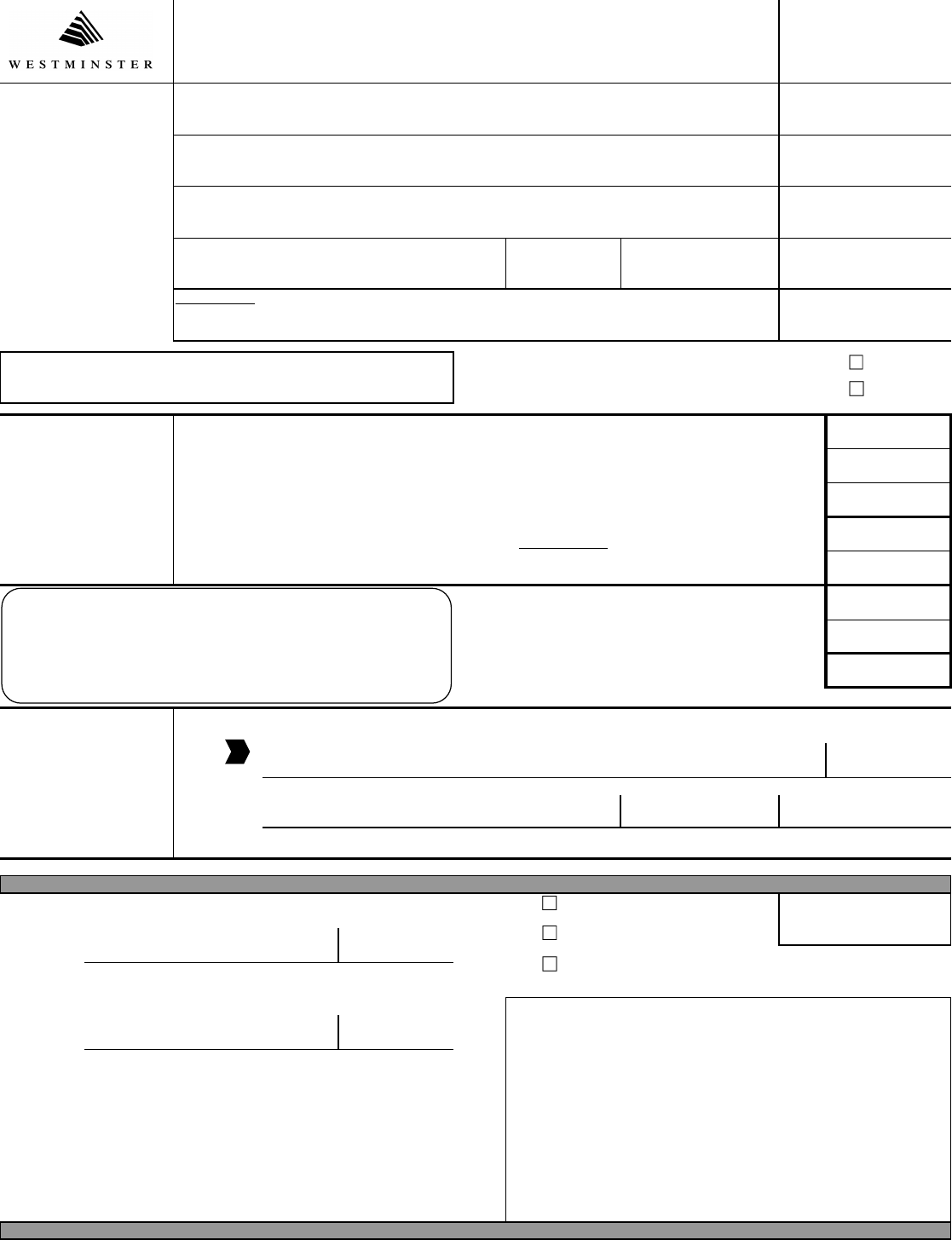

HTML Preview Construction Project Cost Report page number 1.

1) Legal Name of Business or Individual Name (Last, First):

2) Trade Name of Business (if any):

3) Mailing Address:

4) City: 5) State: 6) Zip:

E-mail Address:

10) Project Street Address:

17) Penalty Due (10% of line 16, minimum $15):

18) Interest Due (1% of line 16 per month):

19) TOTAL DUE (total of lines 16 through 18):

Signature Date

Printed Name Title Phone Number

CLAIM/DOC NO.

Signature Date

Signature Date

5300.____________.0000 Amount:__________________________

5400.____________.0000 Amount:__________________________

5300.____________.0911 Amount:__________________________

Return form with payment to: Westminster Department of Finance Sales Tax Division 4800 W 92nd Avenue Westminster, CO 80031

Approved By:

CASHIER VALIDATION - A/P PROCESSING DETAIL

14) Enter the estimated use tax collected upon issuance of the above-listed building permit.

If line 13 equals line 14, no additional use tax is due. Sign and submit the report without payment.

16) If line 14 is less than line 13 enter the difference. This is the additional use tax due.

Computation of

Use Tax Due

CITY USE ONLY

Reviewed By:

Taxpayer

Signature

15) If line 14 is greater than line 13 enter the difference. This is your overpayment amount.

(Include a

Job Cost Report

as documentation for your refund claim)

Under penalties of perjury, I declare that I have examined this Project Cost Report and it is true and correct to the best of my knowledge & belief.

11) Did this project require that construction equipment

owned by the contractor be used in the City?

13) Use Tax Due (Multiply line 12 by 3.85%):

9) Period Ending Date:

7) City Account No. (if assigned):

8) Permit No.:

Construction Project Cost Report

Use Tax Return/Claim for Refund

Please Type or Print Clearly. Include Required Supporting Documentation

12) Enter the total cost of construction materials used on the project.

Include costs of materials used by all subcontractors.

City of Westminster

Department of Finance

Sales Tax Division

DUE DATE FOR RETURN:

Any additional use tax due computed on line 16 must be reported

and paid within 30 days of written acceptance, final inspection, or the

issuance of the Certificate of Occupancy, whichever is later (line 9).

Amounts paid after this grace period are subject to penalty and

interest from the date on line 9.

Yes

No

Denied

Approved in Part: $________________________

Approved