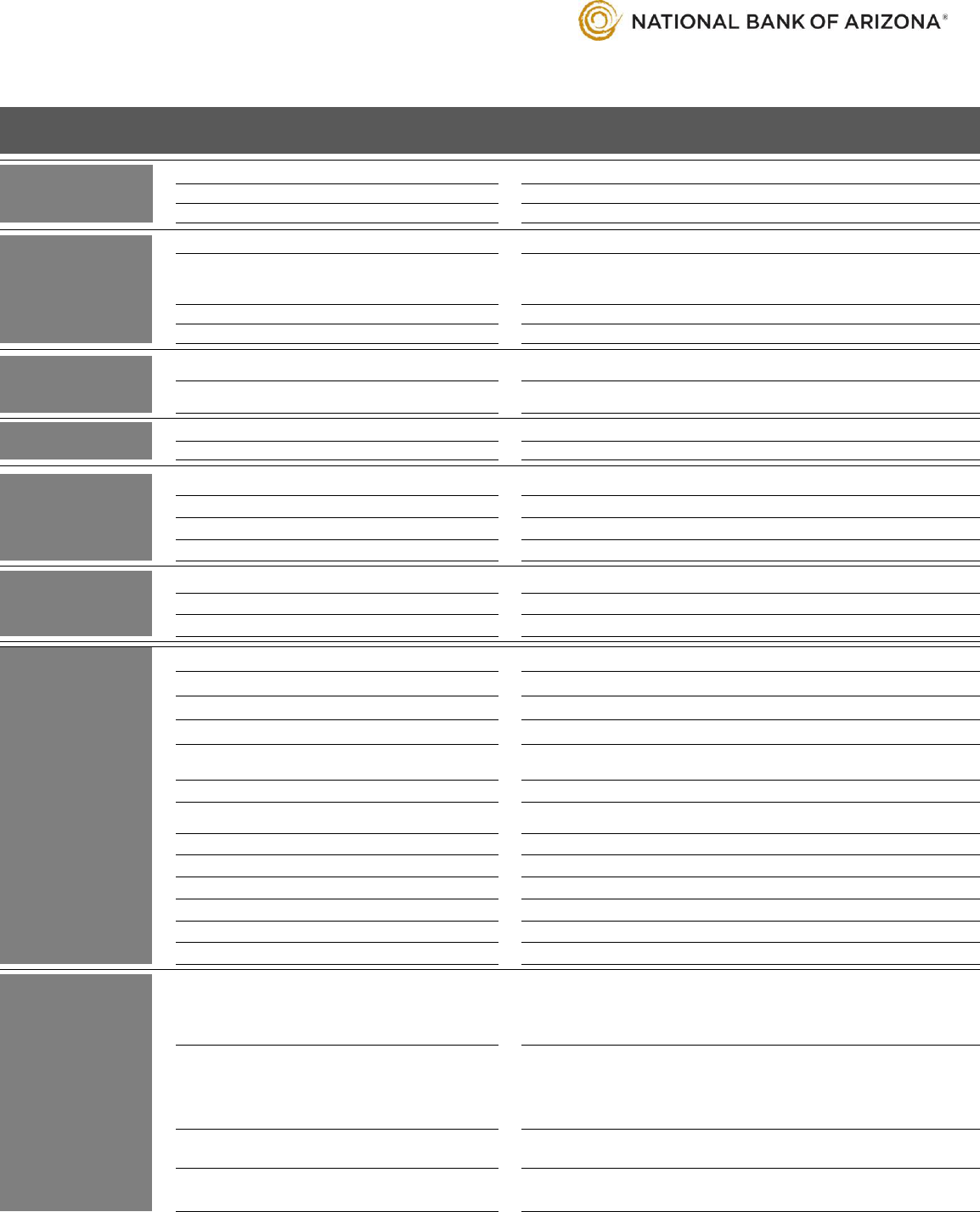

HTML Preview Personal Schedule Sample page number 1.

Personal Accounts Schedule of Fees

Effective August 15, 2016

Account

Verification

Customer Requested Account Verification Letter

$10.00

Third Party Requested Account Verification

$15.00

Account Re-Verification

$10.00

ATM

Transactions

NB|AZ ATM Transaction

1

No Charge

Non-NB|AZ ATM Transaction

1

$3.00

For using another bank’s ATM to complete any

transaction. In addition fees from other bank may

apply.

Non-NB|AZ ATM Inquiry

1

$2.00

International ATM/Debit Transaction

3% of US $

Cashier’s

Checks

Non-Customer

$10.00

Customer

$6.00

Collection Fee

Domestic (In/Out)

$25.00

International (In/Out)

$40.00

Foreign

Exchange

Buy Currency from Customer

No Charge

Buy Checks

$30.00

Sell Currency to Customer

$25.00

Sell Drafts

$15.00

Other than qualified Canadian

Legal

Processing

Garnishment

$100.00

Levy

$100.00

Subpoena

$100.00

Online

Banking

Online Access

No Charge

Online Access with Bill Pay

No Charge

PC Banking Access

No Charge

Quicken, Quickbooks, Money, etc.

PC Banking Access with Bill Pay

$4.95

Quicken, Quickbooks, Money, etc.

Mobile Banking

No Charge

Web browser and mobile app access. Message and data

charges from service provider may apply.

Mobile Banking with Bill Pay

No Charge

eStatements & eNotices

No Charge

Receive electronic statements and notices. Must be enrolled

in Online Banking.

Expedited Payment

$14.99

When using bill pay to make overnight payment.

Popmoney® Transfer Services:

Fees Associated with using Popmoney® Transfer services

Request Money

$1.00

Send Money - Email Template

$0.25

Send Money - Standard Delivery

$1.00

Send Money - Next Day Delivery

$3.00

Overdraft

Transactions

Non-Sufficient Funds Fee

$33.00

Applies to checking and interest-bearing accounts; fee

applies to each paid or returned item if the account is

overdrawn more than $10.00, up to a maximum of five (5)

fees per business day.

Daily Overdraft Fee

$5.00

Assessed to accounts overdrawn for more than four (4)

consecutive calendar days. The fee will be charged on the 5

th

day, and each subsequent calendar day the account is

overdrawn more than $10, for a maximum of 30 calendar

days.

Deficit Funds Transfer

$10.00

Per overdraft covered by transfer from linked deposit

account.

Credit Reserve Line Transfer

(subject to credit approval)

$10.00

Per overdraft covered by transfer from linked line of credit.