HTML Preview Monthly Expense & Income Worksheet page number 1.

Page 1 of 2

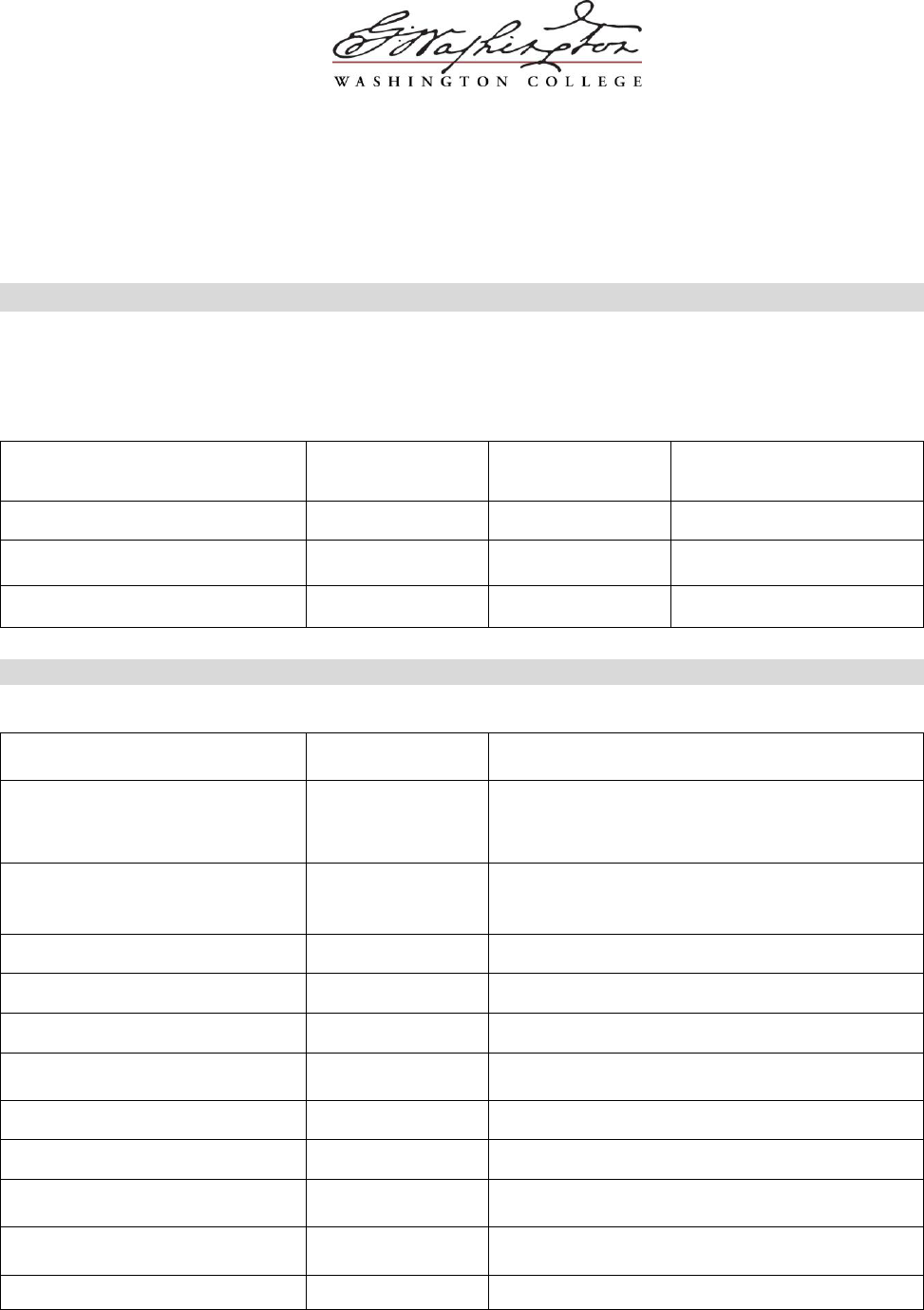

MONTHLY EXPENSE AND INCOME WORKSHEET

Student Name: _____________________________________________________________

Student ID Number: ___________________________ Phone: ______________________

Wages From Work 2015

If you, the student, or your parents earned wages from working in 2015, you must report those wages below,

even if you were not required to file a federal income tax return. Attach copies of all corresponding W-2s to

this form. You must include all monies earned from working, even unreported employment wages and self-

employment. Attach a separate sheet if necessary.

Employer's name

W-2 available?

(yes or no)

Total earned 2015

Recipient (Parent /

stepparent or student)

Monthly Income 2015

Report all sources of monthly income in 2015 for you and your parents below. Attach a separate sheet if

necessary.

Source of Monthly Income

Amount Per

Month

Recipient ( parent / stepparent or student)

Income from work

$

$

$

Unemployment compensation

$

Recipient:

Date range of benefits:

Social Security benefits

$

Disability or Worker’s comp

$

Subsidized housing

$

Veterans benefits (non-

educational)

$

SNAP / WIC / Food Stamps

$

TANF or Public Assistance

$

Spousal support (whether court

ordered or not)

$

Child support (whether court

ordered or not)

$

Support from relatives / friends

$