or Form 1040NR.

▶ Information about Form 2106 and its separate instructions is available at www.irs.gov/form2106.

OMB No. 1545-0074

2016

Attachment

Sequence No

. 129

Your name Occupation in which you incurred expenses Social security number

Part I

Employee Business Expenses and Reimbursements

Step 1 Enter Your Expenses

Column A

Other Than Meals

and Entertainment

Column B

Meals and

Entertainment

1 Vehicle expense from line 22 or line 29. (Rural mail carriers: See

instructions.) . . . . . . . . . . . . . . . . . .

1

2 Parking fees, tolls, and transportation, including train, bus, etc., that

didn't involve overnight travel or commuting to and from work . .

2

3 Travel expense while away from home overnight, including lodging,

airplane, car rental, etc. Don't include meals and entertainment. .

3

4 Business expenses not included on lines 1 through 3. Don't include

meals and entertainment . . . . . . . . . . . . . .

4

5 Meals and entertainment expenses (see instructions) . . . . . 5

6 Total expenses. In Column A, add lines 1 through 4 and enter the

result. In Column B, enter the amount from line 5 . . . . . .

6

Note: If you weren't reimbursed for any expenses in Step 1, skip line 7 and enter the amount from line 6 on line 8.

Step 2 Enter Reimbursements Received From Your Employer for Expenses Listed in Step 1

7

Enter reimbursements received from your employer that weren't

reported to you in box 1 of Form W-2. Include any reimbursements

reported under code “L” in box 12 of your Form W-2 (see

instructions) . . . . . . . . . . . . . . . . . . .

7

Step 3 Figure Expenses To Deduct on Schedule A (Form 1040 or Form 1040NR)

8

Subtract line 7 from line 6. If zero or less, enter -0-. However, if line 7

is greater than line 6 in Column A, report the excess as income on

Form 1040, line 7 (or on Form 1040NR, line 8) . . . . . . .

8

Note: If both columns of line 8 are zero, you can't deduct

employee business expenses. Stop here and attach Form 2106 to

your return.

9

In Column A, enter the amount from line 8. In Column B, multiply line

8 by 50% (0.50). (Employees subject to Department of Transportation

(DOT) hours of service limits: Multiply meal expenses incurred while

away from home on business by 80% (0.80) instead of 50%. For

details, see instructions.) . . . . . . . . . . . . . .

9

10

Add the amounts on line 9 of both columns and enter the total here. Also, enter the total on

Schedule A (Form 1040), line 21 (or on Schedule A (Form 1040NR), line 7). (Armed Forces

reservists, qualified performing artists, fee-basis state or local government officials, and

individuals with disabilities: See the instructions for special rules on where to enter the total.) .

▶

10

For Paperwork Reduction Act Notice, see your tax return instructions.

Cat. No. 11700N

Form 2106 (2016)