HTML Preview Chase Bank Financial Statement page number 1.

Commercial Term Lending

Personal Financial Statement

201 CTL

09/05/16 JPMorgan Chase Bank, N.A. Page 1 of 3

Important Information About Procedures for Opening a New Account: To help the government fight the funding of terrorism and money laundering activities,

federal law requires all financial institutions to obtain, verify, and record information that identifies each person who opens an account. What this means for you:

When you open an account, we will ask for your name, address, date of birth, and other information that will allow us to identify you. We may also ask to see your

driver's license or other identifying documents.

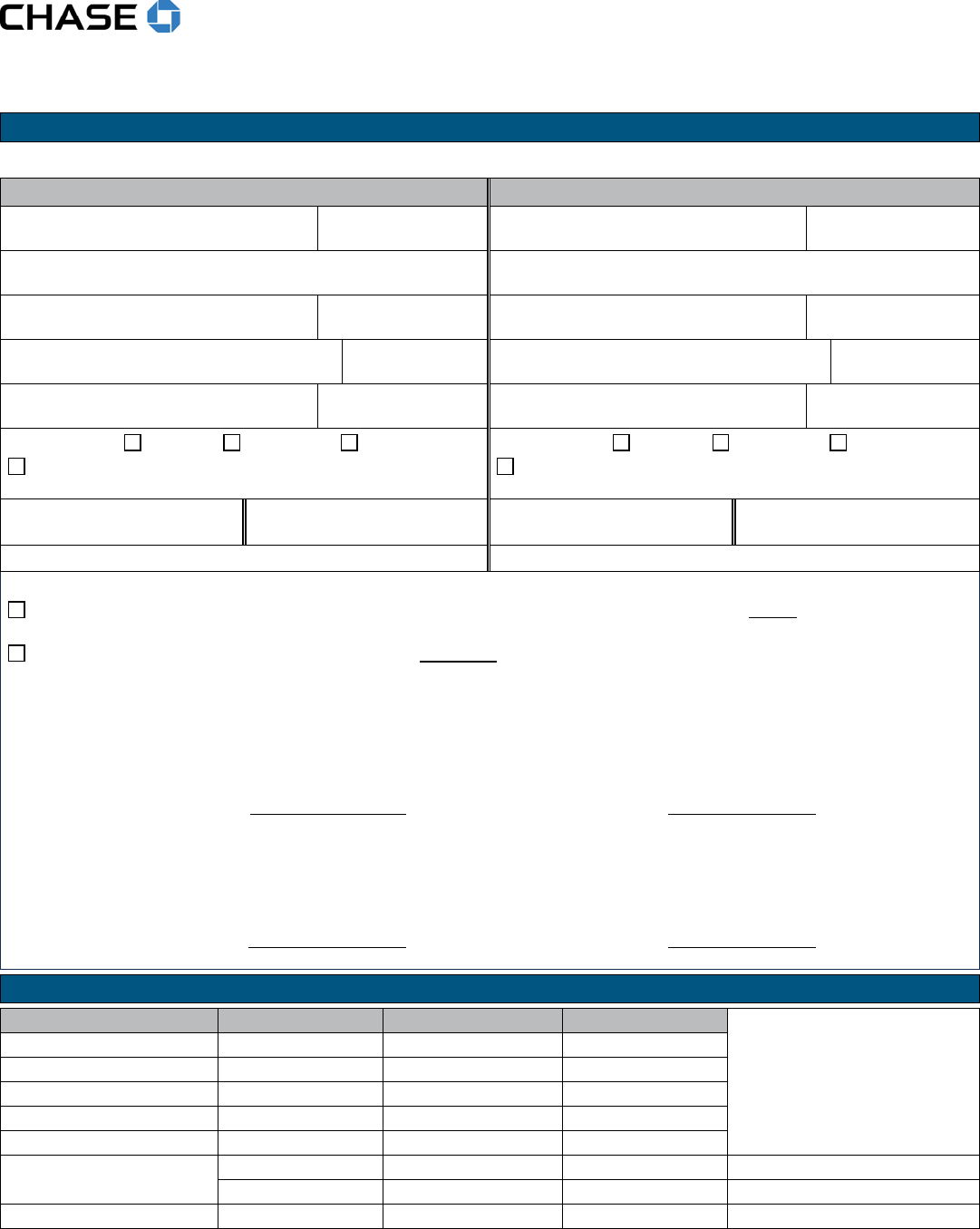

Section 1: Applicant Information

Complete this Personal Financial Statement as Borrower/Principal/Guarantor (“Applicant”) or Co-borrower/Co-Principal/Co-Guarantor (“Co-applicant”) as

applicable. Attach copies of this statement for each additional Co-Applicant.

Applicant Co-Applicant

Legal Name (First, Middle, Last)

Phone Number

Legal Name (First, Middle, Last)

Phone Number

E-Mail Address

E-Mail Address

Social Security Number

Date of Birth

Social Security Number

Date of Birth

Home Address (no P.O. Boxes)

# Years at Address

Home Address (no P.O. Boxes)

# Years at Address

City, State, ZIP Code

Country (if not USA)

City, State, ZIP Code

Country (if not USA)

Marital Status: Married Unmarried Separated

Registered Domestic Partner (RDP) or its equivalent under the

applicable State Law

Marital Status: Married Unmarried Separated

Registered Domestic Partner (RDP) or its equivalent under the

applicable State Law

Occupation

# of Years in Occupation

Occupation

# of Years in Occupation

Primary Source of Income Primary Source of Income

When applicable, check the appropriate box below:

The income or assets of a person other than the Applicant (including the Applicant’s spouse or RDP) will be

used as a basis for loan

qualification, in which case information about that person’s income or assets must be provided; or

The income or assets of the Applicant’s spouse or RDP will not be used as a basis for loan qualification, but the Applicant resides in a

community property state, the security property is located in a community property state, or Applicant is relying on other property located in

a community property state as a basis for repayment of the loan, in which case Lender may request information about the Applicant’s spouse

or RDP, as appropriate.

Any persons, whether married, unmarried, separated, or a RDP may apply for separate credit. Providing joint financial information does not

confirm intent for the two co-applicants to apply for joint credit. Intent to apply for joint credit must be expressly stated. If joint financial condition

is presented, and the intent is for co-applicants to be jointly and severally obligated on the credit (i.e., joint borrowers or guarantors), please initial:

Applicant

Co-Applicant

Initials

Initials

The information provided in this Personal Financial Statement and any supporting schedules (“Statement”) is the most current financial

information available (unless otherwise noted in the date field below) concerning the Applicant or Co-Applicant and there have been no

significant changes in the information provided in this Statement.

The following information (or on the attached financial statement) is a statement of financial condition, as of:

Applicant

/ /

Co-Applicant

/ /

Date

Date

Section 2: Annual Income

Gross Annual Income Applicant Co-Applicant Total

Describe Other Income Notice:

Alimony, child support or separate

maintenance income need not be

disclosed if the Applicant or Co-

Applicant does not wish to have the

income considered as a basis for

repaying this loan.

Base Employment Income

$

$

$

Overtime $ $ $

Commission

$

$

$

Dividends/Interest $ $ $

Net Rental Income

$

$

$

Other Annual Income (see

“Describe Other Income Notice”)

$ $ $

$

$

$

Total Annual Income $ $ $