HTML Preview Home Budget Planner page number 1.

DEVEREUX & Co

SOLICITORS

www.devlaw.co.uk

____________________________________________________________________________

BUDGET PLANNER

to print and complete or use to create your own spreadsheets

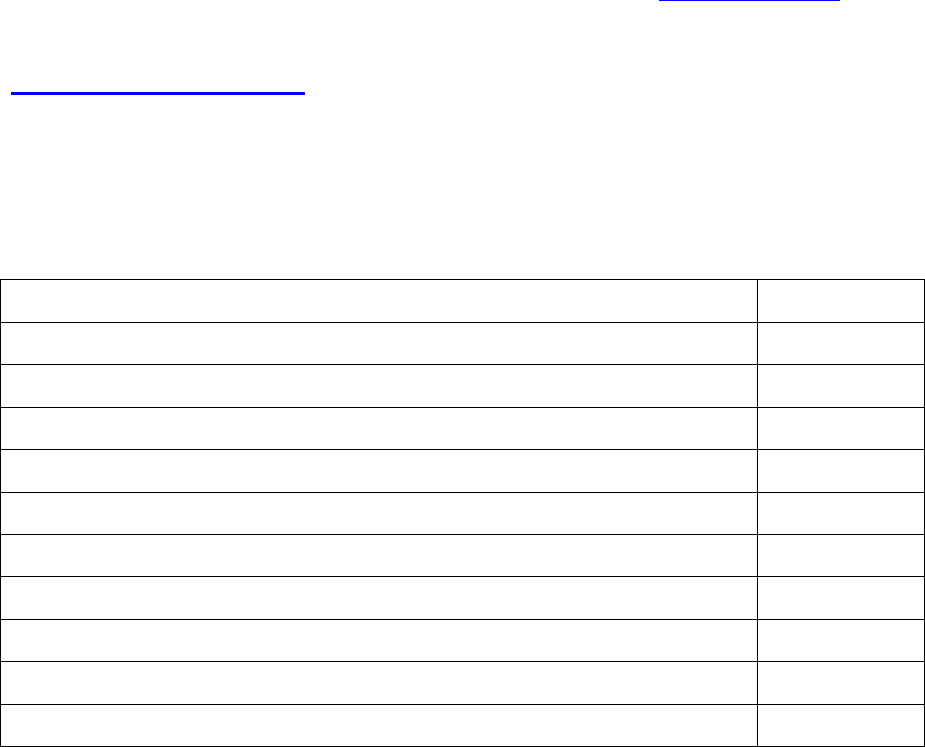

A - NET MONTHLY INCOME (£ per month)

Assumption : eg this is the household income of [name] currently / as from [date]

Net salary / wages

Net pension income

Child Benefit

Child Tax Credit

Working Tax Credit

Other Benefits

Net investment income

Maintenance (specify source)

Other income

TOTAL

Notes

1 For net income we suggest you look at the last 3 pay advices and take an average of the

‘bottom line’ figure. This will reflect deductions for tax, National Insurance and pension

contributions. If it includes deductions for Save As You Earn schemes or AVC

payments, you should add back these deductions to the bottom line. This is a simple

approach and will not always produce an entirely accurate picture; the position may for

example be complicated by bonuses and benefits in kind. It is still a good starting point.

2 For Child Tax Credit and Working Tax Credit show the figure for the entitlement,

whether or not it is actually received but make a note to that effect.

3 Ignore small amount of net investment income and only record substantial and regular

payments which are expected to continue.

4 If you are receiving maintenance in the form of a regular payment of a specific sum,

show it here. If someone pays some of your household bills (including the mortgage)

direct, do not show this as a maintenance payment but include in the list of Outgoings

below the items they pay for you as a cost of your household.