HTML Preview Income Tax Job Application Form page number 1.

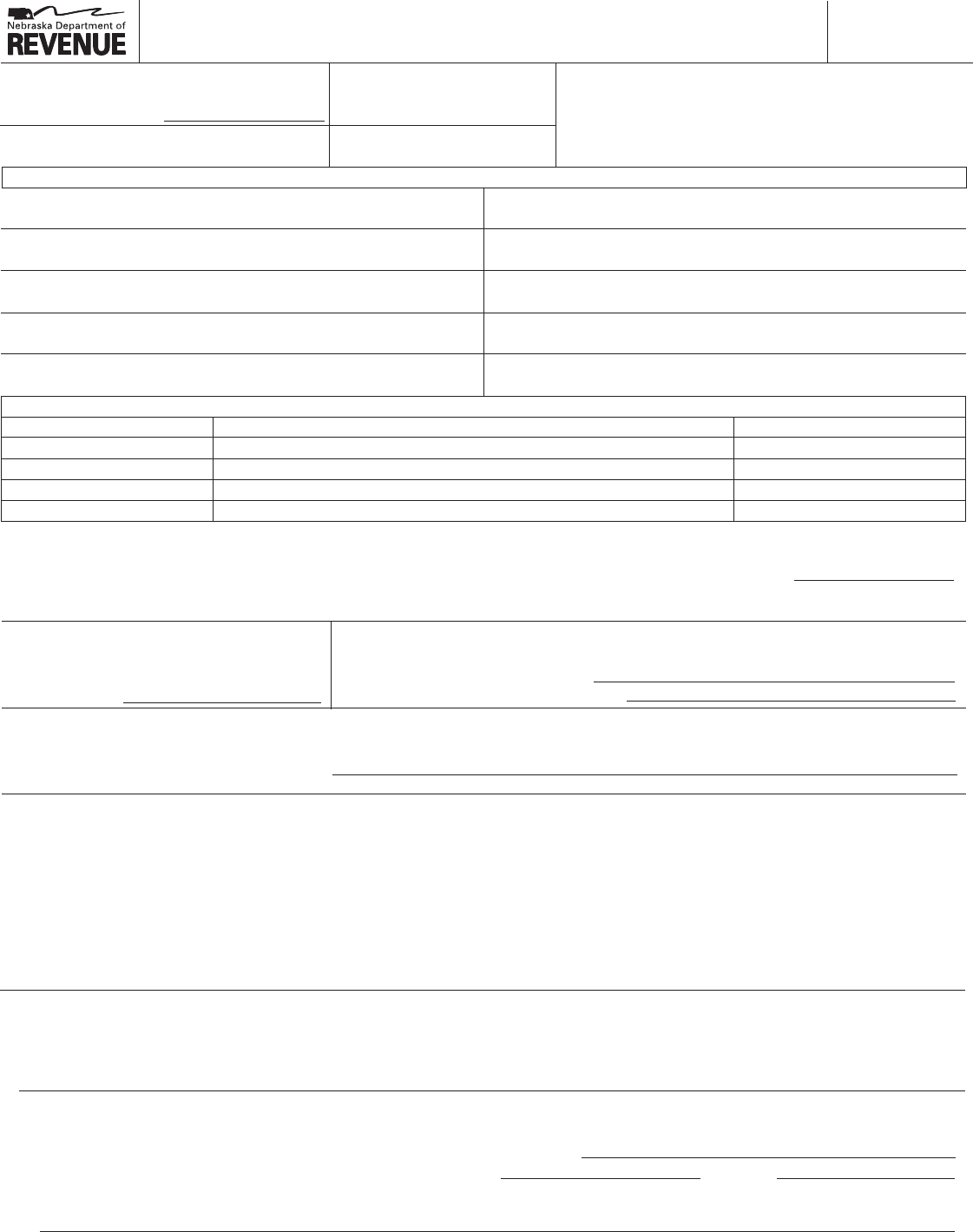

7-100-1975 Rev. 11-2014 Supersedes 7-100-1975 Rev. 9-2014

12 Provide a description of your business operations, products that you sell, and services that you provide.

a. Primary business type: c Retailer c Lessor c Wholesaler c Manufacturer c Construction Contractor c Other

If you marked “Lessor”, do you lease motor vehicles to others for periods of longer than 31 days? c Yes c No

b. If your business does not operate year-round, identify the months you operate.

c. How many business establishments do you operate: in Nebraska? in U.S.A.?

d. If you purchased an existing business, identify the previous owner.

Form

20

Complete Reverse Side

Name Address City Zip Code Nebraska ID Number

Nebraska Tax Application

11 Reason for Filing Application – Check Appropriate Boxes. If box 3 is checked, you may cancel your old Nebraska ID number on the final

return, on a Form 22, or by providing the number and final date in box 3 below.

(1) c Original Application (3) c Changed Business Entity (To cancel Nebraska ID number (4) c Add Tax Program

(2) c Change in Partners of previous entity, write the ID number and final date here: (5) c Other (attach explanation)

ID #_________________________ Date_______________)

From - To -

c Sole Proprietorship c Sole Proprietorship

c Partnership c Partnership

c Limited Liability Company c Limited Liability Company

c Corporation c Corporation

9 Accounting Period (Type of Year) (see instructions)

(1) c Calendar – January 1 to December 31

(2) c Fiscal – 12 Month Ending

(3) c Fiscal – 52 or 53 Week Ending

8 Accounting Basis

(1) c Cash

(2) c Accrual

(3) c Other

7 Type of Ownership

(1) c Sole Proprietorship (5) c

Foreign Corporation (another state or country)

(9) c Nonprofit Organization

(2) c Partnership (6) c S Corporation (10) c Cooperative

(3) c Nonprofit Corporation (7) c Governmental (11) c Limited Liability Company

(4) c Corporation (8) c Fiduciary (Estate or Trust)

Name Doing Business As (dba) Name

Legal Name

Business Street Address (Do Not Use PO Box) Street or Other Mailing Address

City State Zip Code City State Zip Code

Name and Location Address of Business (print clearly) Name and Mailing Address

1 Do you hold, or have you previously held a Nebraska

ID number?

c Yes c No

If Yes, provide the number:

2 Federal Employer ID Number (EIN)

3 County of Business Location Within

Nebraska

4 For Department Use Only

Please Do Not Write In This Space

5 Name and Address of Legal Entity/Owner

Is your Nebraska location within the city limits? (1) c Yes (2) c No

10 Location of Records

(1) c Same as Location Address (3) c Other Address (provide below)

(2) c Same as Mailing Address

6 Identify Owner and Spouse (if joint ownership), Partners, Members, or Corporate Officers (one of the listed individuals must sign as applicant).

Social Security Number Name, Address, City, State, Zip Code Title, If Corporate Officer

Address City State Zip Code

PRINT FORM

RESET FORM

Important Message