HTML Preview Business Profit And Loss Form page number 1.

File pg. 11

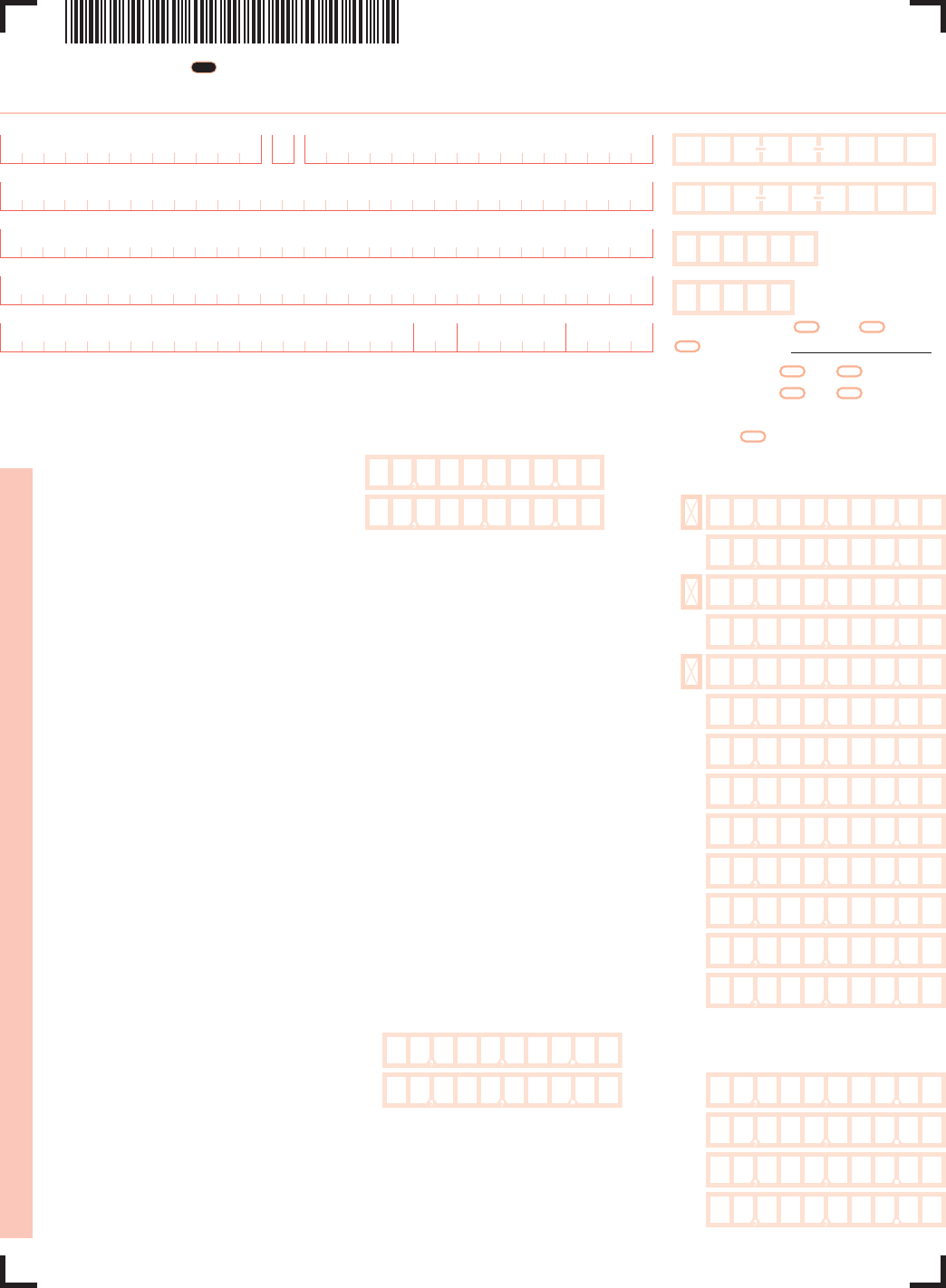

Ovals must be filled in completely. Example: If any line shows a loss, mark an X in box at left of the line.

SOCIAL SECURITY NUMBER OF PROPRIETOR

EMPLOYER IDENTIFICATION NUMBER (if any)

PRINCIPAL BUSINESS CODE (from U.S. Schedule C)

NUMBER OF EMPLOYEES

Accounting Method: Cash Accrual

Other (specify)

00

00

00

5

If showing a loss, mark an X in box at left

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

00

Schedule C Massachusetts Profit or Loss from Business 2015

FIRST NAME M.I. LAST NAME

BUSINESS NAME

MAIN BUSINESS OR PROFESSION, INCLUDING PRODUCT OR SERVICE

ADDRESS

CITY/TOWN/POST OFFICE STATE ZIP + 4

Did you materially participate in the operation of this business during 2015? (If “no,” see line 33 instructions) . . . . . . . . . . . . . . . . . . . . . . Yes No

Did you claim the small business exemption from the sales tax on purchases of taxable energy or heating fuel during 2015?. . . . . . . . . . . Yes No

Exclude interest (other than from Massachusetts banks) and dividends from lines 1 and 4 and enter such amount in line 32 and in Schedule B, line 3.

Caution: If this income was reported to you on Form W-2 and the “Statutory employee” box on that form was checked, fill in here:

1 a. Gross receipts or sales . . . . . . . . . . . . . . . . . . .

b. Returns and allowances. . . . . . . . . . . . . . . . . . . a

–

b = 1

2 Cost of goods sold and/or operations (Schedule C-1, line 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3 Gross profit. Subtract line 2 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4 Other income. Do not include interest income (other than from Mass. banks) and dividends . . . . . . . . 4

5 Total income. Add line 3 and line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6 Advertising . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7 Bad debts from sales or services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8 Car and truck expenses . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9 Commissions and fees . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10 Depletion. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11 Depreciation and Section 179 deduction . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12 Employee benefit programs (other than in line 17) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13 Insurance (other than health). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13

14 Interest:

a. mortgage interest paid to financial institutions . . .

b. other interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . a

+ b = 14

15 Legal and professional services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16 Office expense . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

17 Pension and profit-sharing plans . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17