HTML Preview Health Needs Analysis page number 1.

Healthcare Needs Analysis

This document is a guideline on aspects that could be taken into account to provide advice to healthcare

clients who want to join a medical scheme.

This document serves as a mere guide and should not be used as the definitive and only source of

information in implementing any procedures in your business and for advising clients. Your due diligence

must be done.

A) Establishing and defining a professional relationship

: Disclose the following information to the client

List the medical schemes and health insurance products you are accredited with and can

provide advice on.

Accredited with the Council of Medical Schemes and Financial Services Board (FSB)

Show that you have the necessary experience and the required credits to provide healthcare

advice.

Commission earned and how it is paid.

On-going services (Service level Agreement).

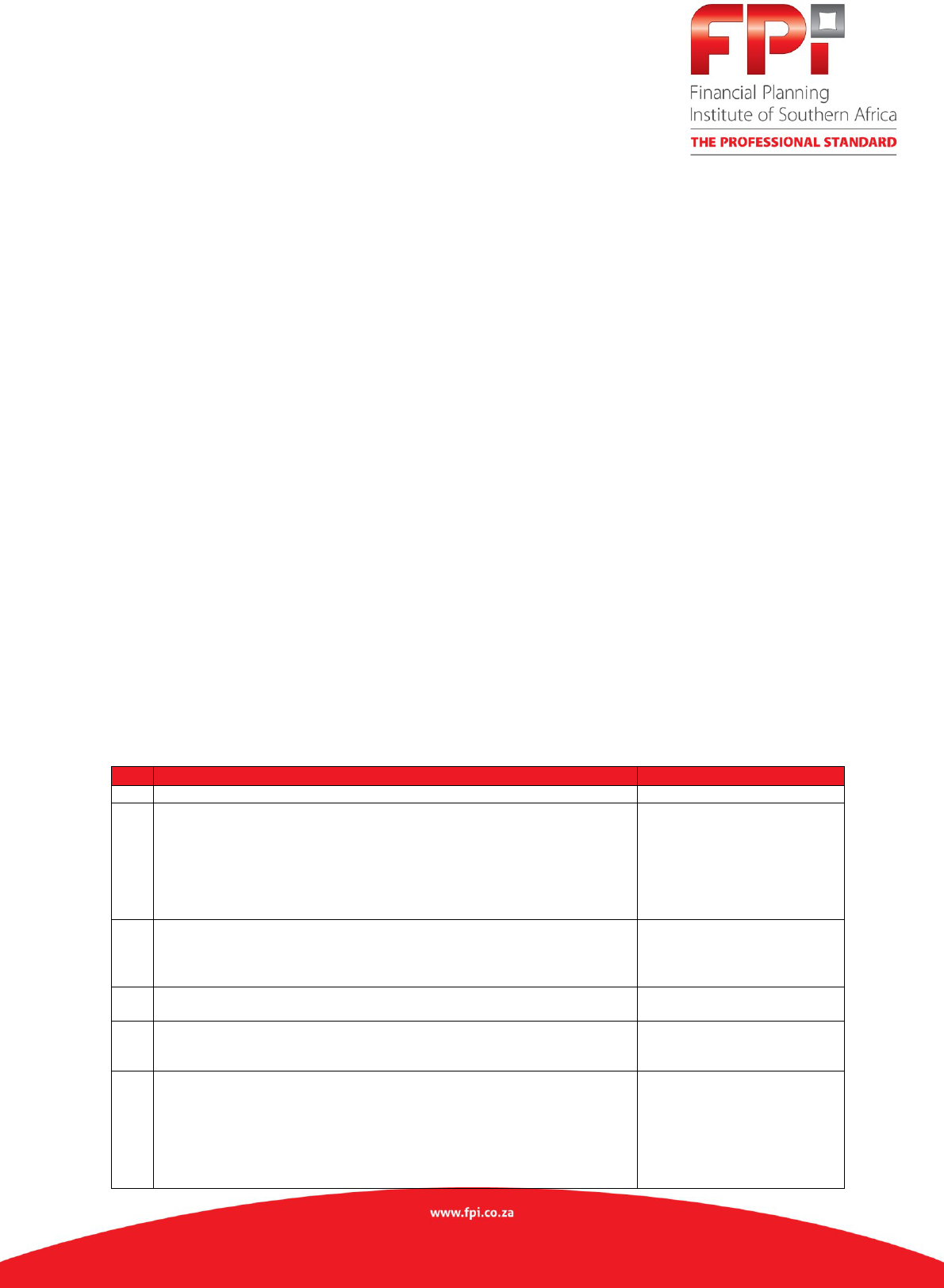

B) Gathering data from the client via the medical scheme application

form and the client’s healthcare needs & preferences

Collect the following general client information

Possible reason

1

Name, ID, Contact numbers and e-mail address

Record purposes

2

Ages of Principal member, spouse and children.

A young healthy adult may only require hospital cover for catastrophic

events and emergencies. Adults who want to start a family might

require good maternity benefits and should they have children,

sufficient day-to-day benefits. Adults older than 40 might require

sufficient chronic medication cover.

Important to determine

medical cover requirements

and late joiner penalties

when calculating

contributions.

3

Number of Dependants and if the dependants are adults or children

Important to calculate the

contribution and to

determine medical cover

requirements.

4

Date of commencement of cover

Paying in advance or arrears.

5

Is the individual currently on a South African registered Medical Scheme

has there been a break in membership or is it the first time the

individual is applying to join a Medical Scheme

To determine waiting

periods, exclusions & late

joiner penalties.

6

Is the client part of an Employer Group which enjoys group underwriting

dispensation? Employees who join the Employer’s selected medical

scheme within three months of employment will normally not attract

any waiting periods, exclusions or late joiner penalties. Employees of

some Employer Groups may not attract waiting periods or exclusions,

but employees may attract late joiner penalties even if they join within

three months of their employment date.

To determine waiting

periods, exclusions & late

joiner penalties.