HTML Preview One Page Financial Plan page number 1.

Develop a budget to ensure you are valued.

1) Use last year’s records as a starting point for your five-line income statement.

If you’re starting a new operation, plenty of information is available!

For example:

- http://agalternatives.aers.psu.edu/

- http://cdp.wisc.edu/Budgets,%20Spead%20&%20Programs.htm

- http://www.ces.uga.edu/Agriculture/agecon/printedbudgets.htm

Make sure you take regional cost differences into account (land rent is a

good example of this.)

2) Calculate your five-line income statement.

COGS = any expense that helps produce one more unit of output.

Production labor and associated payroll expenses, including workman's

compensation, unemployment taxes, FICA, Medicare, health insurance

Crop or livestock inputs – seed, fertilizer, soils, chemicals, feed

Overhead = any expense that you incur no matter how much production

you actually have.

The main ones are the "DIRTI" Five:

Depreciation, Interest, Repairs, Taxes, Insurance

Don't forget to include Managers' and Bookkeepers' wages/salaries,

marketing, and utilities.

3) Calculate the percent of sales for each line.

(Divide the dollars for each line by the total sales.)

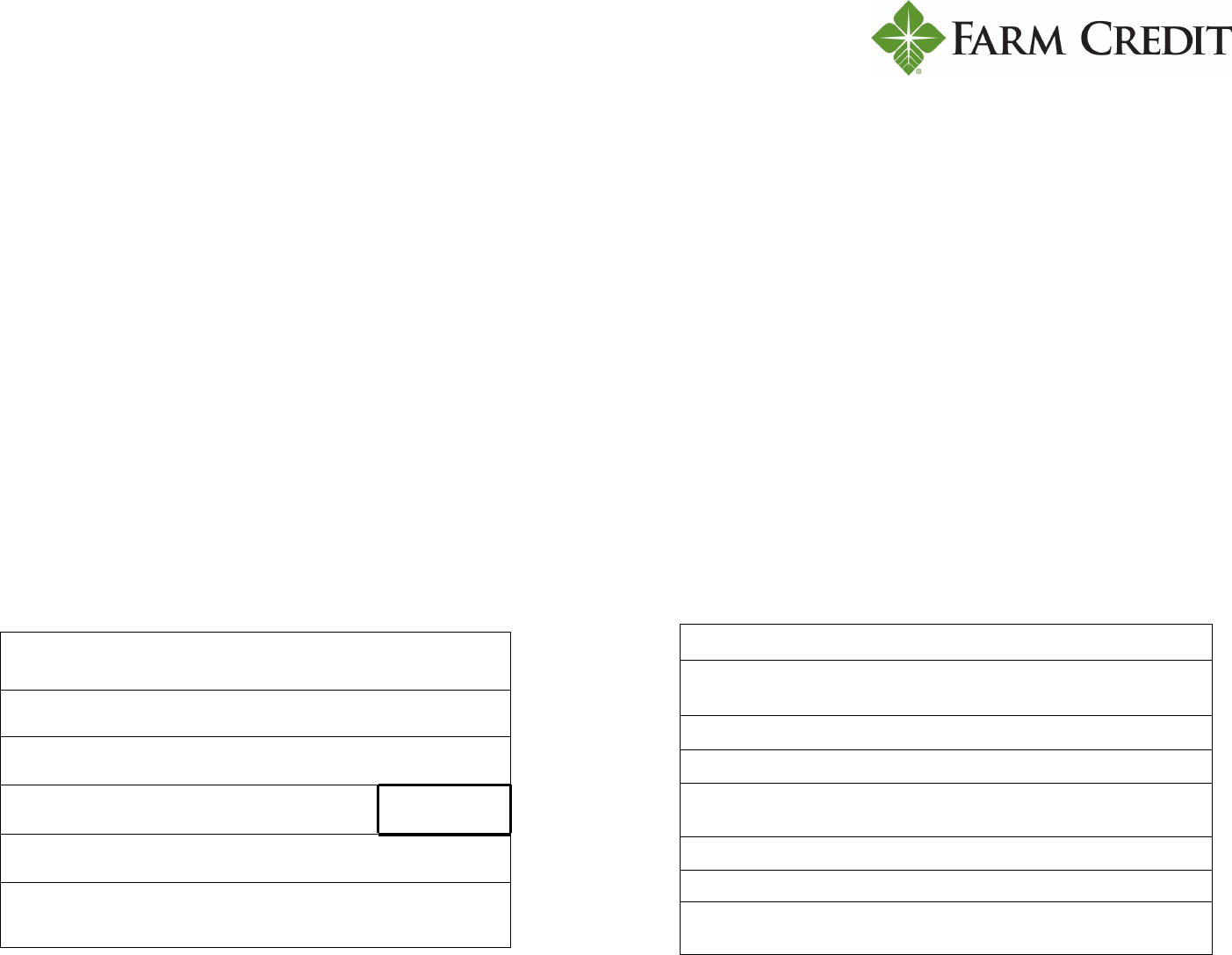

Owner Draw Desired

(include income taxes):

$

Bank principal payments required:

$

Overhead expenses

$

GROSS MARGIN REQUIRED: (C+D)

$

COGS

$

SALES VOLUME REQUIRED:

(E/[E as % of sales—from historical])

$

TOTAL PROFIT REQUIRED: (A+B)

$

(A)

(B)

(C)

(D)

(E)

(F)

(G)

2011 BUDGET

Historical

Dollars % of Sales

Sales:

$

100%

- Cost of Goods Sold:

$

%

= Gross Margin:

$

%

- Overhead

$

%

= Profit (Net Income)

$

%

4) Create your budget—from the bottom up. Start with your desired draw

(the amount you and your family need to take from the operation to

live on, plus income taxes). Add the principal portion of any loan

payments you need to make in 2011 to get the total profit needed from

the operation.

5) Add your overhead expenses to the required profit to figure the gross

margin the operation will need to yield. Your overhead expenses

shouldn’t change much from the previous year, unless you’ve under-

gone a significant expansion or other major change.

6) Determine the breakeven sales needed in your operation to support the

overhead obligations and profit required. Do this by dividing the gross

margin (E) by the gross margin as a percent of sales (taken from your

records, calculated in step 3).

7) Step back and see if this budget makes sense. Is this sales volume

reasonable for this year, especially if it’s your first year in business? Is

it possible for the acreage you raise and the market prices of your

products? If it is, great! Develop a marketing plan (action plan) to

achieve that level of sales. If not, that's okay. Rework until you have a

plan that is sound. If this is a building year, how will you achieve your

goal (and finance the operation in the meantime)? Address these

questions early in the year to ensure you have a complete plan.