HTML Preview Mortgage Settlement Statement page number 1.

The Public Reporting Burden for this collection ofinformation is estimated at 35 minutes per response for collecting, reviewing,and reporting the data. This agency may not collect this information, and you are

notrequired to complete this form, unless it displays a currently valid OMBcontrol number. No confidentiality is assured;this disclosure is mandatory. This is designed to provide the parties to a RESPA c overed

transaction with information during the settlement process.

HUD-1

Page 1 of 3

(CS1413840.PFD/CS1413840/14)

OMB Approval No. 2502-0265

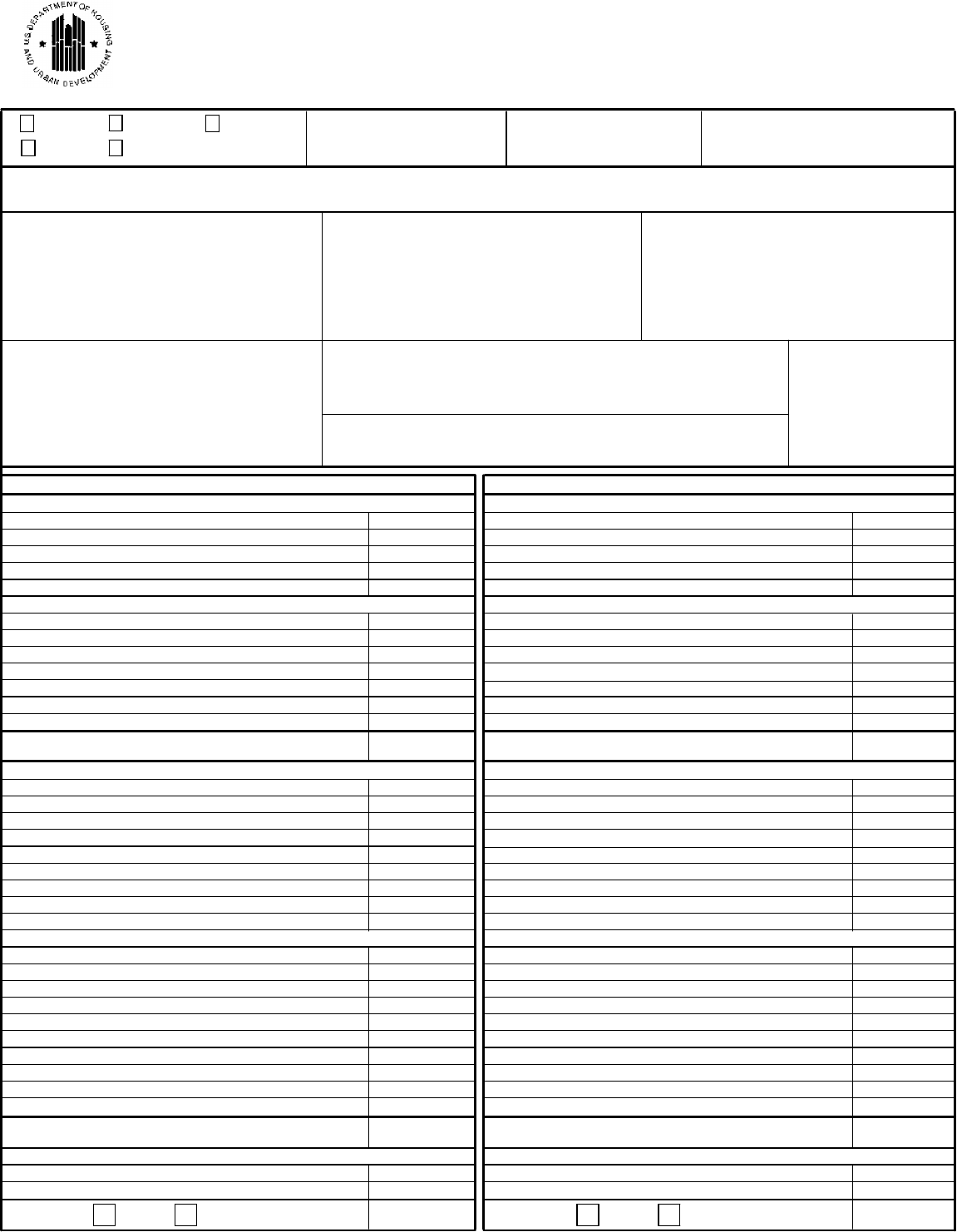

A. Settlement Statement (HUD-1)

B. Type of Loan

1. FHA 2. RHS 3.

X

Conv. Unins. 6. File Number: 7. Loan Number:

8. Mortgage Insurance Case Number:

CS1413840

4. VA 5. Conv. Ins.

C.

Note:

This form is furnished to give you a statement of actual settlement costs. Amounts paid to and by the settlement agent are shown.

Items marked "(p.o.c.)" were paid outside the closing; they are shown here for informational purposes and are not included in the totals.

D. Name and Address of Borrower: E. Name and Address of Seller: F. Name and Address of Lender:

Eager Buyer Joe Seller Mortgage Express

123 N. Main St.

Memphis, TN 38017

G. Property Location: H. Settlement Agent:

I. Settlement Date:

123 N. Main St. CloseTRAK, LLC

Memphis, TN 38017 8046 N. Brother Blvd., Suite 103

January 15, 2015

Shelby County, Tennessee Bartlett, TN 38133 Ph. (901)333-1360

Place of Settlement:

8046 N. Brother Blvd., Suite 103

Bartlett, TN 38133

J. Summary of Borrower's transaction K. Summary of Seller's transaction

100. Gross Amount Due from Borrower: 400. Gross Amount Due to Seller:

101. Contract sales price 150,000.00 401. Contract sales price 150,000.00

102. Personal property 402. Personal property

103. Settlement Charges to Borrower (Line 1400) 5,793.26 403.

104. 404.

105. 405.

Adjustments for items paid by Seller in advance Adjustments for items paid by Seller in advance

106. City/Town Taxes to 406. City/Town Taxes to

107. County Taxes to 407. County Taxes to

108. Assessments to 408. Assessments to

109. 409.

110. 410.

111. 411.

112. 412.

120. Gross Amount Due from Borrower

155,793.26

420. Gross Amount Due to Seller

150,000.00

200. Amounts Paid by or in Behalf of Borrower 500. Reductions in Amount Due Seller:

201. Deposit or earnest money 1,000.00 501. Excess deposit (see instructions)

202. Principal amount of new loan(s) 120,000.00 502. Settlement charges to Seller (Line 1400) 10,334.00

203. Existing loan(s) taken subject to 503. Existing loan(s) taken subject to

204. 504. Payoff First Mortgage

205. 505. Payoff Second Mortgage

206. 506.

207. 507. (Deposit disb. as proceeds)

208. 508.

209. 509.

Adjustments for items unpaid by Seller Adjustments for items unpaid by Seller

210. City/Town Taxes 01/01/15 to 01/15/15 48.90 510. City/Town Taxes 01/01/15 to 01/15/15 48.90

211. County Taxes 01/01/15 to 01/15/15 62.90 511. County Taxes 01/01/15 to 01/15/15 62.90

212. Assessments to 512. Assessments to

213. 513.

214. 514.

215. 515.

216. 516.

217. 517.

218. 518.

219. 519.

220. Total Paid by/for Borrower

121,111.80

520. Total Reduction Amount Due Seller

10,445.80

300. Cash at Settlement from/to Borrower 600. Cash at settlement to/from Seller

301. Gross amount due from Borrower (line 120) 155,793.26 601. Gross amount due to Seller (line 420) 150,000.00

( ) ( )

302. Less amount paid by/for Borrower (line 220) 121,111.80 602. Less reductions due Seller (line 520) 10,445.80

X

303. Cash From To Borrower

34,681.46

603. Cash

X

To From Seller

139,554.20

* Paid outside ofclosing by borrower(B), seller(S), lender(L),or third-party(T)