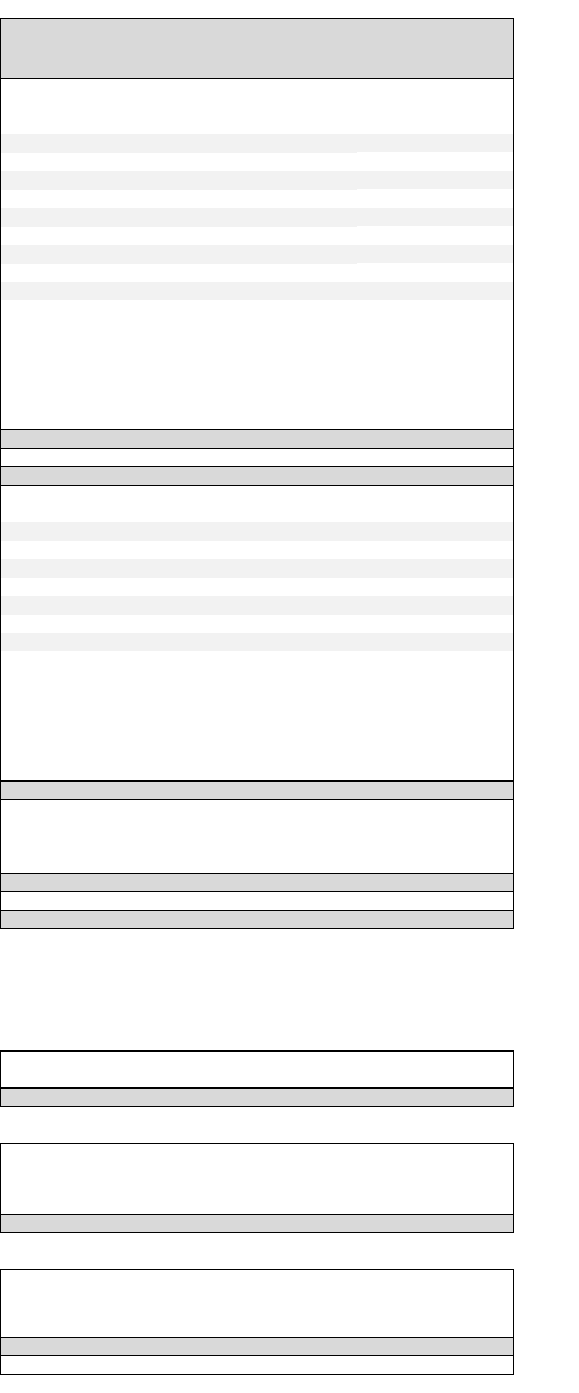

HTML Preview Personal Balance Sheet For Bank page number 1.

Amounts in NOK millions

Norges Bank balance sheet for

April as per 18th of May 2016

ASSETS 30 April 2016

FINANCIAL ASSETS

Deposits in banks 12 565

Secured lending 59 604

Unsettled trades 5 310

Equities and units 149 989

Equities lent 5 324

Bonds and other fixed income instruments* 254 119

Bonds lent 818

Financial derivatives 14

Claims on the IMF 64 844

Lending to banks 23 801

Other financial assets 2 690

Total financial assets 579 078

Investments, Government Pension Fund Global 6 986 438

Non-financial assets 2 819

TOTAL ASSETS 7 568 335

LIABILITIES AND EQUITY

FINANCIAL LIABILITIES

Secured borrowing 982

Unsettled trades 34 259

Financial derivatives 3

Other financial liabilities 788

Liabilities to the IMF 58 189

Deposits from banks, etc. 32 811

Deposits from the Treasury 189 737

Notes and coins in circulation 48 706

Total financial liabilities 365 475

Deposits in krone account, Governments Pension Fund Global 6 986 438

Other liabilities 1 030

TOTAL LIABILITIES 7 352 943

Equity 245 356

Profit for the year -29 964

TOTAL EQUITY 215 392

TOTAL LIABILITIES AND EQUITY 7 568 335

Note 1 Specification Deposits from banks, etc.

Sight deposits from banks 32 603

Other deposits 208

Deposits from banks, etc. 32 811

Note 2 International reserves

Total international reserves 503 152

Note 3 Foreign exchange reserves

Total foreign exchange reserves 453 079

Of which petroleum buffer portfolio 20 021

Norges Bank's international reserves comprise foreign exchange reserves and defined asset and

liability items related to the International Monetary Fund (IMF). These defined items are Special

Drawing Rights (SDRs), Norway’s quota subscripton in the IMF, loans to the New Arrangement to

Borrow (NAB) and NOK liability to the IMF.

The foreign exchange reserves comprise Norges Bank's assets of foreign currencies under

management. The foreign exchange reserves are divided into a long-term portfolio, a money

market portfolio and a petroleum buffer portfolio.

*Bonds and other fixed income instruments at Norges Bank’s balance sheet are entirely associated with

management of the foreign exchange reserves. Norges Bank issues government debt and enters into

financial contracts regarding government debt management in the name of the Ministry of Finance.

Transactions related to government debt management is recognised in the government accounts and not in

Norges Bank’s balance sheet.