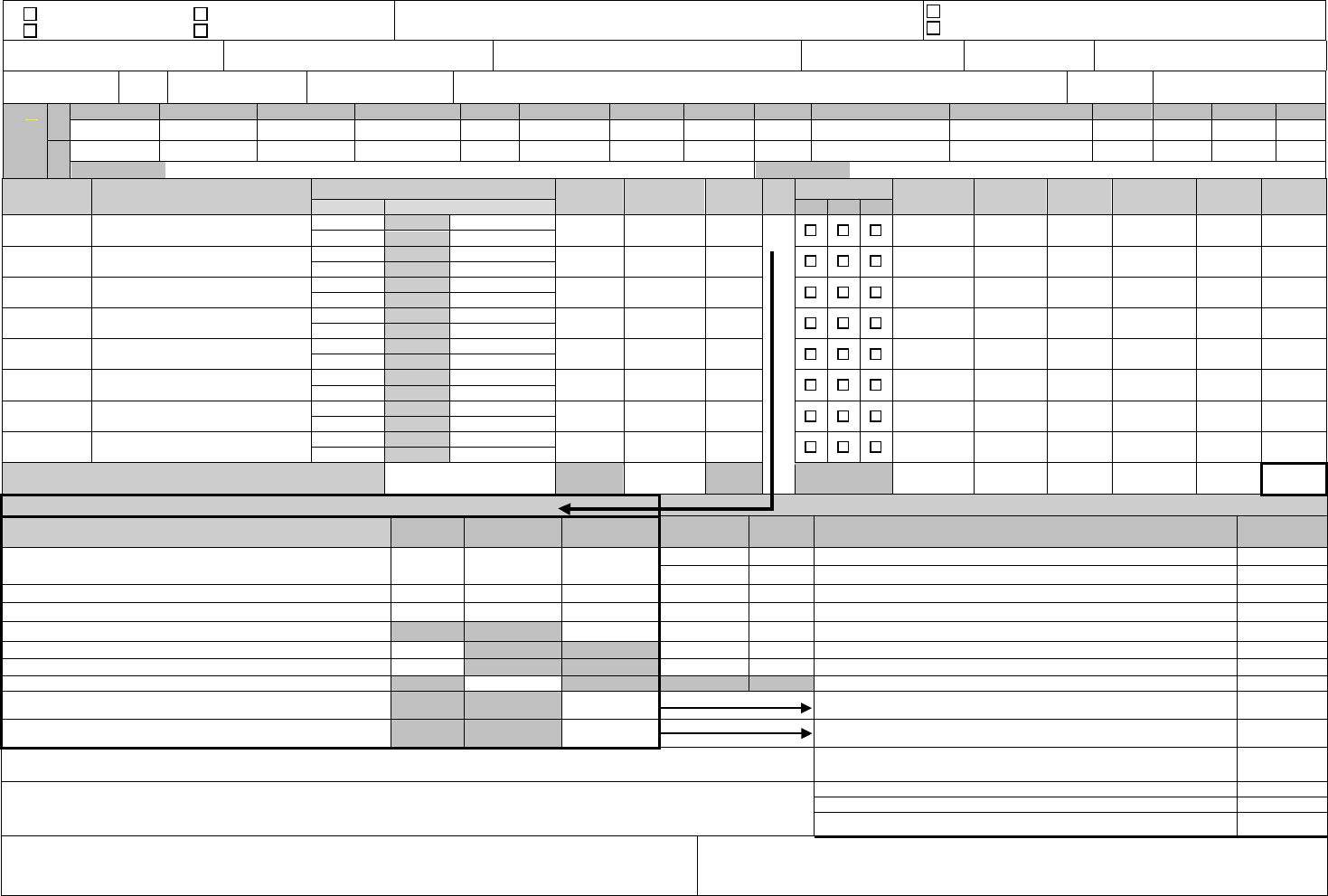

HTML Preview Employee Business Expense Report page number 1.

FI-00529-09 (11/13) Page 1 of 2

IN-STATE SHORT TERM ADVANCE

OUT-OF-STATE RECURRING ADVANCE

SEMA4 EMPLOYEE EXPENSE REPORT

Check if advance was issued for these expenses

FINAL EXPENSE(S) FOR THIS TRIP?

Employee Name

Home Address (Include City and State)

Permanent Work Station (Include City and State)

Agency

1-Way Commute Miles

Job Title

Employee ID

Rcd #

Trip Start Date

Trip End Date

Reason for Travel/Advance (30 Char. Max) [example: XYZ Conference, Dallas, TX]

Barg. Unit

Expense Group ID (Agency Use)

Chart

String(S)

A

Accounting Date

Fund

Fin DeptID

AppropID

SW Cost

Sub Acct

Agncy Cost 1

Agncy Cost 2

PC BU

Project

Activity

Srce Type

Category

Sub-Cat

Distrib

%

B

A. Description:

B. Description:

Date Daily Description

Itinerary

Trip Miles

Total Trip &

Local Miles

Mileage

Rate

Meals

Total Meals

(overnight stay)

Total Meals

(no overnight stay)

taxable

Lodging

Personal

Telephone

Parking Total

Time

Location

B

L

D

Depart

Figure mileage reimbursement below

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

Depart

Arrive

VEHICLE CONTROL #

Total Miles

Total MWI/MWO

Total MEI/MEO

Total LGI/LGO

Total PHI/PHO

Total PKI/PKO

Subtotal (A)

MILEAGE REIMBURSEMENT CALCULATION

OTHER EXPENSES – See reverse for list of Earn Codes.

Enter the rates, miles, and total amounts for the mileage listed above. Get the

IRS rate from your agency business expense contact.

Rate Total Miles Total Mileage Amt.

Date Earn Code Comments Total

1.

Enter rate, miles, and amount being claimed at equal to the IRS rate.

2.

Enter rate, miles, and amount being claimed at less than the IRS rate.

3. Enter rate, miles, and amount being claimed at greater than the IRS rate.

4.

Add the total mileage amounts from lines 1 through 3.

5. Enter IRS mileage rate in place at the time of travel.

6. Subtract line 5 from line 3.

7. Enter total miles from line 3.

Subtotal Other Expenses: (B)

8.

Multiply line 6 by line 7. This is taxable mileage.

(Copy to Box C)

Total

taxable mileage greater than IRS rate to be reimbursed: (C)

MIT or MOT

9.

Subtract line 8 from line 4. If line 8 is zero, enter mileage amount from line 4.

This is non-taxable mileage.

(Copy to Box D)

Total nontaxable mileage less than or equal to IRS rate to be rei

mbursed: (D)

MLI or MLO

If using private vehicle for

out-of-state travel: What is the lowest airfare to the destination?

Total Expenses for this trip must not exceed this amount.

Grand Total (A + B + C + D)

I declare, under penalty of perjury, that this claim is just, correct and that no part of it has been paid or reimbursed by the state of Minnesota or by another party except with respect to

any advance amount paid for this trip. I AUTHORIZE PAYROLL DEDUCTION OF ANY SUCH ADVANCE. I have not accepted personal travel

benefits.

Employee Signature _________________________________________________ Date _____________________Work Phone:

Less Advance issued for this trip:

Total amount to be reimbursed to the employee:

Amount of Advance to be returned by the employee by deduction from paycheck:

Approved: Based on knowledge of necessity for travel and expense and on compliance with all provisions of applicable travel regulations.

Supervisor Signature __________________________________________ Date _______________ Work Phone:

Appointing Authority Designee (Needed for Recurring Advance and Special Expenses)

Signature ____________________________________________________________ Date ________________________