HTML Preview Acrobat Pdfmaker 5.0 page number 1.

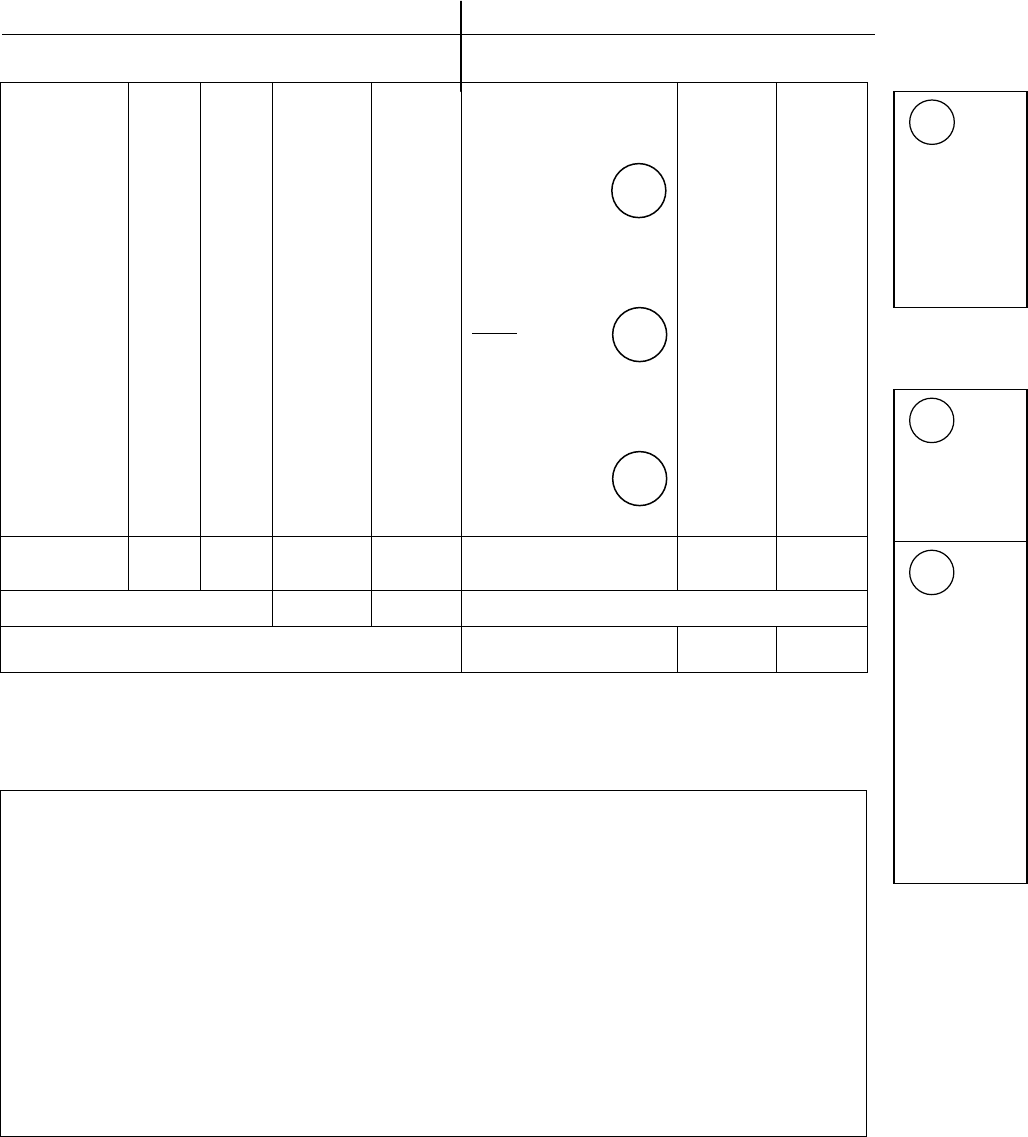

ABC Corp. Employee Name: Mary Smith

450 Chamber Street Social Security #: 999-99-9999

Somewhere, USA 01010 Period End Date: 01/07/05

Wages Deductions

Current Y-T-D Current Y-T-D

Description Hours Rate Amount Amount Description Amount Amount

1

2

3

Regular

Overtime

Holiday

Tuition

40.00

1.00

10.00

15.00

400.00

15.00

37.43*

400.00

15.00

0.00

37.43

Federal Withholdings

Social Security Tax

Medicare

Tax

NY State

Income Tax

NYC Income Tax

NY SUI/SDI Tax

Other

401(k)

Life Insurance

Loan

Dental

HMO

Dep Care FSA

37.29

24.83

5.81

8.26

5.11

0.61

27.15*

2.00

30.00

2.00*

20.00*

30.00*

37.29

24.83

5.81

8.26

5.11

0.61

27.15

2.00

30.00

2.00

20.00

30.00

Totals

452.43 452.43

Deduction Totals

193.06 193.06

Taxable Gross

335.85 335.85

NET PAY

259.38 259.38

1

Details of

applicable

federal,

state, and

local taxes

paid.

3

Flexible

Spending

Accounts

(for health

care, child

or

dependant

care,

parking

expenses)

are pre-tax

deductions.

2

401(k)

savings is a

pre-tax

deduction.

• Excluded from federal taxable wages

ABC Corp. Payroll Advice # 00000000

450 Chamber Street Advice of Credit Date 1/07/2005

Somewhere, USA 01010

Pay TWO HUNDRED FIFTY NINE AND 38/100 DOLLARS

To the MARY SMITH

Order of 215 MAIN STREET

ANYTOWN, USA 98765

NON-NEGOTIABLE