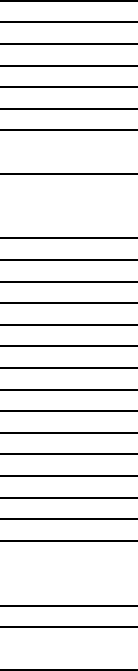

HTML Preview Bank Income Statement page number 1.

Income Statement for a Small Business

For period from ________ to _________

Sales

Less cost of goods sold

Opening inventory

Purchases (direct materials)

Factory wages

Total

Less closing inventory

Equals cost of goods sold

Gross profit (or income)

Expenses

Salary (owner)

Wages

Rent or mortgage interest

Utilities (electricity, heat, etc.)

Insurance

Advertising and promotion

Automobile

Other travel

Office expenses

Storage

Maintenance

Depreciation

Bad debts

Interest

Other expenses

Total expenses

Earnings (or loss) Before Taxes

Income taxes

Net Earnings (or loss)

Use this worksheet to prepare your Income Statement if you are already in business, and as a

format for pro forma (projected) income statements.

Gross profit (or income) is obtained by deducting the cost of goods sold from sales.

Net earnings (or profit) or loss is obtained by deducting all expenses from the gross profit.

Net earnings is the amount to be transferred to the retained earnings section of the balance sheet.