HTML Preview Personal Balance Sheet page number 1.

Your personal balance sheet

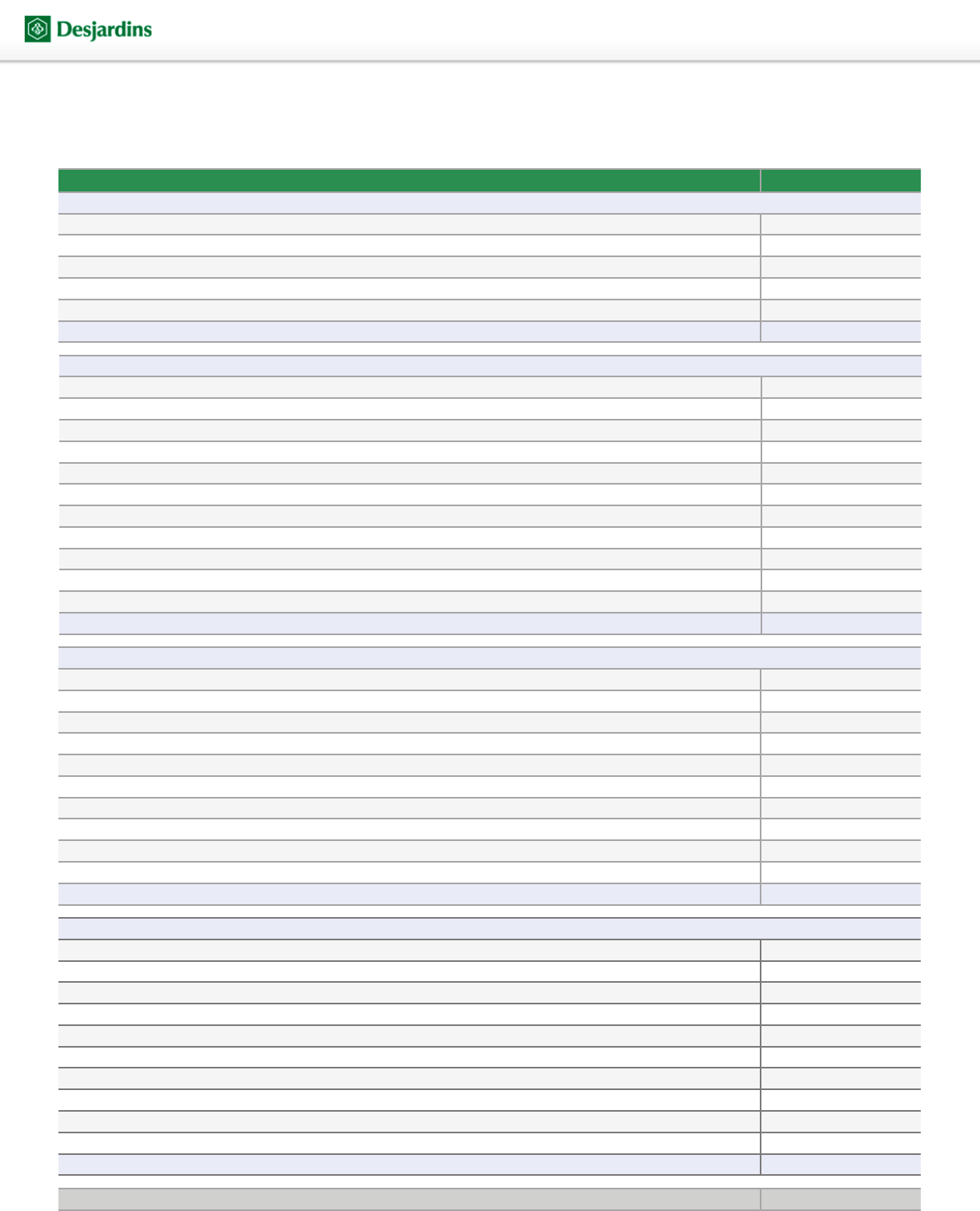

Calculate your net worth using a list of what you own (assets) and what you owe (liabilities) at a given point in time. Your balance sheet is a useful tool for

making big nancial decisions or developing investment strategies.

Assets (What you own) Approximate value

Current assets

Cash (chequing account balance) $

Savings account $

Savings bonds (Canada and Quebec) $

Term savings (regular or redeemable and maturing within 12 months) $

Other assets (money market funds, T-bills, etc.) $

Total current assets

Non-registered investments

Term savings (regular and maturing after 12 months) $

Indexed term savings $

Desjardins Permanent Shares $

Bonds (e.g.: corporate bonds, strip coupons, debentures). Do not include savings bonds. $

Investment funds $

Cash surrender value of life insurance $

Capital régional et coopératif Desjardins $

Fonds des travailleurs (FTQ, CSN, etc.) $

Stock savings plan (SSP) $

Stock $

Other $

Total non-registered investments

Registered plans

Registered Retirement Savings Plan (RRSP) $

Locked-In Retirement Account (LIRA) or Locked-In RRSP $

Registered Retirement Income Fund (RRIF) $

Life Income Fund (LIF) $

Registered Education Savings Plan (RESP) $

Annuity (Life or Fixed-term) $

Registered Pension Plan (pension fund) $

Deferred Prot-Sharing Plan (DPSP) $

Tax-Free Savings Account (TFSA) $

Other $

Total registered plans

Personal assets

Furniture $

Vehicles (car, boat, motorcycle, snowmobile, camper, motorized vehicle, etc.) $

Primary residence $

Secondary residence (cottage) $

Rental property (income property) $

Land $

Collections $

Art $

Jewels $

Other $

Total personal assets

Total assets

Acrobat Reader 7.0 and higher:

To enter and save information on this document, you must first save it to your hard drive. Click on the diskette icon in the tool bar or select the “Save as” option from the “File” menu.

0.00

0.00

0.00

0.00

0.00