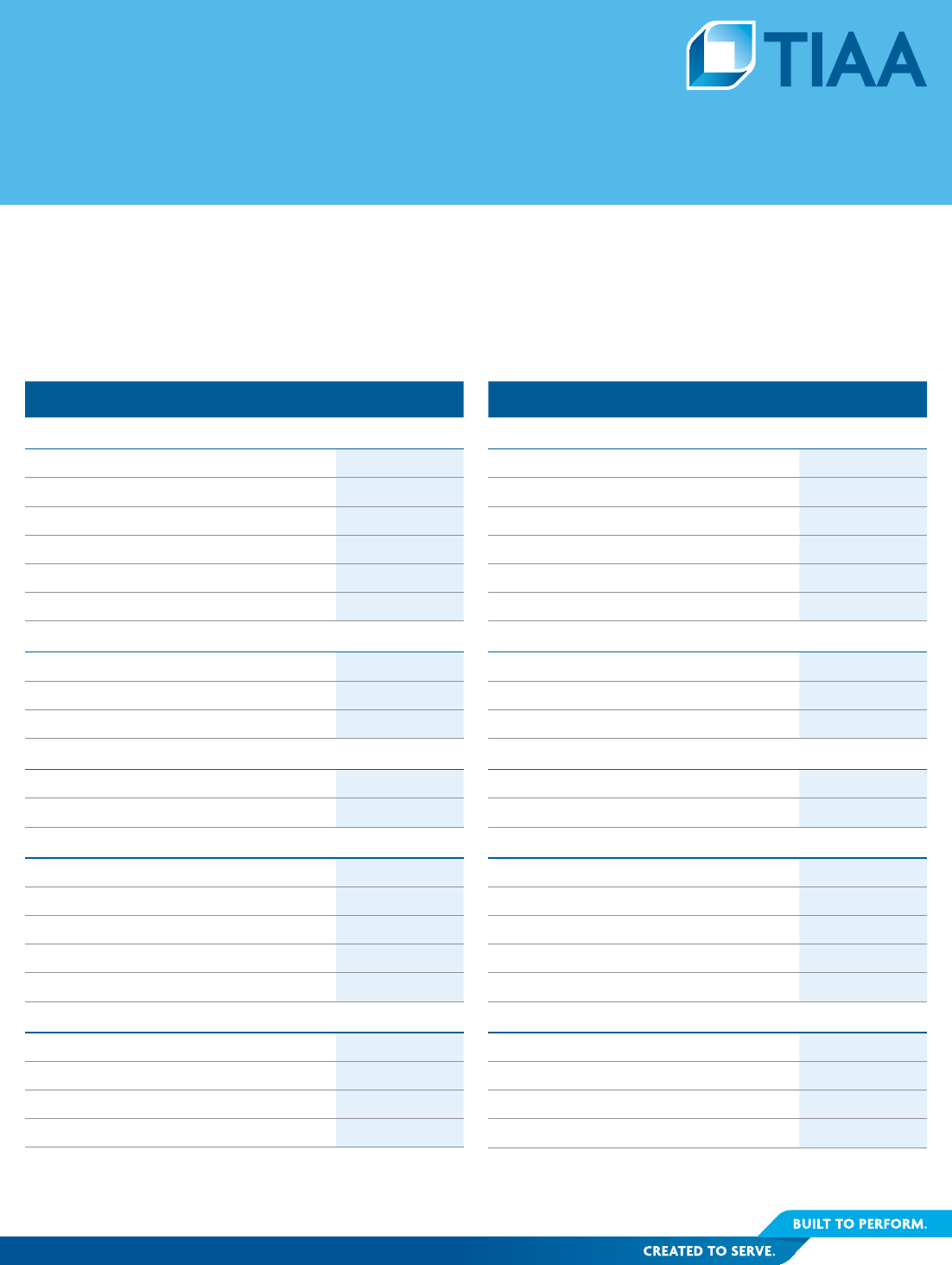

HTML Preview Retirement Budget Worksheet page number 1.

Many retirees nd that their essential expenses in retirement take up a lot of their income. Creating a budget to help get a

general idea of what you’re spending is a smart decision. If you are looking for a target starting point for assessing what your

expenses might be in retirement and you’re uncertain where to begin, you might consider using a rough estimate of 70% as

essential and 30% discretionary (or nonessential) spending. Of course, your actual budget will vary based on your lifestyle

and personal situation.

Essential budget items Per month

Household expenses

Mortgage/rent

$

Utilities/cable/internet

$

General maintenance

$

Household supplies

$

Property tax & insurance

$

Credit card debt payments

$

Meals

Groceries

$

Beverages

$

Essential entertaining

$

Personal care

Clothing

$

Products/maintenance

$

Healthcare

Medicare/supplemental insurance

$

Out-of-pocket payments

$

Dental

$

Eye doctor/glasses

$

Other essential expenses

$

Transportation

Car payments/auto insurance

$

Maintenance and fuel

$

Taxes, registration, etc.

$

Essential transportation costs

$

Discretionary budget items Per month

Household expenses

Home improvement

$

New purchases

$

$

$

$

$

Meals

Dining out

$

Entertaining

$

$

Personal care

The extras

$

Products/maintenance

$

Healthcare

Other out-of-pocket insurance

$

$

$

$

$

Transportation

Discretionary travel

$

Vacations

$

Upgrades

$

Other

$

Retirement Budget Worksheet