HTML Preview Travel & Expense-8-5-08-1X page number 1.

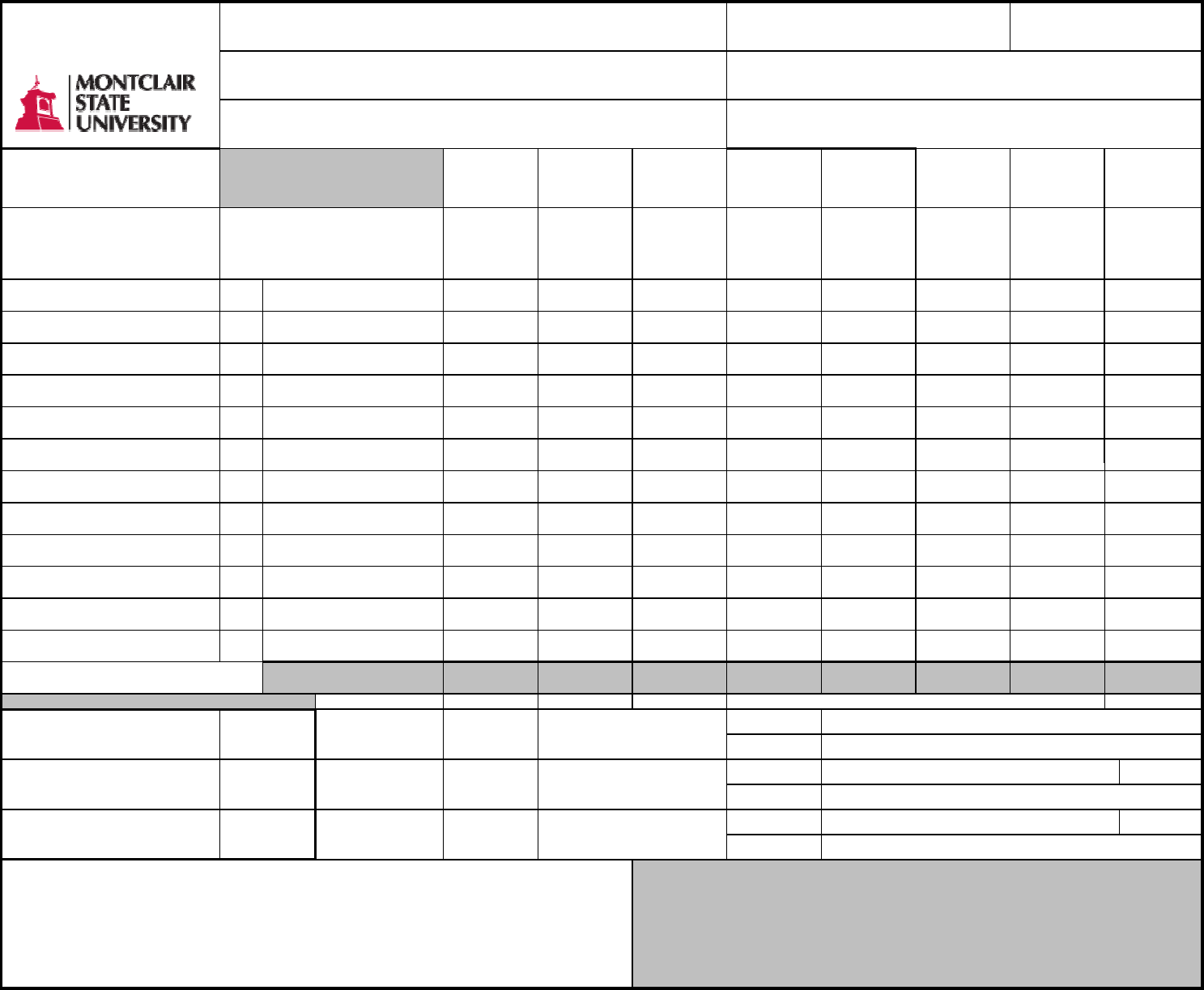

TR NUMBER

REPORT PERIOD BEGINNING ENDING

SUN DATE

MON DATE TUES DATE WED DATE THURS DATE FRI DATE SAT DATE

EXPLANATION OF ITEMS

1

2

3

4

5

6

LAST NAME FIRST NAME M. I.

HOME ADDRESS NUMBER STREET APT.

CITY STATE ZIP CODE

CWID

DEPARTMENT BLDG/ROOM TEL. EXT.

*Explain meetings and related and

miscellaneous below. Indicate day

incurred, persons involved and business

purpose.

TOTALS

TRAVEL & EXPENSE INVOICE

Mileage Allowance

Tolls an

d Parking

Trans. (Air)

Hotel/Motel (Room Only)

Trans. (Rail, Taxi, Etc.)

Auto Rental

Town or City

To:

From:

Daily Mileage

(PERSONAL CAR)

DAY AND TYPE OF EXPENSE

6

7

8

9

10

11

12

Account No. (10 digit) Amount Voucher No.

Employee Print: D

ate:

Signat

ure:

Supervisor Print: Date:

Signature:

Fiscal Agent Print: Date:

Signature:

Hotel/Motel (Room Only)

Breakfast (Incl. Tips)

Lunch (Incl. Tips)

Dinner (Incl. Tips)

Registration Fee

Meetings + Related *

Deduct-Pre Paid Items (enter

negative

number)

Balance Due Employee

Miscellaneous *

DAILY TO

TALS

RECONCILIATION OF CASH

Grand Total of Expenses

2. Requ

est for Approval form If travel is of non-scholarly capacity,

and TR-1 not previously submitted (unless traveling to state agency).

1. Original Receipts

The following must be attached:

EMPLOYEE CERTIFICATION

I certify

that the above expenses are correct in all respects

; that the distances as charged have been actually and necessarily traveled by me

on the dates therein specified that the amount as charged ha

s been actually paid by me for traveling expenses; that no part of the account

and TR-1 not previously submitted.

Insurance Co.: Coverage:

4

. Mapquest printout to verify mileage

5. US G

eneral Svcs Admin (GSA) printout to verify per diem.

6. US General Svcs Admin (GSA) printout to verify lodging if non conference travel.

on the dates therein specified that the amount as charged has been actually paid by me for traveling expenses; that no part of the account

has been paid M.S.U. but the full amount id due. I

also CER

TIFY that on the date(s) when the above items of expense were incurred the

vehicle I was using on M.S.U. business was covered b

y liabil

ity insurance as follows:

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

0.00

Employee acting in a scholarly capacity?

Yes

No

STUDENT

CHECK IF APPLIES: