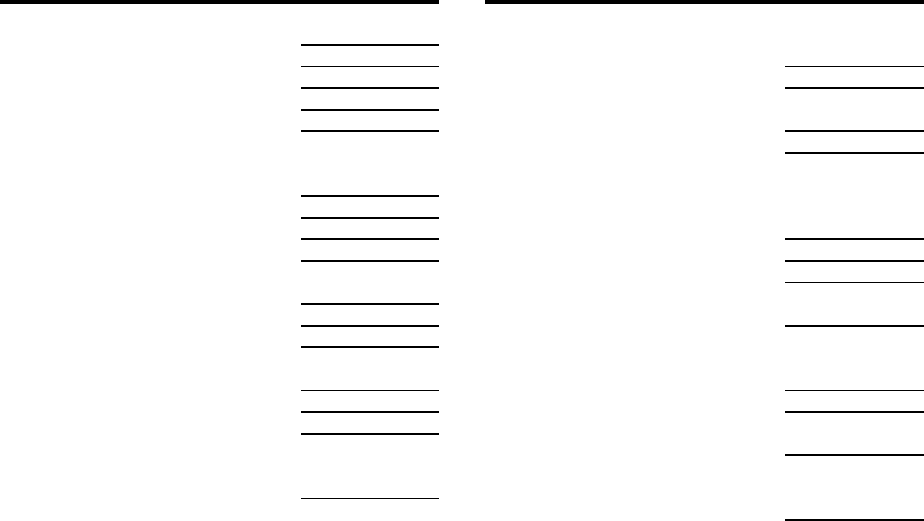

HTML Preview Balance Sheet For Small Business page number 1.

Balance Sheet For A Small Business

Assets

Liabilities

Current assets

Current Liabilities

Cash in bank

Accounts payable

Accounts receivable

Short-term loans

Inventory

Other payments due

Total current assets

in 12 months

Total current liabilities

Fixed assets

Land

Long-term liabilities

Buildings

Long-term loans

Less depreciation

(due after 1 year)

Net land & buildings

Mortgage

Total long-term liabilities

Equipment

Less depreciation

Total liabilities (L)

Net equipment

Owners' equity

Cars & trucks

Investment

Less depreciation

Retained earnings

Net cars & trucks

Total owners' equity (E)

Total assets (A)

Total liabilities and

owners' equity

Total assets equals total liabilities

plus owners' equity or A=L+E

Use this worksheet to prepare the balance sheet you will include in your business plan. Yours

may have slightly different categories depending on the type of business. Use a similar format to

prepare pro forma (projected) balance sheets.

"Investment" represents the amount you and/or your partners or other owners have invested in the

business.

"Retained earnings" is the net earnings or profit you have put back into the business.

The total for owners' equity (calculated by deducting total liabilities from total assets) also represents

the net worth of your business.